BULLETIN: U.S. Citizen Presiding Over New Zealand Firms Ran Ponzi, Stole Millions And Was Aided By Pitchmen In Utah And Louisiana, SEC Says

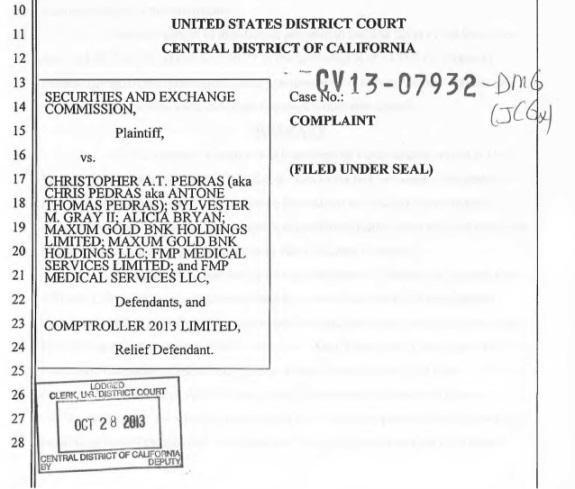

BULLETIN: The SEC has gone to federal court in the Central District of California and alleged that a U.S. citizen running companies in New Zealand and relying on pitchmen in Utah and Louisiana operated a Ponzi scheme and stole millions of dollars from investors.

BULLETIN: The SEC has gone to federal court in the Central District of California and alleged that a U.S. citizen running companies in New Zealand and relying on pitchmen in Utah and Louisiana operated a Ponzi scheme and stole millions of dollars from investors.

A federal judge has approved an emergency asset freeze, the SEC said.

Named defendants, according to the SEC, were Christopher A.T. Pedras, a U.S. citizen who resides in Turlock, Calif., and operates firms in both America and New Zealand; Sylvester M. Gray II of Kaysville, Utah; and Alicia Bryan of Bossier City, La.

Pedras presided over “sham investment opportunities ranging from a bank trading program to kidney dialysis clinics,” the SEC said. The agency added that Pedras “advised investors not to respond if contacted by the SEC.

“He characterized SEC investor questionnaires as ‘fake’ and stated that the SEC’s investigation was motivated by a ‘personal vendetta’ against him,” the agency said.

As part of the scam, the SEC alleged in its complaint, “In March 2012, Pedras conducted an in-person seminar at Paramount Studios in Los Angeles for actual and prospective investors. At the seminar, he described the nature and benefits of the Maxum Gold Trade Program and the safety of investors’ funds in escrow accounts.”

Bryan, the agency said, has a criminal record and pleaded guilty in September 2008 “to a charge of attempted felony theft in the State of Louisiana, arising from her attempt to cash a counterfeit check from her then-employer, an internet company for whom she collected charitable donations and sent them to a purported disaster relief organization overseas.”

“Rather than conducting any legitimate business activity, Pedras and his partners were simply operating a Ponzi scheme that was ultimately doomed to collapse,” said Michele Wein Layne, director of the SEC’s Los Angeles Regional Office. “This emergency action stops them from fraudulently raising any more money from U.S. investors.”

The scams gathered at least $5.6 million from U.S. investors, the SEC said.

Corporate defendants include Maxum Gold Bnk Holdings Limited of New Zealand; Maxum Gold Bnk Holdings LLC of Nevada; FMP Medical Services LLC of Nevada; FMP Medical Services Limited of New Zealand.

From a statement by the SEC (italics added):

The SEC alleges that Christopher A.T. Pedras, who has residences in Turlock, Calif., and New Zealand, misled his initial investors into believing they were investing in a profitable trading platform in which his company served as an intermediary between global banks. When Pedras and his companies encountered difficulty paying the promised 4 to 8 percent monthly returns, they began steering investors to a different investment program to purportedly increase the value of their investment by 80 percent by funding kidney dialysis clinics in New Zealand. Pedras’s business partner Sylvester M. Gray II and lead sales representative Alicia Bryan helped him solicit investors for both programs, and the money was never invested as promised. Earlier investors were paid supposed returns with funds received from newer investors, and Pedras stole more than $2 million and spent another $1.2 million on sales agents.

Pedras also is known as Chris Pedras and Antone Thomas Pedras, the SEC said.

The New Zealand Financial Markets Authority filed a prospectus cancellation against Pedras’ FMP Medical Services Limited last month, saying it that marked “the first time that FMA has cancelled an offer document.”

The cancellation means “FMP must stop the offer and that it cannot allot any shares,” the New Zealand agency said. “FMP must immediately repay any investors who have subscribed to the offer.”