3RD UPDATE 9:36 AM EDT MARCH 17 U.S.A. This one features highly questionable dealings between an alleged MLM securities fraudster (TelexFree’s Sann Rodrigues) and an alleged Ponzi schemer (Daniel Fernandes Rojo Filho of DFRF Enterprises). Filho also has been linked to the alleged 2010 Finanzas Forex/Evolution Market Group Ponzi scheme, a Ponzi-board “program” that allegedly had ties to the narcotics trade.

Suffice to say, this developing story has a lot of moving parts. Here’s our distillation:

On March 14, the SEC alleged that Rodrigues — whose assets are frozen — had transferred two expensive cars to Florida attorney Robert Eckard. Eckard is representing Rodrigues in the SEC’s civil case against him and other TelexFree figures and also in the Justice Department’s criminal case against him for immigration fraud.

The transfers potentially created a conflict of interest for Eckard, given that Rodrigues currently is jailed for civil contempt for violating the asset freeze and has not purged that contempt, according to the SEC. Getting out of hock with the court will cost the huckster at least $334,000, perhaps more. Rodrigues claims he cannot pay and that the court should free him and put him on a payment plan.

U.S. District Judge Nathaniel M. Gorton of Massachusetts is hearing the case.

Why didn’t Rodrigues apply the two cars to purge the contempt?

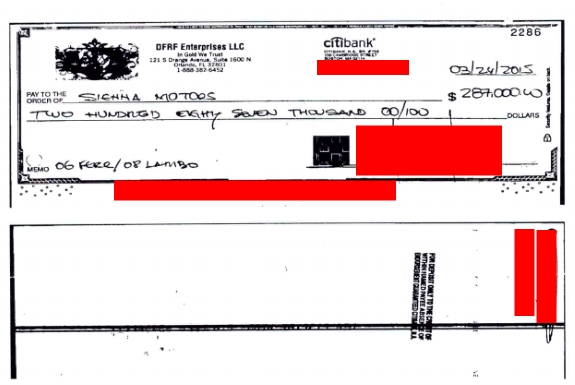

Well, according to the SEC, the cars — a 2008 Lamborghini Gallardo and a 2012 Fisker Karma — were transferred to Eckard after the agency moved for contempt against Rodrigues in August 2015.

The SEC further suggested in its filings that Eckard paid far below book value for the cars. In the case of the used Lamborghini, the SEC said, the lawyer paid only $30,000 for a car that months earlier had sold for five times that sum.

Eckard paid only $20,000 for the Fisker Karma, which months earlier had sold for three times that sum, the SEC said. Fisker Karma is an electric luxury vehicle whose operator declared bankruptcy..

Reached by the PP Blog today, Eckard pointed to court filings in which he says Rodrigues — strapped for cash because of the freeze — paid him with cars, rather than cash. And, the lawyer contended, no conflict existed and the SEC had cleared the cars from the asset freeze.

Because Rodrigues paid with cars, not cash, it created an unusual situation with vehicle taxes, Eckard said. He added that he consulted with authorities in Pasco County and with the Florida Department of Revenue when transferring the cars to his name.

“I did not pay anything for the vehicle, but was required to put an amount down for tax purposes, since it was not a gift,” Eckard advised Gorton about the Lamborghini.

The Fisker Karma was accepted from Rodrigues as payment for legal fees and proved to be a lemon with bad electrical parts and bad tires, Eckard contended.

Eckard is moving to strike the SEC’s assertions from the court docket.

Both Rodrigues and Filho are Brazilian by birth and Florida residents. How they came together remains unclear.

The SEC linked Rodrigues to Filho last year.

NOTE: Our thanks to the ASD Updates Blog.

UPDATE 3:53 P.M. EDT U.S.A. MARCH 22: Looks as though Rodrigues will be released from jail, after coming up with a plan to purge the contempt. This matter is separate from the SEC’s securities-fraud case against him filed in April 2014.

Big Four accounting firm Pricewaterhouse Coopers posted more than $115,000 in fees from the TelexFree Ponzi/pyramid scheme and will pay it all back under the terms of a stipulated settlement with TelexFree Trustee Stephen B. Darr, according to court filings.

Big Four accounting firm Pricewaterhouse Coopers posted more than $115,000 in fees from the TelexFree Ponzi/pyramid scheme and will pay it all back under the terms of a stipulated settlement with TelexFree Trustee Stephen B. Darr, according to court filings.