URGENT >> BULLETIN >> MOVING: Zeek Vendor Pleads Guilty To Obstructing Probe

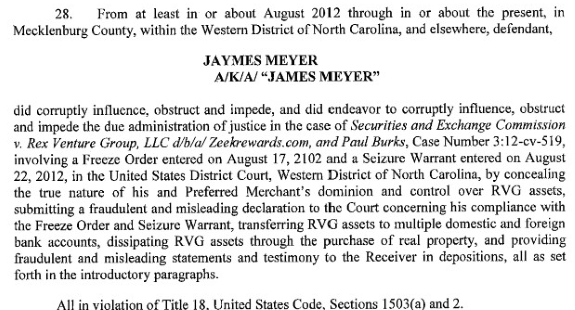

From the criminal charges filed against Zeek payment vendor Jaymes Meyer in the Western District of North Carolina.

URGENT >> BULLETIN >> MOVING: (12th Update 2:57 p.m. EDT U.S.A.) In what may be a warning shot fired across the bow of payment vendors who hope to profit from Ponzi schemes, Zeek Rewards’ vendor Jaymes Meyer of Preferred Merchants Solutions LLC has pleaded guilty to a criminal charge of obstructing investigators in the Zeek Ponzi- and pyramid-scheme case.

Meyer, 47, of Napa, Calif., was charged criminally March 10 by federal prosecutors in the Western District of North Carolina. They alleged he hatched an “elaborate obstruction of justice scheme to conceal millions of dollars from the Government using a series of domestic and foreign nominees and related bank and brokerage accounts.”

He was specifically accused of impeding the SEC’s Zeek probe beginning in 2012 and later lying to a federal judge and Zeek receiver Kenneth D. Bell.

Senior U.S. District Judge Graham C. Mullen is presiding over the SEC’s Zeek case.

As the PP Blog reported in October 2014, Bell accused Meyer of directing a $4.8 million transfer from a Rex Venture Group trust account to Preferred Merchants’ account “just 19 minutes after the SEC told them about the asset freeze and imminent shutdown of RVG” on Aug. 16, 2012.

Rex, or RVG, was the operator of Zeek. It was under the control of accused Zeek Ponzi schemer Paul R. Burks. Burks is scheduled to go on trial in July.

By March 2015, Bell and investigators had tracked Zeek money that flowed through Preferred to the Cook Islands and real estate in the Turks and Caicos. Prosecutors’ allegations against Meyer include a notice of forfeiture of $4.8 million.

U.S. Magistrate Judge David S. Cayer accepted the guilty plea from Meyer on March 22. Certain documents in the case remain sealed. One document shows Meyer withdrew $195,000 in Zeek money in cash.

At least two other payment vendors may be in Bell’s sights. On Feb. 21, 2016, the PP Blog reported that millions of dollars that originated through Zeek-related transactions involving Payza and Payment World may have ended up in a collapsed Russian bank.

NOTE: Our thanks to the ASD Updates Blog.

Full statement of U.S. Department of Justice on the Meyer guilty plea:

________________________________________________________________

Financial Services Company Executive Pleads Guilty To Obstruction Of Justice

CHARLOTTE, N.C. – The CEO of Preferred Merchants LLC, a financial services company based in Napa, California, pleaded guilty yesterday to engaging in an elaborate obstruction of justice scheme to conceal millions of dollars—which were subject to a freeze order and seizure warrant—from the government using a series of offshore accounts, domestic and foreign nominee accounts, a shell company and related bank and brokerage accounts.

Assistant Attorney General Leslie R. Caldwell of the Justice Department’s Criminal Division, U.S. Attorney Jill Westmoreland Rose of the Western District of North Carolina, Special Agent in Charge Michael Rolin of the U.S. Secret Service’s Charlotte, North Carolina, Field Division and Special Agent in Charge Thomas J. Holloman III of the Internal Revenue Service-Criminal Investigation (IRS-CI) Charlotte Field Office made the announcement.

Jaymes Meyer, aka James Meyer, 47, of Napa, pleaded guilty yesterday before U.S. Magistrate Judge David S. Cayer of the Western District of North Carolina in Charlotte to obstruction of justice.

According to the plea agreement, in or about 2012, the U.S. Securities and Exchange Commission’s (SEC’s) Division of Enforcement commenced a securities fraud investigation concerning a Ponzi scheme centering on Rex Ventures Group LLC (RVG), a North Carolina-based company for which Preferred Merchants held millions in assets in treasury and trust accounts. As a result of its investigation, the SEC filed a civil enforcement action against RVG, after which the court entered a freeze order that appointed a receiver and froze all of RVG’s assets. Among other things, the receiver was responsible for marshaling, managing and distributing remaining RVG assets to impacted RVG investors. In addition to the freeze order, the U.S. Secret Service also obtained a seizure warrant of RVG assets held by Meyer through Preferred Merchants. Meyer admitted that in August 2012, the SEC informed him of, among other things, the investigation and the court order freezing RVG’s assets and requested that Meyer freeze any RVG assets in his possession, custody or control.

According to the plea agreement, in response to this request, Meyer misled the SEC by falsely implying that Preferred Merchants did not exercise dominion or control over any RVG assets when, in fact, Meyer controlled approximately $17.4 million in RVG assets. Meyer further admitted that he wired approximately $4.8 million from an RVG trust account to a brokerage account under his control within an hour of learning about the SEC’s investigation. Over the next 10 months, Meyer used that money to purchase homes in Napa and the Turks and Caicos, to which he subsequently made $1.5 million in improvements, and withdrew approximately $195,000 in cash. He also established a Cook Islands-based trust account, formed a shell company and opened a brokerage account in the shell company’s name to further conceal the trail of RVG assets subject to the freeze order and seizure warrant.

Meyer also admitted that throughout the pending civil litigation surrounding the RVG scheme, he made fraudulent and misleading statements to the U.S. District Court for the Western District of North Carolina, the SEC and the court-appointed receiver during depositions.

In connection with his plea agreement, Meyer agreed to pay an approximately $4.8 million money judgment and to forfeit the homes that he purchased in the Turks and Caicos and Napa as proceeds of the obstruction of justice offense.

The U.S. Secret Service and the IRS-CI investigated the case.

Assistant U.S. Attorney Mark T. Odulio of the Western District of North Carolina and Trial Attorney Kevin Lowell of the Criminal Division’s Asset Forfeiture and Money Laundering Section-Bank Integrity Unit are prosecuting the case.

________________________________________________________________

Source: https://www.justice.gov/usao-wdnc/pr/financial-services-company-executive-pleads-guilty-obstruction-justice-0

Patrick

Winston-Salem Journal is reporting Burks’ criminal trial has been pushed back until July.

http://www.journalnow.com/news/local/criminal-trial-of-ex-zeekrewards-owner-paul-burks-moved-to/article_2dfa3ba6-9f19-5c81-b60b-d0825d09375f.html

Patrick