Kenneth D. Bell, the court-appointed receiver in the Zeek Rewards Ponzi scheme case, said in a statement today that he had recovered nearly $300 million and that “[t]here may be tens of millions of dollars more of recoverable assets.”

Kenneth D. Bell, the court-appointed receiver in the Zeek Rewards Ponzi scheme case, said in a statement today that he had recovered nearly $300 million and that “[t]here may be tens of millions of dollars more of recoverable assets.”

On Aug. 17, the SEC described Zeek as a $600 million Ponzi- and pyramid scheme that had affected more than 1 million people.

Securing receivership assets has been his “first priority” since his Aug. 17 appointment by Senior U.S. District Judge Graham C. Mullen, Bell said.

Bell’s statement appeared today on the receiver’s website. He noted that clawback actions may be in the offing, although he didn’t specify when.

“Among those from whom we intend to recover assets are those affiliates who took more out of Rex Ventures than they put in,” Bell said.

Rex Venture Group LLC is North Carolina-based Zeek’s parent company.

“Many of you received little or nothing from this enterprise,” Bell said. “In order to make everyone as whole as possible, those who profited from participating should surrender their gains.”

And Bell said he was aware that bogus information about Zeek was spreading online.

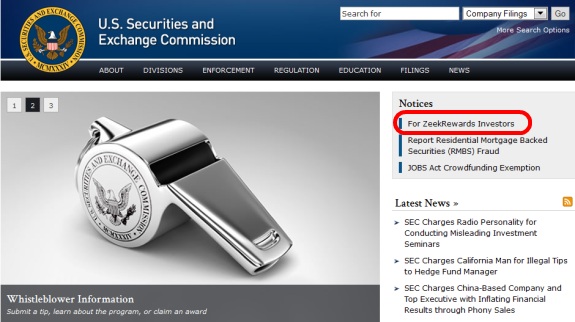

“Finally,” Bell said, “I read in many emails and web postings that some affiliates claim to have spoken to me or the SEC. False information is being circulated by these claimants. I have not spoken to any of those claiming to have done so. I will communicate with you through this web site. If I could answer all of the hundreds of thousands of emails and calls from you I would, but obviously I can’t. I also recommend that you consider only what the SEC posts on its web site for its position on this matter.”

In an Aug. 27 statement, Bell said that his “early investigation shows that the number of victims could be double” the SEC’s Aug. 17 estimate of 1 million.

“By sheer number of victims, this is one of the largest, if not the largest, Ponzi scheme to go into receivership in U.S. history,” Bell said in the Aug. 27 statement.

Visit the receiver’s website. Read the Sept. 13, 2012, statement from the receiver.