Training material purportedly produced in November 2009 and published online shows prospects of INetGlobal how to transfer money from the company to a reloadable debit card. The presentation reveals that INetGlobal was using the same debit-card firm that provided services for a Florida man implicated in October 2009 — just a month before the INetGlobal training material purportedly was produced — in an alleged international fraud scheme that gathered at least $22 million and made Ponzi payments to members via debit cards.

The training material is confusing in places, and the form in which it was published suggests that some INetGlobal members with Chinese names shared information to recruit Chinese prospects. At the same time, the training material and other information accessible at the same website suggests Chinese members also worked together to create instructional materials that showed other Chinese members and prospects how to offload their profits in cash at ATM machines and receive $300 sign-up bonuses that may not have been available to all INetGlobal members.

It is possible that a single member or group of members created the training material and the companion information. Whether the material, which does not purport to be hypothetical and appears to include no disclaimer language, used the names of real members was unclear. Also unclear is whether the approach had the approval of INetGlobal. What is clear is that the information was published openly online and purportedly reflects INetGlobal financial transactions that occurred among Chinese members in November 2009.

A “Contact” address on the website that published the information lists a street address in British Columbia, even though the domain itself lists a registration address in Mainland China. The British Columbia street address returns a page in Google search results that purports to lay out a conspiracy case against judges in Canada for issuing unfavorable rulings in what appears to be a matter unrelated to INetGlobal.

Just two months earlier, in September 2009, some Clickbank vendors were complaining that links to their businesses were being placed in INetGlobal’s advertising rotator without their knowledge. The Clickbank vendors also complained that INetGlobal was passing along bandwidth costs to them and that their businesses were experiencing a surge in unproductive traffic from China.

The author of the training document on debit cards was listed as Annie Zhang, according to the “Properties” of the document, which was published in PDF format.

The training document was published on a website whose domain-registration address was listed as “Xian, Shanxi . . . China.” The domain on which the information was published was registered to Jun Zhang. The website encourages prospects to submit their email address and wait to receive a return email “to get a referrer ID and referrer name that you will need in the registration process.”

Visitors to the website registered in China are told that, by registering for INetGlobal in this fashion, they can “Make Free Fast Money $300 Right Now.” The site instructs viewers to purchase a “$2000 Executive Business Package,” provide proof of the purchase by return email and wait to receive their bonus.

“We will send $300 free fast money to your V-Cash account,” the site tells viewers. “If you prefer, we can send $300 to your PayPal account too!”

Another URL at the same domain instructs prospects on how to register for a Clickbank account to promote products through INetGlobal. The instructions are available in multiple languages, including English, Chinese and Japanese.

The debit card featured in the PDF training material on the website registered in China is known as the “Exclusive One” card and is issued by Anres Technologies Corp. of Las Vegas. The Exclusive One card is pictured in the INetGlobal training material, and Anres’ name is referenced in court filings by the U.S. Secret Service in the INetGlobal case.

Anres’ name also is referenced by the SEC in a case filed last year in Florida against David F. Merrick, Traders International Return Network (TIRN), MS Inc., GTT Services Inc., MDD Consulting Inc. and Go ! Tourism Inc. Merrick and the companies were accused of running a Florida-based Ponzi scheme that used debit cards and claimed a presence in Panama.

Among the claims in the SEC case was that “Merrick and TIRN falsely represented that investors requesting a withdrawal of funds would receive a debit card loaded with their initial investment and return on their investments, when, in fact, the money loaded on the cards was money from other investors,†according to the SEC.

The PP Blog wrote about the TIRN case on Oct. 15, 2009. Millions of dollars were moved across borders, the SEC said.

“[A]t least $2.3 million of investor funds were transferred to accounts in Panama, Mexico, Malaysia, Switzerland and the Netherlands,†the SEC said. It added that about $8.8 million was placed on debit cards to make Ponzi payments to members..

Although TIRN was not an autosurf, debit cards have become increasingly popular in the autosurf universe. The TIRN case demonstrated that alleged fraudsters were relying on debit cards to pull off international financial schemes.

Anres was not named a defendant in either the TIRN case or the emerging INetGlobal case. The company has not been accused of wrongdoing.

In recent months, the FBI has expressed public concerns that criminal organizations were turning to preloaded debit cards to launder money and that users were taking advantage of a “shadow” banking system.

Card Highlighted In Instructional PDF For INetGlobal

The purported INetGlobal training material appears in a PDF that includes screen shots. The person (or persons) who assembled the material appear to have Chinese names, and the English-language material walks prospects through the process of converting electronic credits to cash that can be loaded onto an Exclusive One debit card and withdrawn at ATMs.

In February, the Secret Service said it believed INetGlobal was targeting Chinese members in an international Ponzi scheme. The purported training material lists IP addresses in the United States and Canada in a manner that suggests Chinese members in both countries were working together to train other Chinese members how to offload profits onto debit cards and also how to transfer money using INetGlobal’s internal system from one Chinese member to another.

Among the assertions against INetGlobal by the U.S. Secret Service was that the company was engaging in wire fraud and money laundering. The IRS now has entered the case, which suggests that the government also suspects tax crimes.

Material Suggests Account-Sharing And Cross-Border Planning

The second page of the 18-page PDF purportedly shows the back office of an INetGlobal member who appears to have a Chinese name. This page lists the member’s name as “Dong,” lists a five-digit INetGlobal member number, a six-digit V-Cash account number and an IP address that comes back to Minneapolis. The page notes that automatic repurchasing of additional “adpacs” was enabled and set for 50 percent. Viewers were prompted to click on a tab labeled “V-Services.” In the next step, viewers were prompted to click on a graphic labeled “V-Cash Online Payment Services.”

This page forwarded to another prompt to click on a V-Cash logo, which led to a login screen that prompted members to enter a user ID and a password. A “Welcome” screen followed, and members were instructed to click on a tab that prompted them to go to the “Member Center.”

Once inside the Member Center, members were prompted to click on a tab labeled “V-Cash.” This led to a screen that prompted them to enter a password for their V-Cash accounts. The next screen shot showed that V-cash was logging members’ IP numbers; the IP number logged in this screen shot came back to Toronto. Why the shot displayed a Toronto IP when the earlier shot displayed a Minneapolis IP was unclear.

The next screen shot prompted members to click on a tab labeled “balance.” This screen noted a “Currency balance” of more than $3,038 in the account. The next screen was confusing because the currency balance had been lowered by $200. Why the balance was lowered was not made clear in the presentation.

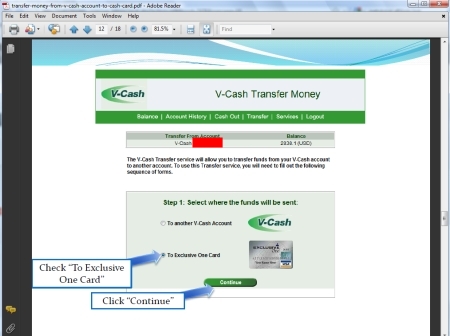

In the next screen shot, the presentation provided the initial instructions on how to transfer money to the Exclusive One card, which is pictured in the document. This screen shot also purported to show that members could transfer money from their V-Cash accounts to other V-Cash accounts from within the company’s internal system. The presentation prompted viewers to select the option to transfer money to the Exclusive One card and press “Continue.”

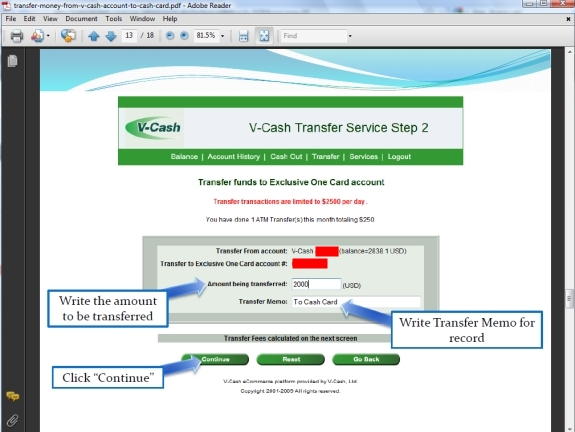

Thereafter, the presentation showed a purported transfer of $2,000 to the Exclusive One card. The presentation noted a $30 fee incurred when making the transfer. The fee rate for the transfer service was described as 1.5 percent. The screen shot noted that the total amount transferred, including the $30 fee, was $2,030. Viewers were prompted to “Click to Confirm” the transfer.

One of the screen shots that followed purported to show a “History” of transfers to and from the account. One of the transfers showed a purported transfer “from” Annie Zhang to an INetGlobal member in the amount of $3,000. It was dated Nov. 3, 2009.

A person named Annie Zhang purportedly is one of INetGlobal’s top recruiters. Some promos for the firm have asserted Zhang was making $100,000 a month as an affiliate of INetGlobal.

Parts of the PDF presentation are confusing. For example, the member’s name that appears on the second page of the presentation does not agree with the member’s name that appears on Page 6 — even though the INetGlobal member account number appears to be the same, as does the V-Cash account number.

On Page 2, the member’s name is listed as “Dong” with an IP number that comes back to Minneapolis. On Page 6, however, the screen welcomes a member named “Lei.” An IP shown on Page 9 comes back to Toronto — not Minneapolis.

In the document’s published form, both Dong and Lei appear to have the same 5-digit INetGlobal number and the same six-digit V-Cash account number. Why two purported INetGlobal members would have the same account numbers is unclear.

INetGlobal Now Has Links To Three Ponzi Cases

In February and March court filings, the U.S. Secret Service linked INetGlobal to the alleged AdSurfDaily Ponzi scheme, alleging that an undercover agent was introduced to INetGlobal by an ASD member. The Secret Service brought the Ponzi case against ASD in August 2008.

The appearance of the Exclusive One card in the purported INetGlobal training material links INetGlobal to a second Ponzi court scrape: the SEC’s case against the alleged David Merrick/TIRN Ponzi scheme, which appears to have used the same debit card as INetGlobal to pay members. The CFTC also filed allegations against TIRN, and the U.S. Attorney for the Middle District of Florida also is investigating TIRN.

Separately, INetGlobal operator Steve Renner was linked to a Ponzi scheme known as Learn Waterhouse in 2004. A company Renner operates — Cash Cards International (CCI) — provided payment-processing services for the Learn Waterhouse scheme, and Renner himself purportedly was an investor in the scheme, according to court filings.

Four of the scheme’s operators were sentenced to lengthy prison sentences in the Learn Waterhouse case. (If you have the time, the PP Blog highly recommends you read this document from the U.S. Court of Appeals for the Ninth Circuit, denying appeals in the case.)

The document recounts the history of the case, including astonishing allegations that Learn Waterhouse told investors that it “had invested $2 billion in a gold mine in Mexico, and [was] working on a billion-dollar Columbus-era ‘find’ on the bottom of the ocean.”

Renner was alleged to have provided payment-processing services for Learn Waterhouse through CCI and to have spent investors’ money on personal purchases.

Randall Treadwell, the ringleader of the Learn Waterhouse scheme, “often claimed that he had a God-given ability to make money, but in hindsight it appears that his talents lay in extracting funds from duped investors,” according to court filings.

Indeed, according to filings in the Learn Waterhouse case, the “purported investments

did not exist at all.

“By the time the defendants’ far-reaching Ponzi scheme collapsed, more than 1,700 investors throughout the United States had lost their investments. At trial, the defendants produced no evidence to suggest that any investment profit was generated by their companies.”

Losses in the Learn Waterhouse case totaled at least $44 million.

Comments

11 responses to “Debit-Card Firm Spotlighted In Purported Training Material For Minnesota-Based INetGlobal Was Referenced In $22 Million Ponzi Case In Florida Last Year; Renner Company Now Has Link To Third Ponzi Court Scrape”

Patrick, the word “confused” has always been used in trying to explain Inetglobal. Steve made everything confusing, bu the bottom line was this. if you thought you could make money surfing with only two levels of upgrades in ASD, well get two people in to inet and get paid 10 levels deep!!!

Steve change the pay plan so much. that by Nov of 09 I don’t now how you got paid, but here is my guess.

With a 2,000.00 purchase into Inet. the person would get $3000.00 in play money. I love how Steve took real money in fees and gave back play money. I can not recall what the sponser got. I thought is was 10% real and 10% on your fake money ( cash Balance), but maybe it was 20% real cash. If it was the latter, really all Zhang did was take the upfront money of her commission pay it back 15 days after (that was the wait time), and then made the surfing money long term. 10 level deep. Steve really wanted to promote Zhang because with out her they would be no Inetglobal. I’m still guessing here but, Steve was the master of making splash pages and I bet he set her’s up. This way she was making $100,000 a month on paper, but given it back under the table. If Canada has an IRS maybe they should look into it.

Cash Cards Int & V-Cash are also mentioned in this court filing from 2006:

http://www.secreceiver.com/megafund/DOCUMENTS/Motion%20to%20Freeze%20Accounts.pdf

I’m not familiar with “MegaFund” or the names of the other defendants, but it sounds a lot like the typical ponzi HYIP that is promoted at the usual ponzi promotion forums. I haven’t checked but I suspect that “MegaFund” was another obvious ponzi scheme.

Thanks, Tony.

Patrick

Here’s the SEC complaint against MegaFund:

http://www.sec.gov/litigation/litreleases/lr19292.htm

The complaint doesn’t mention the word “ponzi” but it was a HYIP, an obvious ponzi scam. It had the usual signs – targeting religious groups, outlandish investment returns, “off shore” bank accounts etc.

You know what? i think i can explain away your confusion. The change in names could simply be the consequence of using different accounts to demonstrate how the system works. The material has been updated to a minor degree from time to time, therefore, people have to make another transaction (because all the transactions are made in real time and it is impossible to be redone) when making these minor updates.

btw, the whole material is there to educate team members in china who has limited English ability to understand how to receive payments, make transactions etc. your accusation is unbelievably inaccurate and misleading.

Hopefully, this could help you to better understand the whole point of these training materials.

Another thing, you mentioned that 200 dollar was deducted the account. This is simply because there was another transaction right before. The system will not automatically update the balance, therefore each time people will need to click on the “currency balance” to see the updated amount left in the account. If you consider the entire material in a whole, then you would not become confused like this.

before you write article on anything, you should at least know how things work and what you are talking about.

kindly regards,

so Jungle nO’s help us out to understand in Nov 09. You sponsor a person for $2,000.00 that get to surf for 3,000 what was the real cash commission on that? Could a person give back $300.00 then make the money on the overrides on the surf?

according to the compansation plan on the iNetGlobal WebSite, the affiliate commision is 10% of the sale.

Please help me. I need my money back from Inetglobal. I joined in February 2010. Since I signed up with the company I am going through depression because they did not pay anything yet. Before joined I was told from upline that you are paid just for clicking 25 ads everyday which will take only 8-10 minutes. Please help me how can I get my money back from them. Thanks. If anybody knows please reply me at briyat@hotmail.com

Baljit,

You have another option as well as waiting for iNetGlobal (or the authorities) to give back to you a small fraction of your losses. Your upline illegally recruited you into a criminal scheme. They do have civil liability as well. In other words, it is possible to sue your upline for damages. Check with a lawyer.