Four Pennsylvania residents have been charged in an alleged pyramid-scheme caper that gathered more than $7.5 million and bilked universities, nonprofits, local governments and other clients, investigators said.

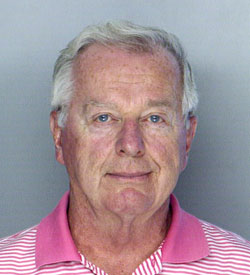

Charged in the case were Brian James Murray, 67, of Scranton; Murray’s wife, Diane D. Murray, 66; Christine M. Oliver-Shean, 51, of Scranton; and Oliver-Shean’s husband, Timothy G. Shean, 53.

Brian Murray was the chief executive officer of the Murray Insurance Agency in Scranton. Christine Oliver-Shean was the president of the company, which is now bankrupt, authorities said.

The former executives are charged with criminal conspiracy, money laundering, theft, insurance fraud, forgery, participating in a corrupt organization, tampering with evidence, obstructing law enforcement and various tax crimes. Among the allegations was that the executives used a business registered in the British Virgin Islands to conceal more than $10 million in income and avoid paying taxes.

Diane Murray, meanwhile, was accused of theft and conspiracy in an alleged scheme to divert money from another business to the Murray Insurance Agency. She also is charged with filing false tax returns.

Timothy Shean was accused of conspiracy, tampering with physical evidence and obstructing law enforcement in an alleged bid to conceal evidence.

In what may go down in the law-enforcement community as a moment of almost impossible symmetry, Pennsylvania Attorney General Tom Corbett got to deliver the type of line that only can be delivered when the fraud-fighting universe aligns itself perfectly.

Indeed, Corbett said, “It is interesting to note that the building in Scranton where Murray’s insurance business was headquartered is known as ‘One Pyramid Center,’ because this was a massive illegal pyramid.”

The pyramid absorbed “millions of dollars from new clients to conceal past thefts and keep the scheme in operation,” Corbett said.

Also charged criminally in the case were three companies: Murray Insurance Agency and Mallow Holding Co. of Scranton, and Gaffer Insurance Co. Ltd. of Tortola, British Virgin Islands.

The case demonstrates that underlings and relatives who participate in a fraud scheme and/or help to conceal evidence can be charged with serious crimes. Corbett said the probe sprouted from an earlier investigation in which Brian Murray was accused of stealing more than $1.3 million in customers’ payments for insurance premiums.

“The losses from large-scale fraud cases such as this one impact everyone who purchases an insurance policy in Pennsylvania, who will face higher premiums and increased costs in the future,” Corbett said.

In essence, Brain Murray was accused of collecting money for insurance premiums — but not forwarding the money to insurers. If a client made a claim, the claim was paid from money sent in by other clients. The scheme collapsed in September 2009.

Listed among the victims were the University of Scranton, Marywood University, Loyola College of Maryland, St. Joseph’s University, Moses-Taylor Hospital, the Borough of Phoenixville, and the Lackawanna County Multi-Purpose Stadium.

Other nonprofits and unsuspecting businesses also were fleeced in the scam, investigators said.