BULLETIN:

UPDATED 10:03 P.M. EDT (U.S.A.) A jury in Harris County, Texas, has thrown down the gauntlet to hucksters targeting financially strapped consumers by finding more than 1,400 violations and returning a spectacular verdict of $13.8 million against a purported “debt repair” firm that had a multilevel-marketing component.

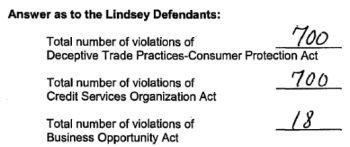

The jury, which found that the accused firms engaged in deceptive trade practices and were required to register under the Business Opportunity Act but did not do so, assessed a penalty averaging $9,732 for each of 1,418 violations it found, bringing the total to $13.8 million.

In announcing the verdict, the office of Texas Attorney General Greg Abbott published the jury’s actual findings that outlined the violations and the spectacular financial penalties against the defendants. The jury not only awarded the state $342,590 to handle the cost of bringing the prosecution, but also awarded $38,880 to apply to the state’s costs if the verdict was challenged in the Court of Appeals or the Texas Supreme Court.

As part of the verdict, the panel specifically found that Jubilee Financial Solutions LP, Jubilee Financial Management LLC and Robert M. Lindsey did not register the purported “business opportunity” with the Texas Secretary of State as required when the “initial consideration” involves more than $500 and customers believe they will earn or likely will earn a profit by paying the fee.

Jubilee Financial Solutions did business as The Credit Card Solution (TCCS).

Prosecutors said Lindsey and the companies — along with another entity known as the Freedom from Debt Alliance — “used illegal ‘debt invalidation’ schemes that purported to help financially struggling Texans.”

More than 700 people paid an “average” of $3,000 for the fraudulent services, and emerged “worse off financially after paying TCCS,” prosecutors said.

“Under state law, multilevel marketers must register with the Texas Secretary of State and obtain surety bonds in order to lawfully operate in the state, but the defendants failed to do so,” prosecutors said.

Read more about the Texas Business Opportunity Act and registration requirements here.

Find the jury’s verdict documents here.

Comments

5 responses to “KABOOM! Texas Jury Hits ‘Debt-Repair’ MLM Firm With $13.8 Million Verdict; Panel Even Says Defendants Must Pay State’s Cost If They Appeal”

MORE ON BUSINESS OPPORTUNITY LAW

ROD COOK\

http://www.business-opportunity-watchdog.com/

Rod,

For the sake of clarity, I added a link to the Texas AG’s site that outlines the state’s Business Opportunity Act and explains the registration requirements.

Patrick

http://www.ccdnscam.com/the-people/robert-m-lindsey/

More here, from 2009:

http://getoutofdebt.org/16358/bob-lindsey-claims-to-be-good-christian-and-then-dupes-consumers-out-of-thousands-for-debt-relief-2

Hi Tony,

Thanks for those.

Man, how bizarre. Cross-wearing Lindsey seems to have been in the collection-agency business, then in the business of trying to beat collection agencies — and this after his jail time for a separate caper in which he was charged with “engaging in organized crime in the first degree.”

The “cocaine” apparently made him do it.

Lindsey’s debt-repair/MLM business, prosecutors said, was “not based in federal law but rather is in gross violation of federal law.”

They also called him a career con man.

It was like reading some of the ASD filings. His missives to the masses even had that element of EvilGUBment.

Patrick