BULLETIN: The SEC has gone to federal court in Houston, alleging that Firas Hamdan was conducting an affinity-fraud scheme targeted at the Lebanese and Druze communities. The agency is seeking an asset freeze against Hamdan and his unregistered company, FAH Capital Partners Inc. The scheme is alleged to have gathered about $6 million over five years.

“Hamdan’s affinity scam preyed upon people’s tendency to trust those who share common backgrounds and beliefs,” said David R. Woodcock, director of the SEC’s Fort Worth Regional Office. “Hamdan raised money by creating the aura of a successful day trader among friends and family in his community, and he continued to mislead them and hide the truth while trading losses mounted.”

Hamdan is 49. The SEC says he has an address in Houston and previously used an address in Sugar Land.

“Hamdan is well-known in the Houston-area Lebanese and Druze communities and has enjoyed a reputation as a successful day trader,” the SEC said in its complaint. “He is also a former treasurer of the Houston branch of the American Druze Society (‘ADS’), a non-profit cultural organization to which many Houston-area members of the Druze religion belong.”

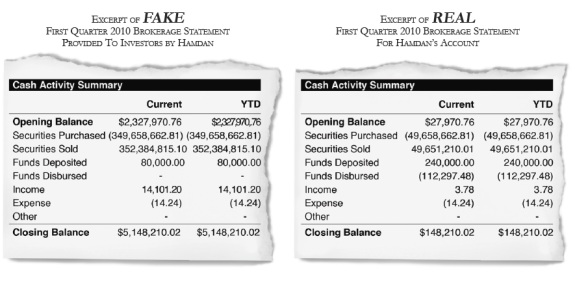

Falsified records helped drive the scam, the SEC said.

As has been the case in other scams, Hamdam allegedly claimed he used a “proprietary trading algorithm.”

“Hamdan explained to investors that his algorithm was ‘plugged into’ his trading account at TD Ameritrade to further minimize investor loss,” the SEC charged. “Hamdan promised investors that, as a result of this algorithm, he could guarantee the fixed monthly return based on the amount they invested with him.”

As has been the case with other scams, Hamdan also talked about “promissory notes.”

“Although the precise terms of the notes appear to vary among investors, the notes generally provide for returns of approximately 30% per year,” the SEC charged.

Read SEC Investor Alert on affinity fraud.

A snippet (italics added):

Fraudsters who carry out affinity scams frequently are (or pretend to be) members of the group they are trying to defraud. The group could be a religious group, such as a particular denomination or church. It could be an ethnic group or an immigrant community. It could be a racial minority. It could be members of a particular workforce – even members of the military have been targets of these frauds. Fraudsters target any group they think they can convince to trust them with the group members’ hard-earned savings.

At its core, affinity fraud exploits the trust and friendship that exist in groups of people who have something in common. Fraudsters use a number of methods to get access to the group. A common way is by enlisting respected leaders from within the group to spread the word about the scheme . . .

Read the SEC complaint against Hamdan.