UPDATED 12:14 P.M. EDT (U.S.A.) Being under investigation in Brazil and Massachusetts and getting kicked out of Rwanda apparently isn’t viewed in MLM La-La Land as a strong-enough clue that it’s time to give up the TelexFree ghost.

Or maybe it is — and the TelexFree-related fire sales have begun. It wouldn’t be the first time that members of an HYIP tried to sell their holdings while regulators were circling.

At least in the United States, one of the TelexFree issues is whether the purported “opportunity” is selling unregistered securities as investment contracts. That’s bad enough.

But things potentially could get worse. Individual TelexFree members now may be creating bundles of securities and fueling even more questions about a dangerous TelexFree black market.

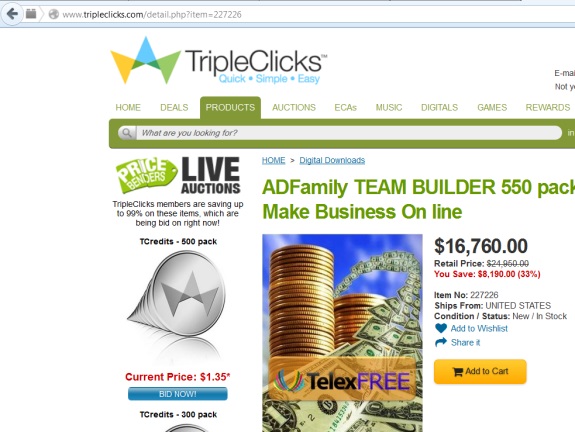

An ad for a package of 550 TelexFree AdCentrals appears on a site known as “TripleClicks.” The asking price? $16,760.

Good grief.

The bundle, according to the ad, ships from the United States.

“You Save: $8,190.00 (33%),” the ad contends.

It goes on to say this (italics added):

1) you will pay 16,760$ to get a value of 24,950$ of voip subscription that you can use by your self

2) you will earn up to 110,000$ in one year (minimum guarantee 100% 56,100$ only posting 55 adtext for day)

3) You will get a lot of Vpoints that will be useful for your SFI Business

4) you will be refunded 100% if within about 18 weeks you will not have fully recovered the money spent initially. If of course you did all needed to get back money (it mean 30 minutes copy and paste everyday without sponsoring or sale nothing at all)

so nothing to loose here but only to get…

How the “refunding” would be accomplished wasn’t explained. The ad suggests, however, that TelexFree would “repurchase” the packs over time.

In addition, the ad contends that BehindMLM.com, a site that reports on emerging MLM frauds, has “what I believe is a more skeptical perspective on what is going on behind the Telexfree name.” The ad that bundles TelexFree “AdFamily” packs then asks and answers its own question:

“Does Telex Free Work? I confidently say it works, with Capital Y as in Yes! You see this company has a track record already.”

Visit BehindMLM.com. Among other things, BehindMLM has reported on money-laundering allegations involving TelexFree.

Comments

16 responses to “UNBELIEVABLE: Bundle Of 550 TelexFree ‘AdCentrals’ Advertised For $16,760, A Purported Discount Of $8,190; Purchaser Will Receive ‘Minimum’ Guaranteed Payout Of $56,100 — And Maybe Even $110,000, Pitch Claims”

It probably comes with that AdAssure Lite thing pushed by Labriola himself.

Can these be bundled and securitized into taxpayer backed mortgages? Then Wall Street Banks could buy them, securitize and bundle them into and get bailed out by the Federal Reserve and taxpayers!

In my father’s first round of basic investment lessons:

“If it’s such a GREAT deal … why are you trying to sell it to ME??”

I’ve seen similar “fire sales” by the suckers stuck with worthless “units” in WCM777/Kingdom777/Global Unity and Better Living Global Marketing recently.

SD

.

For what it’s worth, those “bailed out by taxpayers” banks paid back every cent of that moeny, with interest..just sayin’

Taxpayer loans is not how the banks stole from us. The Fed bought trillions of worthless securities from the banksters, allowing them report huge profits & pay huge bonuses even during the hight of the recession, and replenish the balances sheets with this free money from the Fed.

The banksters got 100% on the dollar (maybe more there has never been a good audit of the Fed) for their fraudulent securities, we the taxpayers got worthless securities sitting in the Fed vault even now.

All ultimately paid for by you and me.

Still has nothing to do with the topic of this article. Go spout your nonsense elsewhere

Quick note: I do wonder if I’ll ever write about an HYIP without someone bringing up or even railing against “the Fed” and injecting the “bailout.”

“timbers” is being pretty mild here and may be reflecting his deeply held views.

But I do want timbers to recognize that the story above is about an ad that suggests TelexFree members may be packaging/bundling securities during investigations on at least three continents and telling prospects they can purchase an income.

So, a potential train wreck — TelexFree — may be creating conditions under which additional train wrecks can occur, potentially on tracks that run through towns large and small across the globe.

I’d be interested in hearing your thoughts on that, timbers. And if you have any thoughts on why the Fed and the “bailout” keep being introduced in stories about HYIPs, I’d like to hear those, too.

Patrick

Thanks Patrick. No expert on HYIP here, but can share with you my experience with Telexfree if that is any help. (Warning: it may bore you).

I live in Massachusetts. My husband is Brasilian and started doing Telexfree Jan 2013 and finished Dec 2013. I was mad at him for this, in response he explained his father in Brasil bought Telexfree and asked him to do it, because he is blind and could no longer post the adds (his father is going blind but my husband later told me the rest of the story was not true…he did it himself). Later I was amaze he was doing well, and joined him May 2013. Shortly after May 2013, Telex was shut down in Brazil and I expected to lose money. That is when I seriously researched Telexfree and found your blog and behindlml. Your blogs helped confirm my initial suspicions.

My husband is no longer doing Telexfree, and my contracts end in may and june 2014. I expect Telexfree may stop paying any week now if it is not shut down.

Initially I thought Telexfree was a marketing arm for phone company that paid to hire people to post adds, to save on expensive online advertising. That line of reasoning was easy to accept as I watched how well my husband was doing.

Now, many Telexfree people are looking for new HYIP. Prime Click 8 and wings are mentioned most within my earshot. I will not be joining them.

Very much appreciate your reporting, Patrick, learned a lot. I will not be renewing my Telexfree contracts (if it is still around).

It may be of some interest to you that Yves Smith is currently suing CalPERS (California pensions) for release of financial reporting documents pertaining to pension funds it is obligated to provide, and stonewalling her. There may be institutionalized fraud/HYIP potential of a different nature in how CalPERS has been managed these state pensions.

Regarding Whip “nonsense”: Susan Webber (penn name Yves Smith) runs Naked Capitalism, recognized expert on financial reporting blogs. This happens to be an issue the right (Ron Paul) and left (Yves Smith) agree on in many instances, and the Fed actions I mentioned are known to have occurred.

timbers: there’s at the minimum, a moral difference people playing within the rules, but profiting from it for all its worth, vs. scammers out there out to take money from people like you and me.

There is no excuse for the bank bailouts… except for the huge cascade effect it would have that would have dragged down the entire US economy. And laws are passed and “stress tests” are often ordered to make the banks more resilient. Lessons have been learned. Governments have an “institutional memory” in the form of laws and precedents and such.

People, on the other hand, does not. Scams just change names, but it’s the same scams for 100 years or much longer. And people STILL fall for the same Ponzi or pyramid or 3 card monte or whatever.

On the subject of Patrick’s post, for the first time am hearing people offering Telexfree credits at discount for cash. The reason offered is to avoid paying taxes on the income. As some bought heavily just before the old plan came to an end, their credits are accumulating rapidly, and $10,000 is the max for bank transfers without Feds getting involved. Also, their payment system crashed for part of Tuesday, 3/25, and Tuesday is the only day to request payment…this may factor too. Some may realize better to get cash now should it be unavailable later – though it seems to be the same people gobbling up contracts before the plan changed on 3/9.

Forgot to mention – People are offering to sell opened but unused old Telexfree contracts created before the switch over on 3/9. The old contract is viewed as more desirable than the new plan. Some may have expected to sell old contracts at a premium? No price indicated but here is an example:

http://www.moneymakergroup.com/Telexfree-Telexfreeco-t415036.html&st=1410

I wouldn’t bet on that being the case.

Banks in the USA are required to file a Suspicious Activity Report (SAR)

“In United States financial regulation, a suspicious activity report (or SAR) is a report made by a financial institution to the Financial Crimes Enforcement Network (FinCEN), an agency of the United States Department of the Treasury, regarding “SUSPICIOUS OR POTENTIALLY SUSPICIOUS ACTIVITY

“FinCEN requires a SAR to be filed by a financial institution when the financial institution suspects insider abuse by an employee; violations of law aggregating over $5,000 where a subject can be identified; violations of law aggregating over $25,000 regardless of a potential subject; transactions aggregating $5,000 or more that involve potential money laundering or violations of the Bank Secrecy Act; computer intrusion; or when a financial institution knows that a customer is operating as an unlicensed money services business”

I am aware of that being the case.

My point is, keeping payments under $10,000 is no guarantee of keeping the Feds at bay.

It’s the suspicious ACTIVITY that will bring TelexFree USA undone with US banks.

I understand but these people don’t think of themselves as doing anything wrong in requesting money. $10,000 is just a limit they face.

Is there any way to keep feds at bay? Googling pressure cookers can get you a visit from the FBI and our phones are spied on by NSA and sold to corporations. Pressure cookers are common in Brasil, my husband is Brasilian and finding a pressure cooker in U.S. is not as easy here as elsewhere. We’ve purchased 2 pressure cookers in the past year.

The problem they are facing is not with the “Feds” but with the banks themselves.

One of the outcomes of post 911 is that banks are required by law to have an automated process for monitoring transactions and accounts and filing Suspicious Activity Reports.

While a supposed transaction limit may keep members naively believing they remain “under the $10,000 radar” it is no longer the case.