BULLETIN: What happens if it is alleged by law enforcement that you’re a Ponzi schemer/affinity fraudster, a business associate of a Ponzi schemer/affinity fraudster or a vendor of a Ponzi schemer/affinity fraudster?

BULLETIN: What happens if it is alleged by law enforcement that you’re a Ponzi schemer/affinity fraudster, a business associate of a Ponzi schemer/affinity fraudster or a vendor of a Ponzi schemer/affinity fraudster?

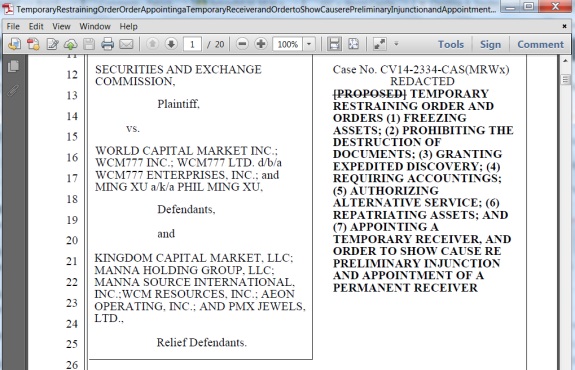

A federal judge has frozen at least 54 bank or financial accounts the SEC has linked to WCM777, an alleged $65 million Ponzi- and pyramid scheme with domestic and offshore conduits.

Accused operator Ming Xu had “authority” over at least 16 of the accounts, according to court filings. Who controlled the others was not immediately clear.

WCM777 was accused of targeting the Asian and Latino communities in a ribald HYIP scam that in part traded on the names of famous businesses, perhaps particularly companies in the hospitality industry. Many immigrants work in the hospitality trades.

Although the asset freeze was made public yesterday, it became known only today how many accounts it affected.

The order has a provision that covers “all accounts at any bank, financial institution or brokerage firm, or third-payment payment processor, all certificates of deposit, and other funds or assets.”

Banks/vendors expressly covered by the order include Bank of America, Wells Fargo, Merrill Lynch, Comerica, HSBC, E*Trade, JPMorgan Chase, Citibank, East West Bank and American Continental.

It also became known today that Krista L. Freitag of E3 Realty Advisors of Los Angeles has been appointed receiver. The receiver already has taken control of at least two websites linked to WCM777, including WCM777.com.

U.S. District Judge Christina A. Snyder of the Central District of California has approved the asset freeze and the appointment of Freitag, a forensic accountant.

Snyder has authorized the SEC to conduct depositions “on two days’ notice” and cleared the agency to perform depositions even on Saturdays.

“Depositions may be taken Monday through Saturday,” according to the order.

And Snyder also authorized the SEC to bypass subpoenas and serve “a deposition notice by facsimile, hand or overnight courier” upon “agents, servants, promoters, employees, brokers, associates, and any person who transferred money to or received money from the bank accounts . . .”

Meanwhile, Snyder ordered Freitag “to conduct such investigation and discovery as may be necessary to locate and account for all of the assets of or managed by Defendants World Capital Market Inc., WCM777 Inc., WCM777 Ltd. d/b/a WCM777 Enterprises, Inc., and Relief Defendants Kingdom Capital Market, LLC; Manna Holding Group, LLC; Manna Source International, Inc.; WCM Resources, Inc., and their subsidiaries and affiliates, and to engage and employ attorneys, accountants and other persons to assist in such investigation and discovery.”

The judge also ordered the defendants and relief defendants not to destroy records and to repatriate assets.

Comments

2 responses to “BULLETIN: Federal Judge Freezes At Least 54 Bank/Vendor Accounts Linked By SEC To Alleged WCM777 Ponzi/Pyramid That Targeted Asians And Latinos; Court Authorizes Saturday Depositions And Orders Protection Of Records And Assets To Be Repatriated”

Parallels Between SEC Scrutiny In Herbalife, WCM Missing The Point

http://www.valuewalk.com/2014/03/sec-shuts-down-cloud-computing-pyramid-scheme/

He’s technically right, but he’s barking up the wrong tree. It’d be FTC leading the investigation, not the SEC, on Herbalife.