UPDATED 12:07 P.M. EDT (U.S.A.) You can’t blame legitimate MLMers if they’re feeling a little jittery. Herbalife, one of the industry’s stalwarts, is under investigation by the FTC, which has many duties, including enforcing laws against false advertising and pyramid schemes. Precisely why the FTC is investigating Herbalife is unknown. Hedge-fund manager Bill Ackman says Herbalife is a pyramid scheme that plumbs and churns vulnerable population groups. (See Nov. 13, 2013, PP Blog editorial: “Herbalife And Polarization In The Latino Community.”)

A public company, Herbalife itself announced the probe on March 12, saying it had received a “Civil Investigative Demand” (CID) and will “cooperate fully” with the agency.

But even as Herbalife wore a confident face and shared the FTC news, others within the MLM realm were making the trade look ridiculous on a global scale. MLM already is known for train wrecks (see example) and spectacular PR gaffes (see example). The sorry circus taking place outside of Herbalife’s immediate sphere of influence (see below) couldn’t come at a worse time for the firm.

To Herbalife’s credit, there was no attempt to demonize the FTC or pretend the CID was unimportant. So, score an early point for the supplement-maker in the category of PR awareness.

The unfortunate reality for Herbalife, however, is that it is ensconced in an industry that serves up one outrageous scam after another. And because some quirky or downright bizarre MLM “programs” have shown an almost unbelievable ability to raise tremendous sums of money quickly, the issue is not simply about a PR deficit. It’s also about national and cross-border security.

That’s why Herbalife’s conduct while it is under investigation by the FTC matters to the entire trade.

Attempts by Stepfordian MLMers to paint law enforcement as the enemy and dismiss the importance of a CID sent by North Carolina Attorney General Roy Cooper to the Zeek Rewards MLM “program” in July 2012 made MLM look silly. Claims from Zeek’s Stepfordian wing that the receipt of a CID was “exciting” news made it look beyond clueless.

Whether the trade likes it or not, all of this Stepfordian behavior gets pinned on “MLM.” And MLM therefore looked particularly ridiculous when the SEC, a month after the North Carolina CID, described Zeek as a Ponzi- and pyramid scheme that had gathered hundreds of millions of dollars in less than two years and had ripped off hundreds of thousands of people by planting the seed it paid an interest rate of 1.5 percent a day and that earnings could be “compounded.”

So, if you’re a legitimate MLMer and need a comforting thought, here’s one for you: Unlike Zeek, Herbalife isn’t trying to sell the “exciting” angle to its legions of members during a government probe. And here’s a tip for legitimate MLMers and individuals considering signing up for an MLM: When someone tells you a government investigation is exciting news, get the hell off the list or stop reading the Blog. Recognize that you’re being splashed with sugary vomit and programmed by an MLM Stepfordian.

The PP Blog’s analysis of Zeek is that it was a criminal enterprise from the start that was designed in part to reel in participants dissatisfied with traditional MLM companies such as Herbalife that sell the dream but have low distributor success rates and high burn rates. Refugees from Herbalife and other traditional MLMs were perfect marks for Zeek’s MLM, a collection of predatory vultures unlike the MLM world had ever seen.

We’re bringing this up because MLM so often ventures into Stepfordland. So, odd as it sounds, Herbalife did itself (and the industry) a favor by avoiding the word “exciting” when describing a CID. For perfectly understandable reasons, it allowed only that it “welcomes the inquiry given the tremendous amount of misinformation in the marketplace” and that it is “confident that Herbalife is in compliance with all applicable laws and regulations.”

Even though Herbalife did not fumble the ball when announcing the probe, the company still needs to work on its messaging. Last year, when the firm was confronting Ackman’s pyramid allegations and companion assertions that it was plumbing and churning Latinos/Hispanics to sustain growth, Herbalife described former U.S. Surgeon General Richard Carmona — a new appointee to its board — as “[b]orn to a poor Hispanic family in New York City.”

In highlighting Carmona’s circumstances as a newborn delivered into poverty in the Big Apple more than 60 years ago, Herbalife perhaps was projecting some stress. Whether it also was projecting an accidental hint of a Stepfordland within Herbalife remains on open question.

Given the disturbing plumbing-and-churning assertions against the firm, Herbalife would have done better by simply announcing Carmona’s appointment and including only his academic/business/public-service credentials in the announcement. It doesn’t matter that other enterprises with which he is involved have used the same line about hailing from a “poor Hispanic family” to describe him. They’re not being accused of pillaging vulnerable populations.

In short, Herbalife cannot afford to be seen as a Stepfordland company. Nothing can erode marketplace confidence faster.

Poor or even insidious messaging has harmed MLM for years. It is an industry that, unfortunately, is known for serial disingenuousness, absurd misrepresentations, gross distortions, impossible constructions and outright lies.

How Other Industry Messages Could Hurt Herbalife

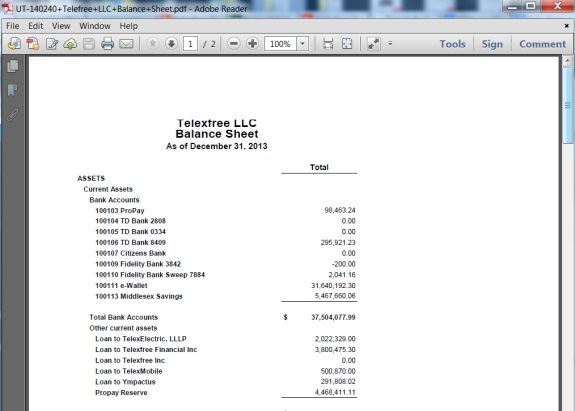

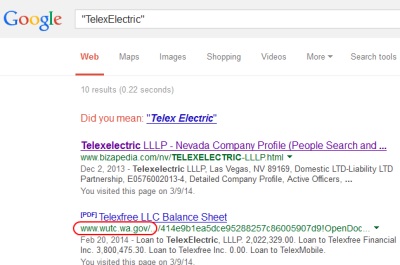

On March 11, a day before Herbalife announced the FTC probe, members of the TelexFree MLM were taking to the web and planting the seed that President Obama had TelexFree’s back. The assertions are either a gross misunderstanding of the JOBS Act and the concept of raising startup capital through crowdfunding or a typical MLM lie to provide extra cover for the scheme. (See Google Translation from Portuguese to English here. See original here.)

For starters, TelexFree, which appears to have gathered $1 billion or more in less than two years, wants the public to believe it is not selling securities, despite affiliate claims the “program” delivers “passive” income. Moreover, it is not raising capital under the JOBS Act, which is a work-in-progress. In October 2013, the SEC formally proposed that a “company would be able to raise a maximum aggregate amount of $1 million through crowdfunding offerings in a 12-month period.”

The sum of $1 million is less than the sum TelexFree pitchman and former SEC defendant Sann Rodrigues says he’s earned from TelexFree since Feb. 18, 2012.

Rodrigues started pitching TelexFree before the JOBS Act even became law and before the SEC even promulgated rules. So, strike the JOBS Act claim.

Beyond that, TelexFree is under investigation by the Securities Division in its home state of Massachusetts. There’s also at least one probe in Africa, specifically in Rwanda, where a genocide occurred in the 1990s. Meanwhile, in South America, Brazilian prosecutors have called TelexFree a pyramid scheme. Police in Europe have issued warnings about TelexFree, amid concerns that the “opportunity” is targeting the Madeiran community.

At a minimum, TelexFree is at least as clueless as Zeek, home of the “exciting” CID. As noted above, TelexFree pitchman Sann Rodrigues is a former defendant in an SEC pyramid-scheme and affinity-fraud case. If that weren’t enough, TelexFree executives and reps apparently have access to a “private jet” that recently made a flight between the Dominican Republic and Haiti.

Passengers on the “private jet” reportedly were met by the motorcade of Haiti’s Prime Minister, according to a TelexFree rep who was selling a credit-repair “program” from the stage of a Massachusetts hotel while telling the Haiti story.

If there’s a surefire way to destroy the public’s confidence in the emerging JOBS Act, it’s for a bunch of MLMers to go around planting the seed that the President of the United States has authorized TelexFree as a crowdfunding company — and to water that seed by talking about “private jets” that can be flown by the TelexFree MLM into Haiti to line up struggling Haitians to sell credit repair and financial advice to struggling Americans.

Yes, we know: It’s altogether too much to believe. But the bitter reality for MLM — and therefore for Herbalife — is that it’s actually happening.

TelexFree says it’s in the communications business, and is expanding from VOIP into cell phones and, highly curiously, credit repair and financial advice. This is an MLM quagmire if ever there was one, especially since American MLMers say sums from $289 to $15,125 sent to TelexFree virtually triple or quadruple in a year.

If MLMers ever wonder why the trade has so many critics, they need look no further than TelexFree or Zeek before it.

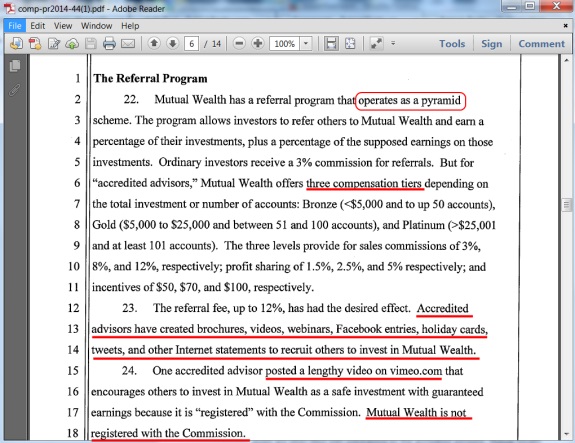

With Zeek smoldering in the ashes of Ponzi/pyramid history and TelexFree serving up a current symphony of the bizarre, the MLM trade now also is confronting yet-another epic PR disaster — namely, a “program” known as WCM777 that, like TelexFree, is under investigation in multiple countries.

Like TelexFree and Zeek, WCM777 also promoted preposterous returns.

But that might be just the beginning of WCM777’s problems. Among other things, WCM777 has claimed it is “Launching The Way TV to transform nations & Joseph Global institute to train a group of Josephs to bless the world.”

But the “Joseph Global Institute” and a companion enterprise that trades on the name of Harvard appear to be shams. And The Way TV launched long ago through an entity known as Media for Christ, which became the center of an international firestorm over a production known as “Innocence of Muslims.”

Particularly disconcerting now are reports that tens of millions of dollars may have gone missing from the WCM777 coffers. In 2013, the SEC alleged that a “program” known as Profitable Sunrise may have gathered tens of millions of dollars before disappearing.

Don’t kid yourself: There is no doubt that the circumstances surrounding some MLM “programs” are affecting economic security and contributing to concerns about national security.

MLM Minefields

As noted above, precisely why the FTC is investigating Herbalife is unclear. The Zeek case initiated by the SEC, however, could supply a clue or even a specific reason for the U.S. government to be concerned about Herbalife. A look at the list of alleged “winners” by the court-appointed receiver in the Zeek case suggests that Zeek became popular in immigrant communities, which may signal MLM affinity fraud on top of Ponzi and pyramid fraud.

It also may signal immigrant-on-immigrant crime under the MLM umbrella.

This information is preliminary, meaning a more thorough analysis is needed. But it at least suggests that some MLMers are proceeding from fraud scheme to fraud scheme and either laying waste to immigrant communities in the United States or setting the stage for immigrant populations to become immersed in litigation and MLM scams.

The surname name of “Johnson,” for instance, is one of longstanding in America. So, it can be expected that a major fraud scheme with 1 million or so members such as Zeek would pull in a number of people with that last name. There are about 45 people with that name on the Zeek list.

At the same time, there are about 60 people on the list with the Asian name of “Li.” So, “Li” has significantly more appearances than “Johnson.”

And what about “Smith,” another traditional American name? Well, there are about 52 “Smiths” on the list. Contrast that with the names “Nguyen” (about 146) and “Chen” (about 137).

There also are many Latino/Hispanic names on the Zeek list. Mind you, this is the list of alleged Zeek winners, not losers. The list of losers — perhaps as many as 800,000 — is not publicly available. (Because it is believed that many Zeek members had multiple user IDs, the number of user IDs may exceed the actual number of losers. But even if the 800,000 figure only incorporates user IDs, it remains troubling. The early data on the winners’ names suggest that immigrants could have been targeted as marks by other immigrants and also by long-established American MLMers.)

Latino groups have voiced concerns about Herbalife targeting vulnerable populations. With Zeek data suggesting such targeting occurred within Zeek, the MLM trade have may to confront some tough questions: Is a mature American MLM market being shored up by a disproportionate share of recent or relatively recent immigrants? And are American MLM companies prospecting in new lands creating losing propositions for the native inhabitants of those lands?

TelexFree certainly has targeted Portuguese and Spanish speaking populations — in the United States, Brazil and elsewhere. So has WCM777, which also has targeted Asians and Asian-Americans.

People are free to criticize Bill Ackman’s assertions that Herbalife is a pyramid scheme that is targeting vulnerable populations. But if MLMers who criticize Ackman expect to be taken seriously, they’d better be able to explain what appears to have happened at Zeek and what appears to be occurring now with both TelexFree and WCM777.

U.S. MLMers of any stripe — from longstanding citizens and naturalized ones to individuals hoping one day to proudly call themselves Americans — need to say no loudly to “programs” such as Zeek, TelexFree and WCM777.

And at a minimum, Herbalife needs to stop selling a message of “get rich quick” or turning a blind eye to it and stop trying to explain away its burn rate as the byproduct of affiliates who didn’t work hard enough to realize the dream.

Herbalife cannot be blamed for Zeek, but the burn rate may explain how Zeek and similar schemes rise to cherry-pick traditional MLMers and their recruits who have made little or no money with companies such as Herbalife.

No matter what the FTC has on its mind, any assertion by Herbalife that its current program is exemplary will be the strongest evidence of all that it, too, resides in MLM La-La Land. That would be a tragedy, given that Herbalife is viewed in the MLM community as a beacon of freedom.