URGENT >> BULLETIN >> MOVING: (11th Update 9:43 p.m. EDT U.S.A.) The court-appointed receiver in the Zeek Rewards Ponzi- and pyramid case has sued MLM attorney Kevin Grimes and the Grimes & Reese law firm, alleging malpractice, negligence and breach of fiduciary duty.

URGENT >> BULLETIN >> MOVING: (11th Update 9:43 p.m. EDT U.S.A.) The court-appointed receiver in the Zeek Rewards Ponzi- and pyramid case has sued MLM attorney Kevin Grimes and the Grimes & Reese law firm, alleging malpractice, negligence and breach of fiduciary duty.

In the Grimes action, the receiver is seeking “an amount in excess of $100 million.”

In another action concerning a professional who worked for Zeek or was associated with purported “opportunity,” the receiver has sued attorney and tax consultant Howard N. Kaplan. Zeek operated an MLM “program” tied to a purported penny auction.

As is the case in the Grimes action, the receiver is seeking a sum of more than $100 million against Kaplan for alleged damages.

Both Kaplan and Grimes should have known better, but nevertheless helped Zeek thrive while helping Zeek gain unwarranted credibility by lending their professional reputations to a fraud scheme that gathered hundreds of millions of dollars, receiver Kenneth D. Bell alleged.

“By virtue of his knowledge of [Zeek operator Rex Venture Group] and ZeekRewards and his legal expertise, Grimes knew or should have known that RVG was perpetrating an unlawful scheme which involved a pyramid scheme, an unregistered investment contract and/or a Ponzi scheme. Despite this knowledge, Grimes actively encouraged investors to participate in the scheme by creating a so-called ‘compliance’ program that provided a false façade of legality and legitimacy and knowingly allowed his name to be used to promote the scheme,” Bell said in the complaint against Grimes.

Bell accused Grimes of turning a “blind eye” to markers of fraud at Zeek such as unusually consistent payout percentages.

“This fake consistency should have, at a minimum, caused reasonably diligent legal counsel to inquire further about the validity of the alleged profits,” Bell alleged. “Indeed, the program publicly advertised historical average returns of 1.4% per day, which no legitimate investment could accomplish. But, Grimes deliberately turned a blind eye to these incredible claims and chose not to seek further information.”

And Kaplan, Bell alleged, “knew or should have known that insufficient income from the penny auction business was being made to pay the daily ‘profit share’ promised by ZeekRewards.

“Kaplan knew or should have known that the money used to fund ZeekRewards’ distributions to Affiliates came almost entirely from new participants rather than income from the Zeekler penny auctions,” Bell continued. “Further, Kaplan knew or should have known that the alleged ‘profit percentage’ was nothing more than a number made up by [Zeek operator Paul R.] Burks or one of the other Insiders. Rather than reflecting the typical variances that might be expected in a company’s profits, the alleged profits paid in ZeekRewards were remarkably consistent, falling nearly always between 1% and 2% on Monday through Thursday and between .5% and 1% on the weekends, Friday through Sunday.”

From Bell’s complaint against Kaplan (italics added):

Instead of properly informing Affiliates of the different tax implications they would face if their Zeek payments were properly characterized as coming from an ‘investment’ rather than a ‘trade or business,’ Kaplan failed to inform Affiliates, either on the calls or in his FAQs, of the material fact that payments to Affiliates should be characterized as investment income for tax reporting purposes.

For example, in the FAQs that he drafted and allowed ZeekRewards to post to its website, Kaplan advised that Affiliates should use IRS Schedule C (“Profit or Loss from Business”) to record their income, making no mention of the fact that they should use IRS Schedule D (“Capital Gains and Losses”) . . . If Kaplan had candidly disclosed the material fact that Affiliate income would be properly characterized by the IRS as capital gains, the obvious negative tax implications would have caused many Zeek Affiliates to remove their cash earnings from the program rather than reinvesting them, short-circuiting the scheme much earlier. Since he did not, Affiliates were placated in their misguided belief that ZeekRewards was a lawful program.

It has been a remarkably awkward time for MLM attorneys. Gerald Nehra, Richard Waak and their law firm have been accused by plaintiffs in TelexFree-related litigation with racketeering and violations of the federal securities laws. TelexFree plaintiffs have asserted Nehra also counseled Zeek.

From the Zeek receiver’s complaint against Grimes and Grimes & Reese (italics added):

Defendants played an indispensable role in the scheme. Because of the lucrative, seemingly ‘too good to be true’ claims being made by RVG and ZeekRewards, many potential investors were skeptical of whether the scheme was legal and legitimate. So, RVG enlisted the aid of Grimes and other legal counsel to assist in promoting and legitimizing the scheme.

Grimes helped in several ways. First, despite his knowledge that ZeekRewards was a fundamentally flawed and unlawful pyramid and/or Ponzi scheme and was selling unregistered securities, Grimes offered to create and did create a so-called

‘compliance course’ specifically designed to encourage investors and potential investors to believe that if they satisfied the course then it would be a lawful enterprise.

Thus, Grimes knowingly allowed Zeek to portray a false appearance of legality through his bogus ‘compliance’ course.

Grimes profited personally from the compliance courses while allowing ZeekRewards yet another source of investor money. Upon information and belief, Grimes received payments from ZeekRewards not only for his legal counsel, but also for sales of his compliance course to Affiliates. Upon information and belief, Grimes provided the compliance course to ZeekRewards for $5 per affiliate, while allowing ZeekRewards to charge affiliates $30 each for the course, personally profiting from it and allowing RVG yet another means of extracting money from unsuspecting Affiliates.

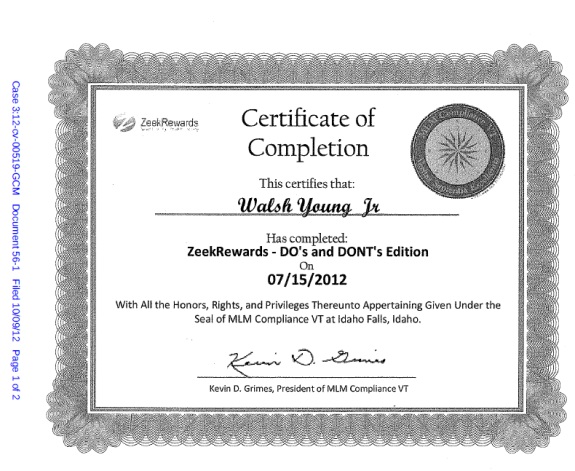

Zeek collapsed in August 2012. The SEC and federal prosecutors now say the “program” gathered on the order of $850 million in less than two years. Two months after the collapse, two members of Zeek sent Senior U.S. District Judge Graham C. Mullen a copy of the “compliance” certification allegedly provided by Grimes (pictured below):

Both Grimes and Kaplan were aware that the Zeek “program” raised issues about the sale of unregistered securities, but nevertheless marched forward, Bell alleged.

Both Grimes and Kaplan were aware that the Zeek “program” raised issues about the sale of unregistered securities, but nevertheless marched forward, Bell alleged.

In February 2012, Bell said, Grimes emailed a Zeek adviser, saying, “I am still in the process of getting my arms around its program, but I have some SERIOUS concerns that it very likely meets the definition of an ‘investment contract.’ It may have other issues as well, but I’m still reviewing their documents.”

By June 2012, according to Bell, a Zeek participant contacted Grimes, saying, “I have completed your compliance course with Zeek and really loved it. I am a great advocate of Zeek and have signed up 31 people whom I feel responsible for. . . . One of my downline is asking questions . . . there is a tremendous amount of income going into Zeek and he is concerned the profit share is coming from the new affiliates – which would make it a ponzi scheme. Can you direct me as to what is the best way to confirm this is not a ponzi scheme[?]”

In response, Grimes emailed Zeek executive Dawn Wright-Olivares, stating, “Do you want me to forward these types of communications to you or anyone else, or would you prefer that I simply discard them? I get several of these each week.”

Grimes, Bell alleged, appeared to have “no concern” about the affiliate’s email.

The MLM lawyer “took advantage of the situation, creating and marketing a compliance training course as window dressing for this illegitimate scheme, allowing the course to be sold to the Affiliates for his own profit,” Bell alleged.

NOTE: Our thanks to the ASD Updates Blog.