Virtually no one was safe from the TelexFree MLM financial menace, documents suggest. Not even the government.

How far and deep did the alleged TelexFree fraud pollution flow? The answer remains unclear a week after Ponzi- and pyramid allegations were filed against the enterprise, but documents suggest pollution at hundreds of thousands of points of contact across a spectrum of vendors, participants and government agencies.

It may be the largest MLM HYIP fraud in world history.

Records in Nevada show that the state Public Utilities Commission ordered TelexFree to pay for newspaper ads publicizing its application to become a telecom provider on April 9, just four days before the firm filed for bankruptcy protection in the state.

Though regulatory requirements vary from state to state, a firm may be asked to pay an application fee and generally must show it can meet the financial demands of being in the telecom business. Hearings may be scheduled to discuss applications and consider objections to them, thus creating the need to pay for public notices on websites and in newspapers.

Given assertions by regulators that TelexFree was a massive Ponzi and pyramid whose purported telecommunications product masked an epic securities-fraud scheme and contributed very little to its overall operation, it is possible that various TelexFree telecom applications in various states were paid for with Ponzi proceeds and that TelexFree vendors and consultants also were being paid with fraud proceeds.

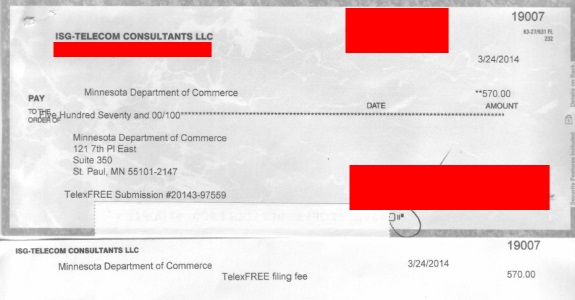

TelexFree caused Nevada, for example, to be paid a $200 application fee. It caused Minnesota to be paid almost three times that sum, according to records. Given the nature of the TelexFree fraud allegations, an untold number of vendors, government agencies or downstream recipients of TelexFree money could have been paid with Ponzi proceeds.

By some accounts, TelexFree had hundreds of thousands of member accounts — people from all over the world who were being paid by the enterprise to recruit even more people.

Polluted money flowing to multiple points is one of the key dangers of HYIP Ponzi schemes. On April 17, TelexFree was the top story in the Department of Homeland Security’s daily infrastructure report.

Earlier, on April 5, a TelexFree promo appeared online in which TelexFree marketing executive Steve Labriola claimed the enterprise had picked up “550,000 new customers in [the] U.S.A. alone” since March 9. Logos of major American media firms rolled on the screen during the Labriola-narrated promo, including the logo of the Las Vegas Review Journal, Nevada’s largest newspaper. The promo implied TelexFree had the backing of the media. Regardless of the suggestion, however, the reality was that a PR news service had caused TelexFree-authored puff pieces to appear on the websites of the prominent media outlets.

Four days later, the Nevada PUC advised TelexFree that the Review-Journal was one of the newspapers in which TelexFree was required to advertise its telecom application. If ever there was a moment of pregnant irony in the MLM sphere, this was it.

The ads, according to the commission, needed to appear in a “minimum one column by three inch ad with black borders on all sides” no later than April 20.

Because TelexFree had asked that its financial reports to Nevada be filed under seal, Nevada Attorney General Catherine Cortez Masto filed a “Notice of Intent to Intervene” in the application process to represent “the public interest,” according to records.

Then-TelexFree President Jim Merrill and TelexFree telecom consultant Joseph Isaacs were copied on the PUC’s April 9 letter that advised TelexFree it was the firm’s responsibility to “contact the newspapers and make timely payment arrangements” for the required telecom-licensing ads, according to Nevada records.

Whether that occurred is unclear.

The PUC warned TelexFree that “your filing may be dismissed for failure to make payments timely.”

TelexFree’s bankruptcy filing occurred four days later, on April 13. Earlier, on April 4, TelexFree — through Florida-based Isaacs — advised the state of Alabama that it needed a hearing scheduled for April 10 to consider its telecom application postponed “for a month” owing to unspecified “scheduling conflicts.”

In Alabama filings, TelexFree contended that it had “total income” of nearly $700 million in 2013 and “net income” of more than $36 million.

Separately, in Minnesota filings in March, TelexFree made the same financial assertions and requested confidential treatment. Minnesota nevertheless published on its website the financial documents TelexFree submitted. Records show that Isaacs’ company sent Minnesota a check for $570 on March 24 to cover filing fees.

By April 15, the SEC was in federal court accusing Labriola and other TelexFree executives of fraud. In its complaint, the SEC made a specific reference to the Labriola video with the rolling logos of media companies and claims TelexFree had picked up more than 500,000 customers in less than a month. (The SEC notes a separate publication of the Labriola video on April 6, but the video appears to have been published on a different site a day earlier.)

In addition to the rolling media logos and claims TelexFree had scored more than half a million new customers, the video featured Labriola complaining about negative TelexFree coverage on Blogs and compared the firm’s experience with bad press to that of MLM companies such as Amway and Herbalife. Herbalife, an MLM company that promotes nutrition supplements, also is the subject of a government probe. It has denied wrongdoing.

The precise reason why Herbalife is under investigation is not publicly known. What is known is that part of the investigation reportedly reaches into the state of Massachusetts. (See April 11 Reuters report with a dateline of “New York/Boston.”)

TelexFree had an operation in Massachusetts. The SEC accused the firm of targeting Brazilian and Dominican communities. Hedge-fund manager Bill Ackman has contended that Herbalife is a pyramid scheme that targets vulnerable population groups.

“I know,” Labriola said in the April 5 video. “You’ve heard the Blogs. I’ve heard the Blogs. I hear every day, ‘The Blogs say this, the Blogs say that.’ You know what’s good about the Blogs talking about us? It means we’re growing. Have you heard about Amway? Herbalife? The big companies out there that have achieved their levels — Bloggers hit them all the time. So, the positive thing is [that] Bloggers are talking about us ’cause we’re growing, ’cause you’re growing the business. They will continue to hit companies that are growing.”

TelexFree was in bankruptcy court eight days later, on April 13. Promoters have claimed $289 sent to the firm returned $1,040 in a year and that $15,125 returned $57,200. TelexFree says it is a telecom firm, but also allegedly sold something called “AdCentral” packages that provided a return promoters described as “guaranteed.”

By April 18, according to filings elsewhere, Isaacs had contacted the Washington State Utilities and Transportation Commission and told regulators there that he believed he’d been duped on matters pertaining to TelexFree’s financial affairs, operations and ability to meet the demands of a competitive telecom company.

“It has come to my attention this week that my client TelexFree, LLC, whom has applied for or has recently been approved to provide telecommunications services in your state, has misrepresented their intentions, their business model, their customer base and the source of all of their revenue, income and profits declared on their 2013 financial statements that were provided to this commission for the approval of their petitions (applications in some jurisdictions),” Isaacs wrote.

Included with Isaacs letter to Washington state were copies of fraud complaints that had been filed against TelexFree April 15 by the Massachusetts Securities Division and the U.S. Securities and Exchange Commission.

“Please disassociate my firm with these alleged [TelexFree] crooks,” Isaacs asked Washington state regulators.

As the PP Blog reported on April 15, one of the contentions against TelexFree by the Massachusetts Securities Division was that information TelexFree had provided Massachusetts investigators was at odds with information TelexFree had provided the Washington State Utilities and Transportation Commission.

Massachusetts also alleged that TelexFree was a massive Ponzi- and pyramid scheme that had gathered more than $1.2 billion.

When the SEC sued TelexFree on the same day, the agency contended that TelexFree co-owners James Merrill and Carlos Wanzeler and TelexFree CFO Joseph M. Craft had engaged in securities fraud and that the firm’s telecommunications product served as a front to mask an investment-fraud scheme.

On March 4, 2014, the PP Blog noted that Zeek Rewards, an MLM firm the SEC sued in 2012 amid allegations it had gathered hundreds of millions of dollars through a combined Ponzi- and pyramid scheme, appeared to have a high number of immigrants in its membership ranks.

A court-appointed receiver’s listing of alleged Zeek Ponzi winners living in the United States showed about 45 people with the last name of “Johnson” and about 52 with the name of “Smith.” By contrast, the document listed about 67 people with the name of “Wang,” about about 61 with the name “Tran,” and about 146 with the name of “Nguyen.” (See story and Comments thread.)

The document raises questions about whether American MLM firms are targeting immigrants and selling an improbable tale of riches to them. The TelexFree probe has led to similar questions.

There also may be concern across U.S. government agencies that some MLMers simply move from one fraud scheme to another. Multiple TelexFree members, for instance, appear to have been members and winners in the Zeek scheme. And some alleged Zeek winners also were participants in the AdSurfDaily MLM Ponzi scheme that collapsed in 2008.