In an announcement dated Jan. 12, 2017, Zeek receiver Kenneth D. Bell said he’ll make a third distribution to Ponzi victims and that a fourth is possible.

After the third distribution, victims will have received about 75 percent of their losses, Bell said. The third distribution is set for March 15.

Let us note here that these results are remarkable. Many Ponzi victims receive only pennies on the dollar, if anything at all. Quick action by the SEC and the U.S. Secret Service in 2012 no doubt benefited the receivership and, in turn, the victims.

A series of clawback lawsuits and other actions initiated by Bell against Zeek net winners and others may return even more to the estate.

Here is Bell’s Jan. 12 announcement in full (italics added):

ANNOUNCEMENT FROM THE RECEIVER – January 12, 2017

I am pleased to announce that we will be making a third partial interim distribution to all Affiliates who hold Allowed Claims on March 15, 2017. When made, combined with the first and second partial interim distributions and the amounts paid by ZeekRewards to such Affiliates before it was shut down, the third partial interim distribution will have returned to victims with Allowed Claims a total of at least 75% of their losses using the rising tide method.

If you previously have received payment from the Receivership, or receive a payment for the first time during the January 31 distribution, you will be issued another payment on March 15, 2017. If you had recovered more than 60% from ZeekRewards prior to its shutdown, but less than 75%, you will receive a distribution as part of the third partial interim distribution.

The funds used to make the third partial interim distribution will be taken from the reserves that I previously held for those Affiliates whose claims were disallowed and forfeited pursuant to the Court’s November 16, 2017 Order that required these claimants to provide their Release and OFAC certification by December 31, 2016. Their failure to do so has permitted me to release these reserves and to pay the third partial interim distribution to Affiliates that hold Allowed Claims.

Finally, we do not have authority to accept new claims and are not considering further requests to amend previously allowed claims. The time to file claims or to amend claims has passed.

I am confident that we will make a further distribution in the future. I ask you for your patience, and thank you for your continuing support.

BULLETIN: Federal authorities have arrested a man and have found $20 million allegedly linked to TelexFree in a box spring in an apartment in Westborough, Mass. Agents have seized the cash and charged Cleber Rene Rizerio Rocha, 28, with conspiring to commit money-laundering.

BULLETIN: Federal authorities have arrested a man and have found $20 million allegedly linked to TelexFree in a box spring in an apartment in Westborough, Mass. Agents have seized the cash and charged Cleber Rene Rizerio Rocha, 28, with conspiring to commit money-laundering.

UPDATED DEC. 22, 2016: The court has extended the claims deadline until March 15, 2017. Earlier story below . . .

UPDATED DEC. 22, 2016: The court has extended the claims deadline until March 15, 2017. Earlier story below . . . In a 23-page lawsuit filed Dec. 1 in federal court for the Southern District of Texas, the MyAdvertisingPays “program” claims it has been ripped off to the tune of $60 million by VX Gateway, a payment processor with alleged business divisions in Texas, Panama and the United Kingdom. The complaint does not say whether MyAdvertisingPays has reported the alleged huge theft to law enforcement.

In a 23-page lawsuit filed Dec. 1 in federal court for the Southern District of Texas, the MyAdvertisingPays “program” claims it has been ripped off to the tune of $60 million by VX Gateway, a payment processor with alleged business divisions in Texas, Panama and the United Kingdom. The complaint does not say whether MyAdvertisingPays has reported the alleged huge theft to law enforcement.

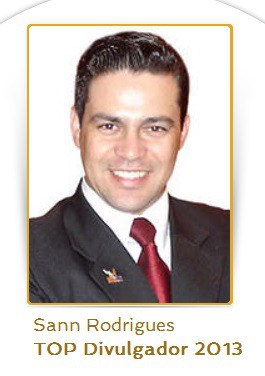

UPDATED 1:56 P.M. ET U.S.A. TelexFree figure Sann Rodrigues could have been sentenced to 10 years for immigration fraud. Instead, he was sentenced yesterday to time served. The office of U.S. Attorney Carmen Ortiz of the District of Massachusetts said early this afternoon that Rodrigues ended up spending 57 days behind bars after his

UPDATED 1:56 P.M. ET U.S.A. TelexFree figure Sann Rodrigues could have been sentenced to 10 years for immigration fraud. Instead, he was sentenced yesterday to time served. The office of U.S. Attorney Carmen Ortiz of the District of Massachusetts said early this afternoon that Rodrigues ended up spending 57 days behind bars after his