(UPDATED 10:13 A.M. EDT APRIL 30 U.S.A.) Back in October 2012, two California members of the collapsed Zeek Rewards MLM “program” filed a self-written pleading with the federal judge presiding over the Zeek Ponzi- and pyramid case in North Carolina.

Just two months earlier — in August 2012 — the U.S. Securities and Exchange Commission had filed an emergency complaint against Zeek to halt its operations. At the time, the SEC described Zeek as a scam that had gathered about $600 million. Over time, the number swelled to about $850 million.

One of the core allegations in the Zeek case was that Zeek’s “advertising” component in which members spammed ads all over the Internet was a sham to help mask Zeek’s massive fraud scheme and the sale of unregistered securities. The 2008 AdSurfDaily Ponzi scheme ($119 million) had a similar “advertising” component and a daily payout rate somewhat on par with Zeek, which duped members into believing they’d receive an average return of about 1.5 percent a day.

The California Zeek members advised Senior U.S. District Judge Graham C. Mullen that Zeek had left them “on the verge of financial devastation.”

They were lured into the scheme based on suggestions it was legal and that members were accumulating wealth, according to the pleading. And the former Zeek members claimed that Zeek pitchman Tom More had acquired “over a million VIP points.”

In March 2014, Zeek receiver Kenneth D. Bell sued alleged Zeek winners and insiders based in the United States, alleging their gains had come from Zeek victims. The complaint against the named winners includes “a Defendant Class of Net Winners” who effectively are being sued in a prospective class action.

Listed as one of the thousands of “Net Winners Who Received $1,000.00 or More” from Zeek was Thomas A. More of Newport Beach, Calif.

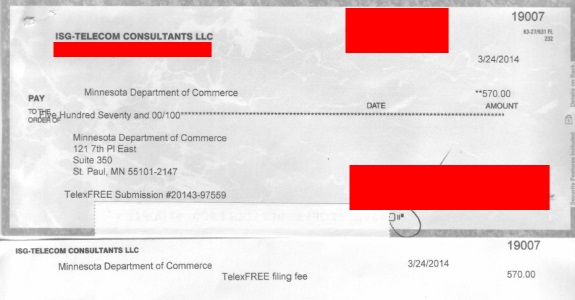

In July 2013, Newport Beach became a staging ground for the alleged TelexFree Ponzi- and pyramid scheme, which the Massachusetts Securities Division (MSD) alleged had gathered more than $1.2 billion and told members they were getting paid for posting ads on the Internet. MSD filed an action against TelexFree two weeks ago today. So did the SEC.

When the SEC went to federal court in Massachusetts on April 15 to file a Zeek-like emergency complaint against TelexFree, the agency pointed to the Newport Beach TelexFree rah-rah session. There is a video of the event titled “TelexFree Corporate Speakers at Newport Beach Extravanganza.”

The video includes “comments” by TelexFree co-owners or executives James Merrill, Carlos Wanzeler and Steve Labriola, according to the SEC complaint.

One of Merrill’s comments, according to the video, was to thank “Tom” for putting together the “fabulous” July 2013 Newport Beach event, which occurred about a month after a court in Brazil froze TelexFree-related assets in that country and imposed a registration ban.

Among Merrill’s other comments, according to the video, was that “large corporations” for which he once provided services “squeeze you . . . until there’s nothing left.”

“They squeeze the employees until there’s nothing left,” Merrill said. “They use you up.”

Although the precise context of a follow-up remark by Merrill was unclear, the Zeek executive suggested that the government of Colombia “feared” network marketers and the “freedom” they represented.

Merrill next set his sights on the U.S. government.

Indeed, he went on to quiz an audience member (“Jay”) about whether Jay could “help the U.S. government with their credit, ’cause I don’t think anybody else . . .” Merrill’s remark appears to be related to a credit-repair service TelexFree had in the offing before it filed for bankruptcy April 13 in Nevada..

“No, he doesn’t want their business,” Merrill said at the Newport Beach “extravaganza,” answering his own question months ahead of the bankruptcy filing. He then suggested that the U.S. government, like the Colombian government, “feared” TelexFree and members of its MLM.

He added, “Those corporations fear your success because they can no longer squeeze you, they can no longer squeeze your wallet.”

Many HYIP “programs” advance conspiracy theories and paint the government as a bogeyman. The JSSTripler/JustBeenPaid “program,” for instance, described U.S. government workers as “part of a criminal gang of robbers, thieves, murderers, liars, imposters.”

JSS/JBP offered a return (precompounding) of 730 percent a year — more than Zeek, more than AdSurfDaily, more than TelexFree. In TelexFree, members said, $289 returned $1,040 in a year, $1,375 returned $5,200 and $15,125 returned $57,200.

Regulators have been warning for years that HYIPs switch forms and put on new disguises. The core scam, however, remains largely the same: claims that average people will become rich by posting ads or clicking on them or by doing nothing at all because visionary business leaders are running the “program.”

The Internet has opened the door to all sorts of viral scams, but electronic virality is not the only concern. Hotel conventions for MLM HYIPs are held in city after city. Madrid, Boston, Newport Beach and other cities were on the TelexFree tour. Certain pitchmen were taped in individual cameos.

TelexFree California organizer Tom More, late of Zeek, had such a cameo.

Here is part of what he said: “Bust and move on this now. Run, don’t walk. Get started today.”

TelexFree appears to have supplanted Zeek as the largest HYIP scam in U.S. history. It likely is the largest in world history.