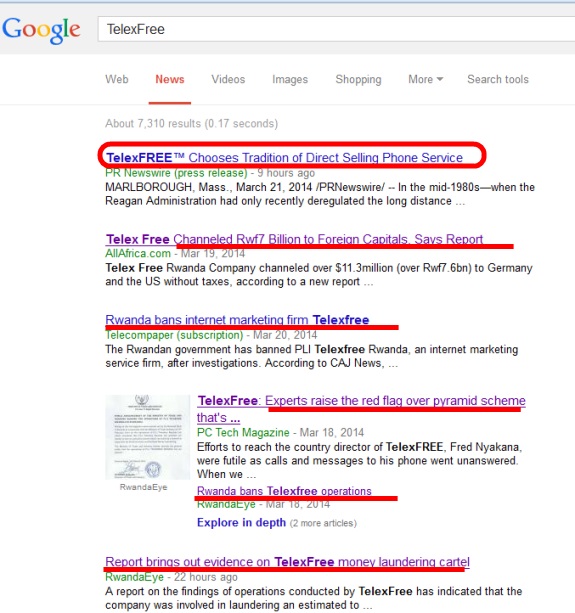

UPDATED 9:24 A.M. EDT (MARCH 22 U.S.A.) TelexFree, alleged to be a pyramid scheme using a VOIP product as a front to mask an investment program, has been under investigation in Brazil since at least June 2013. There’s also an ongoing securities probe in Massachusetts. The government of Rwanda, meanwhile, has announced it booted a TelexFree enterprise after a joint investigation with the African nation’s central bank sparked money-laundering concerns.

Yes, Rwanda has banned TelexFree, something that might set a new standard of embarrassment for an American MLM company. Though the timing may be coincidental, Rwanda did this after a TelexFree pitchman suggested to troops in Boston on March 9 that TelexFree has so much free cash laying around that the two-year-old business can saddle up a “private jet” for trips to Hispaniola and Haiti, perhaps the poorest nation in the Western Hemisphere.

Just a week earlier, promos for a TelexFree convention in Spain bragged that the firm was holding a “Gala Dinner” in Madrid and providing “direct Limo Service” to its recruiting stars. TelexFree also sponsors a professional soccer club in Brazil.

One can hardly blame Rwanda if it is protecting its dignity while wondering what happened to the cash gathered from Rwandan affiliates. And because Uganda has signaled it may follow Rwanda’s lead, the imagery in African media of out-of-touch, greedy American MLMers may not be at its zenith. From a PR perspective, these things couldn’t be happening at a worse time for MLM. Herbalife, an industry stalwart, is under investigation by the U.S. Federal Trade Commission.

There have been rumors for days that Massachusetts-based TelexFree was hiring a CEO. That appears not to have happened. Or, if it has happened, TelexFree hasn’t expressed it clearly in print.

There is a new hand on board, according to a TelexFree news release issued this morning. But nowhere does the release describe the new hand — former MLM telecom executive Stuart A. MacMillan — as TelexFree’s CEO or even as a TelexFree executive. Instead, MacMillan is described in terms that suggest he’s freelance management talent “[s]peaking on behalf of TelexFREE.”

MacMillan doesn’t even get a mention until the tail end of the sixth paragraph of this morning’s release. Instead, the company booted out of Rwanda and under investigation on at least three continents led with an underwhelming headline that highlighted MLM without calling it MLM. “TelexFREE Chooses Tradition of Direct Selling Phone Service.”

So, TelexFree, which says it is a professional communications company, buried whatever news it had and hasn’t made it clear that MacMillan has a title, let alone real decision-making authority. And even if he does have authority, how much of it extends to the overall TelexFree operation is unclear.

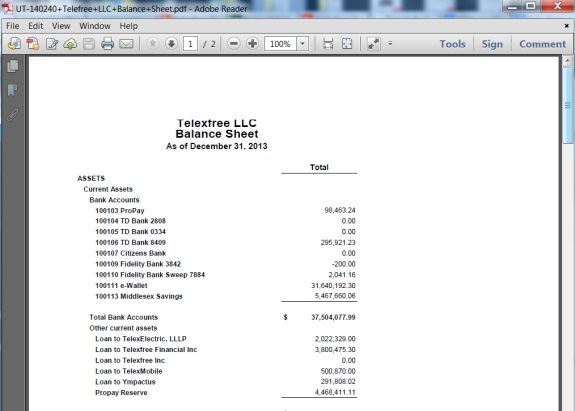

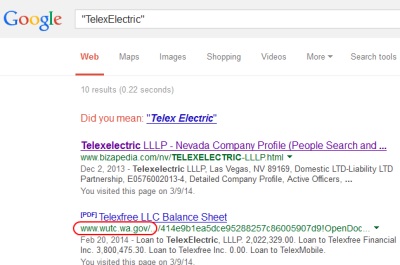

There’s a TelexFree LLC based in Nevada that has been denied registration as a telecommunications company in Washington state. Then there’s TelexFree Inc., which operates from Massachusetts. In Florida, there’s a TelexFree International Inc. that was registered on March 14. Also in Florida there’s a TelexFree Tax Service registered March 14, and a TelexFree Financial Inc. registered Dec. 26. Other companies in Florida also use the name TelexFree. So do at least three companies in California.

In Nevada, at least two companies that appear to have ties to TelexFree have been registered since November. These include Telex Mobile Holdings Inc. and TelexElectric LLLP.

Leading With ‘The Gipper’

The opening line of the news release release fondly harkens back to the “mid-1980s” and the phone-sector deregulation that occurred during “the Reagan Administration.”

It could be worse, we suppose. WCM777, an MLM firm kicked out of Massachusetts and California and under investigation on at least two continents for advertising preposterous returns, tried its hand at channeling both President Reagan (of California) and President Kennedy (of Massachusetts) with rhetorical references to a “City upon a Hill.”

President Reagan finished his second and final term as President in January 1989, more than 25 years ago. He died in 2004. Even his political opponents wept.

Now, TelexFree appears to be suggesting that the deregulation he favored during his years in the White House has put the firm on the success track and inspired it to sell Internet telephony to “Brazilian and Hispanic expatriate communities.”

One of the things that happened during the Reagan administration — and this is not a knock on the President, whom we admired — was that doors opened for phone companies to compete on long-distance pricing. Over time, consumer-pleasing downward pressure on prices and lower margins put some firms at death’s door. One of those firms was Excel Communications, an MLM company that formerly employed MacMillan.

A separate release issued today describes TelexFree as an enterprise that “booked 10,859,669 minutes of VOIP calls” last month. It’s a hollow claim, rather like a husband bragging to a wife on Saturday morning that he’d just trimmed 10.8 million blades of grass in the front yard — while conveniently forgetting to mention that a John Deere did all the heavy work.

What TelexFree conveniently is forgetting is that the issue with it is whether the people who used those 10.8 million minutes it “booked” last month would purchase the VOIP service if it were not attached to an “opportunity” affiliates describe as something that could retire government, corporate and consumer debt if the regulators would just leave it alone.

Moreover, the release does not mention that Sann Rodrigues, previously described as the firm’s top pitchman, was accused by the SEC before TelexFree even came into existence of being a pyramid-huckster who roped Brazilians into an affinity-fraud scheme involving a phone-related product.

“You say you haven’t heard of TelexFREE?” the second release queries. “Then you probably aren’t one of the more than 1 million Portuguese-speaking residents of the Commonwealth of Massachusetts.”

It goes on to say that “[b]efore TelexFREE, Portuguese speakers calling home to Brazil or Portugal were paying high international rates or suffering the frustration of trying to teach elderly parents how to use Skype…after they taught them how to get online.

“In large part due to those frustrations and expenses, Brazilian and Hispanic expatriate communities are embracing the simplicity and economy of TelexFREE.”

Most curious of all in the second release was a TelexFree claim that it “wasn’t until about two years ago that we found a niche community that expressed such overwhelming need for our product.” That’s particularly strange, given that Rodrigues hails from Portuguese-speaking Brazil, as do Portuguese-speaking TelexFree executives Carlos Wanzeler and Carlos Costa.

Rodrigues and Wanzeler, at least, have been pitching phone products to Portuguese-speakers for years. Rival Skype is available in multiple languages, including Portuguese.

Like the first release, the second release doesn’t mention that promoters of TelexFree have claimed that $15,125 sent to the firm fetches back more than $57,000 in a year and that smaller sums of between $289 and $1,375 also virtually triple or quadruple in a year.

The first release, however, at least hints that MacMillan recognizes some in-house problems at TelexFree.

“I see my responsibility as establishing internal governance and an expansion of the products and services,” the release quotes him as saying. “Like so many entrepreneurial companies in the tech space, TelexFREE has been growing so fast, it hasn’t had much time for management. I’ve been brought in to spend that time and to provide that experience, including an end-to-end review of methodologies and controls.” (Emphasis in original.)

Whether MacMillan has the authority to ground the “private jet” to which executives and top reps apparently have access when flying to the Dominican Republic and Haiti was not addressed in the news release. Nor did the release say whether MacMillan planned to eliminate the appearances of limousines in various TelexFree promos or do away with sea-cruise pitchfests.

James Merrill remains TelexFree’s president, according to the second release.

From the second release (italics added):

When asked about the success of the company, President and co-founder Jim Merrill replies, “We have been in VOIP telecommunications for more than a decade; but it wasn’t until about two years ago that we found a niche community that expressed such overwhelming need for our product. Combined with a distribution method that takes our services to them economically, our growth has been exponential.”

It’s as though promising to pay $1,040 on $289, $5,200 on $1,375 and $57,200 on $15,125 — in a year, no less — had nothing to do with it.

Reagan would have thought it madness and advised House Speaker Tip O’Neill that someone was trying to soil that beautiful Massachusetts city upon the hill. And Kennedy would have called TelexFree’s business practices “a wholly unjustifiable and irresponsible defiance of the public interest.”