2ND UPDATE 2:25 P.M. EDT U.S.A. More horrible PR for the MLM trade: Banners Broker international pitchman and pyramid-scheme figure Kuldip Josun embezzled at least $3.6 million from affiliates, according to a receiver’s report.

2ND UPDATE 2:25 P.M. EDT U.S.A. More horrible PR for the MLM trade: Banners Broker international pitchman and pyramid-scheme figure Kuldip Josun embezzled at least $3.6 million from affiliates, according to a receiver’s report.

The money was deposited into a Swiss bank account held by an entity known as World Web Media Inc. and appears to have been used to start an “MLM program” known as “KulClub,” the receiver advised a court in Canada.

Like the alleged $156 million Banners Broker scheme, KulClub had a presence on the MoneyMakerGroup forum, records show. U.S. authorities have alleged MoneyMakerGroup is a place from which fraud schemes are promoted.

KulClub purports to be a “unique revenue sharing program in which KulClub shares the majority of its revenue with all its members. No other club can match it!”

But msi Spergel inc., the Toronto-based Banners Broker receiver, said KulClub likely was started with stolen Banners Broker funds that never were recovered from the Swiss account.

“The Receiver believes that Josun has since used the Swiss bank account funds for personal purposes, including the launching of his own MLM program called ‘KulClub,’” Spergel alleged. The receiver is seeking a sweeping order preventing the dissipation of assets.

How did Josun end up with affiliate funds? After becoming the “main representative among international affiliates” of Banners Broker, the huckster allegedly hosted web events, flew to events in Europe, gathered money from hopefuls and kept it for himself.

From the receiver (italics added/light editing performed):

In that role, Josun would travel to meet with international affiliates, or potential affiliates, and conduct conference calls and seminars via videoconferencing. His day-to-day occupation with Banners Broker was to maximize Affiliate investment into the program, as well as to establish an international network Banners Broker Network. That is, he was responsible for encouraging the development of overseas affiliates into `super-affiliates’ (or “Resellers”), who would establish their own networks of affiliates.

In his role as Banners Broker’s international representative, Josun would frequently fly to overseas locations with a significant amount of company funds. Those funds were used to advertise a lifestyle of success and luxury to potential affiliates. Josun spent existing affiliate funds lavishly in maintaining this facade, as he carried out a campaign to woo wealthy new affiliates to the Banners Broker enterprise.

Josun’s spending in his role as Banners Broker’s international spokesperson lacked any effective oversight. No budgets were set for Josun’s business trips on behalf of Banners Broker, nor was there any control over his expenses.

The Receiver asserts that Josun would regularly receive funds from affiliates meant to be spent on Banners Broker products. Rather than remit these funds to the company, Josun would redirect the funds to his own personal accounts in offshore jurisdictions, intending to place them beyond the reach of creditors.

Similar allegations of cherry-picking have surfaced in the TelexFree Ponzi- and pyramid case. Like Banners Broker and KulClub, TelexFree had a presence on the Ponzi boards.

Josun was hardly alone in misappropriating Banners Broker funds, the receiver alleged.

Rajiv Dixit, a Banners Broker principal charged criminally, “purchased six watches from Weir & Sons in Dublin, Ireland: three Rolexes and three Breitfings,” the receiver alleged. “Two of the watches were women’s watches.”

The receiver’s allegations against Josun appear to be yet-another example of a scammer within a purported revshare “program” scamming both the “opportunity” itself and incoming participants. Although Banners Broker allegedly terminated Josun, it made little difference because the “program” itself was a scam.

Read the receiver’s report.

NOTE: Also see RealScam.com Banners Broker thread and this June 19 “Harrison” post.

UPDATED 3:59 P.M. EDT U.S.A. It surfaced on Twitter today in the

UPDATED 3:59 P.M. EDT U.S.A. It surfaced on Twitter today in the  UPDATED 11:14 A.M. EDT U.S.A. TelexFree Trustee Stephen B. Darr has requested a stay

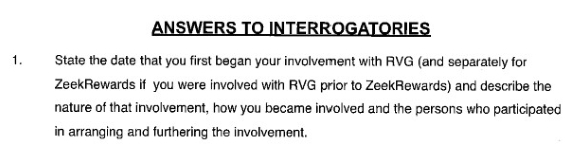

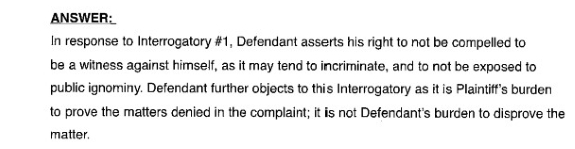

UPDATED 11:14 A.M. EDT U.S.A. TelexFree Trustee Stephen B. Darr has requested a stay BULLETIN: (4th Update 9:13 p.m. EDT U.S.A.) Accused Ponzi schemer Paul Burks ran a “pyramid scheme” known as FollowMe1X2 that was a precursor to ZeekRewards, federal prosecutors say.

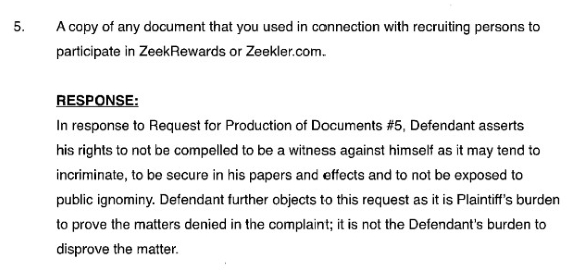

BULLETIN: (4th Update 9:13 p.m. EDT U.S.A.) Accused Ponzi schemer Paul Burks ran a “pyramid scheme” known as FollowMe1X2 that was a precursor to ZeekRewards, federal prosecutors say. It may be a first in MLM clawback cases.

It may be a first in MLM clawback cases. Payza, an HYIP-friendly payment processor that recently bragged on Twitter about its attendance at an event for the teetering TrafficMonsoon scheme, has advised a federal judge that it is not responsible for millions of dollars that allegedly went missing in the Zeek Rewards’ scheme taken down by the SEC in 2012.

Payza, an HYIP-friendly payment processor that recently bragged on Twitter about its attendance at an event for the teetering TrafficMonsoon scheme, has advised a federal judge that it is not responsible for millions of dollars that allegedly went missing in the Zeek Rewards’ scheme taken down by the SEC in 2012. UPDATED 11:53 A.M. EDT U.S.A. Sept. 23, 2016: The claims deadline has been extended until Dec. 31, 2016, at 4:30 p.m. Prevailing Eastern Time. Claims must be filed through

UPDATED 11:53 A.M. EDT U.S.A. Sept. 23, 2016: The claims deadline has been extended until Dec. 31, 2016, at 4:30 p.m. Prevailing Eastern Time. Claims must be filed through

URGENT >> BULLETIN >> MOVING: (6th Update 8 p.m. EDT U.S.A.) TelexFree Trustee Stephen B. Darr has sued MLM attorney Gerald Nehra and the Nehra and Waak law firm, alleging they were “actively involved” in promoting TelexFree’s Ponzi scheme and “duping” participants.

URGENT >> BULLETIN >> MOVING: (6th Update 8 p.m. EDT U.S.A.) TelexFree Trustee Stephen B. Darr has sued MLM attorney Gerald Nehra and the Nehra and Waak law firm, alleging they were “actively involved” in promoting TelexFree’s Ponzi scheme and “duping” participants.

UPDATED 3:11 P.M. EDT U.S.A. A report dated today at ShanghaiDaily.com says an individual “surnamed Xu” and associated with “World Capital Market Inc.” is “now in custody” after a police action against a “pyramid scheme” in China.

UPDATED 3:11 P.M. EDT U.S.A. A report dated today at ShanghaiDaily.com says an individual “surnamed Xu” and associated with “World Capital Market Inc.” is “now in custody” after a police action against a “pyramid scheme” in China.