BULLETIN: (2nd Update 9:46 p.m. EDT U.S.A.) The SEC has gone to federal court in Boston, alleging that “the DFRF fraud is much larger than it first appeared.”

BULLETIN: (2nd Update 9:46 p.m. EDT U.S.A.) The SEC has gone to federal court in Boston, alleging that “the DFRF fraud is much larger than it first appeared.”

The agency also alleges that at least one DFRF investor told investigators that he first heard of DFRF in May or June 2014 from TelexFree Ponzi- and pyramid figure Sann Rodrigues, who attended the same church. If the information is correct, it would mean that Rodrigues had knowledge about DFRF within weeks of becoming a defendant in the SEC’s April 2014 action against TelexFree.

SEC investigators initially tied Rodrigues to DFRF and alleged operator Daniel Fernandes Rojo Filho in a complaint last month. New documents filed by the agency yesterday hint that other DFRF insiders also were involved in TelexFree.

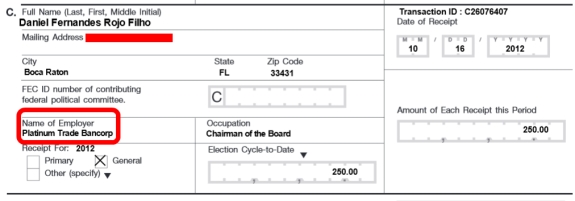

Filho, described by federal prosecutors in Boston as a fugitive, was arrested July 21 in Boca Raton, Fla. on a DFRF-related charge of wire fraud. The FBI is leading the criminal investigation.

From an SEC investigator in a July 23 filing in the agency’s civil case against DFRF Enterprises, Filho, Wanderley M. Dalman of Revere, Mass.; Gaspar C. Jesus of Malden, Mass.; Eduardo N. Da Silva of Orlando, Fla.; Heriberto C. Perez Valdes of Miami; Jeffrey A. Feldman of Boca Raton; and Romildo Da Cunha of Brazil (italics and bolding added/light editing performed):

Another investor (hereafter “Investor B”) told me that he and his spouse invested a combined $61,000 in DFRF. He first heard about DFRF in May or June 2014 from Sanderley Rodrigues de Vasconcelos (“Rodrigues”). (Rodrigues is the subject of a 2007 consent judgment in a Commission enforcement action concerning the “Universo Foneclub” pyramid scheme and a defendant in the Commission’s pending action concerning the “TelexFree” pyramid scheme.) Investor B knew Rodrigues from his participation in TelexFree and as a fellow member of his church.

Rodrigues told Investor B that the minimum investment in DFRF was $50,000. Investor B decided not to invest at that time.

Investor B told me that in July or August 2014, defendants Dalman, Jesus and Silva approached him about investing in DFRF. He knew the three men through TelexFree, because when TelexFree was operating, he would meet with individuals involved in the company on a weekly basis at a hotel in Revere.

Dalman, Jesus and Silva told Investor B about DFRF, explaining that Investor B could earn up to 15% per month. They also told him that he could earn a 10% commission for referring others to DFRF.

Investor B told me that Dalman, Jesus and Silva invited him to meet with Filho at a hotel in Boston, Massachusetts in July or August 2014, which he did.

Investor B told me that, in September 2014, he and his spouse went to a meeting at DFRF’s offices at 60 State Street in Boston. Six to ten other potential investors attended this meeting, at which Dalman, Jesus and Silva spoke about DFRF. Filho later joined the meeting and gave a presentation about investing in DFRF. One of the other attendees asked Filho how DFRF could afford to pay 15% per month. Filho responded that he could take the investors’ money and grow it by a factor of six.

The Rodrigues tie to DFRF now brings the number of fraud schemes in which he has been involved at least to four: Universo, TelexFree, DFRF and IFreeX, described last year by Massachusetts investigators as a TelexFree reload scheme. By victims count, TelexFree may be the largest Ponzi/pyramid scheme in U.S. history, rivaled only by Zeek Rewards in 2012.

Rodrigues, a Brazilian, is not a U.S. citizen. He was arrested at a New Jersey airport in May 2015, upon his return from a trip to Israel. He was charged criminally with immigration fraud, amid allegations he lied to get a green card.

Like DFRF’s Filho, Rodrigues had addresses in Massachusetts and Florida. Filho also is a Brazilian.

Prosecution filings today in the criminal case against Filho assert that he is not a U.S. citizen. He has not been charged with an immigration crime and apparently has a driver’s license issued by a U.S. state, given that he has been seen driving a Lamborghini in Florida.

SEC: DFRF Fraud Numbers Rise

The SEC initially pegged DFRF last month as a fraud that had hauled about $15 million. But further investigation has led to higher numbers — in both total haul and the sum Filho is alleged to have siphoned.

Dealing with Filho first, who was alleged last month to have siphoned more than $6 million. From an SEC filing yesterday (italics added):

The documents we reviewed indicate that, since June 2014, Filho has taken more than $8.6 million from DFRF accounts for himself or his family: He has withdrawn more than $2.7 million in cash. He has used DFRF funds to pay more than $2.2 million of personal and family expenses. He has used DFRF funds to pay more than $2.5 million for luxury automobiles (a 2014 Rolls Royce, a 2015 Lamborghini, a 2014 Lamborghini, a 2013 Mercedes, a 2012 Ferrari, a 2006 Ferrari, a 2015 Cadillac, and a 2014 Cadillac) and automotive-related expenses. He has used DFRF funds to pay nearly $250,000 to members of his extended family. He has used DFRF funds to send more than $1.1 million to the IOLTA account of an attorney in Hollywood, Florida. On June 30, 2015, he used DFRF funds to wire more than $1.1 million to an entity in the Bahamas that is believed to be a law firm. Some of these figures are probably too low, because the documents we have received to date are insufficient to classify approximately $3.5 million of withdrawals from DFRF corporate accounts in June 2015.

Now, dealing with DFRF, alleged last month to have hauled $15 million. From an SEC filing yesterday (italics added/light editing performed):

The documents we reviewed indicate that, from June 2014 through June 2015, DFRF received approximately $22.8 million from more than 1,750 investors: The total may be slightly low, because the documents we have received to date are insufficient to classify approximately $160,000 of deposits to DFRF corporate accounts in June 2015.

The documents we reviewed indicate that none of the investors’ money has been used to conduct gold mining in Brazil and Mali, and that DFRF has received no proceeds from gold mining operations.

The documents we reviewed indicate that DFRF has received no proceeds from a line of credit with Platinum Swiss Trust and has had no banking transactions at all with that company.

The documents we reviewed indicate that DFRF has spent nothing on charitable activities in Africa or anywhere else.

The documents we reviewed indicate that, from June 2014 through June 2015, DFRF had no independent source of revenue except the money received from investors.

The documents we reviewed indicate that, from June 2014 through June 2015, DFRF paid approximately $1.94 million to approximately 250 likely investors for the return of investor principal or purported monthly payments.

Heriberto Valdes, who allegedly hauled $551,403 out of DFRF, has not been served the complaint, the SEC said.

“Valdes is the only defendant who has not been served and whose location is unknown,” the agency said.

Records suggest that Valdes, like Feldman, has a criminal record.

NOTE: Our thanks to the ASD Updates Blog.