EDITOR’S NOTE: On Feb. 5, 2014, Zeek figures and alleged insiders Dawn Wright-Olivares and Daniel Olivares pleaded guilty to federal crimes. Wright-Olivares pleaded guilty to investment-fraud conspiracy and tax-fraud conspiracy. Olivares pleaded guilty to investment-fraud conspiracy. Federal prosecutors in the Western District of North Carolina are maintaining an information site here.

Kenneth D. Bell, the court-appointed receiver in the SEC civil case, also is the special master in the criminal prosecution. The charging document in the criminal case references unnamed “co-conspirators” who are “known and unknown” to federal prosecutors.

UPDATED 5:10 P.M. EDT U.S.A. In court filings apt to find favor in MLM HYIP Ponzi Land, some alleged “winners” in the Zeek Rewards “program” have tried to turn the tables on the court-appointed receiver by claiming he owes them “treble” damages for alleged violations of the North Carolina Unfair and Deceptive Trade Practices Act.

Similar claims were made from the sidelines of the AdSurfDaily MLM Ponzi scheme in 2008. Some ASD members contended that then-Florida Attorney General Bill McCollum should be charged with Deceptive Trade Practices, apparently for having the temerity to bring a pyramid-scheme action against ASD.

Other ASD members contended at the time that federal prosecutors and a U.S. Secret Service agent should be investigated and charged with crimes for their roles in the ASD Ponzi prosecution.

Among the alleged winners in Zeek who’ve filed a counterclaim against receiver Kenneth D. Bell are Rhonda Gates of Nashville, an alleged winner of more than $1.425 million; Durant Brockett of Las Vegas, an alleged winner of more than $1.72 million; and Aaron and Shara Andrews of Lake Worth, Fla., alleged winners of more than $1 million through a Florida shell entity known as Innovation Marketing.

In addition to claiming Bell owes them damages for Deceptive Trade Practices, the counterclaimants assert Bell interfered in contracts with payment processors such as Payza and NXPay and violated their rights under the Fourth Amendment to the U.S. Constitution.

Bell sued them in late February, alleging in a clawback action that their gains were illicit because Zeek was illicit. He also sued several other Zeek alleged winners, including former ASD members Todd Disner of Miami and Jerry Napier of Owosso, Mich. Disner allegedly received more than $1.875 million through Zeek; Napier allegedly received more than $1.745 million.

Disner, in 2011, sought unsuccessfully to sue the United States for alleged violations of his Fourth Amendment rights in its prosecution of the ASD Ponzi case. His co-plaintiff in the case was Dwight Owen Schweitzer, whom filings by Bell described as a Zeek winner of more than $1,000. Several alleged Zeek winners ventured into the “program” after earlier stints at ASD, including Terralynn Hoy, a Florida MLMer who moderated a forum that called purported “sovereign” being Curtis Richmond a “hero” for his efforts to derail the civil-forfeiture action against ASD-related assets.

Richmond, a Californian, was a member of a “sham” Utah “Indian” tribe that once sought to have U.S. Marshals serve bogus arrest warrants against federal judges. ASD figure Kenneth Wayne Leaming later was arrested by an FBI Terrorism Task Force, after allegedly harboring federal fugitives from a separate home-business caper, being a felon in possession of firearms and filing false liens against a judge and prosecutors involved in the ASD case.

Other alleged Zeek winners sued by Bell in clawback litigation include Trudy Gilmond of St. Albans, Vt. (more than $1.75 million); Darren Miller of Coeur d’Alene, Idaho (more than $1.635 million); Michael Van Leeuwen, also known as “Coach Van” of Fayetteville, N.C. (more than $1.4 million); David Sorrells of Scottsdale, Az. (more than $1 million); T. Le Mont Silver Sr. of Orlando, Fla. (more than $773,000 under at least two user names, and more than $943,000 through a Florida shell entity known as Global Internet Formula Inc. with one or more Zeek user names); Karen Silver, Silver’s wife (more than $600,000); David and Mary Kettner of Peoria, Az. (more than $930,000 via one or more user names and shell companies known as Desert Oasis International Marketing LLC and Kettner & Associates LLC); and Lori Jean Weber of Land O’Lakes, Fla. (more than $1.94 million through a shell company known as P.A.W.S. Capital Management LLC.)

Whether other alleged winners would join Gates, Brockett and Aaron and Shara Andrews in asserting claims for damages against Bell was not immediately clear.

What is clear is that a legal war has broken out over Zeek, with alleged winners challenging Bell’s clawback claims by asserting Zeek wasn’t selling unregistered securities as alleged in 2012 by the SEC, that they worked for the money they received or were due, that the alleged winners were not investors, that the SEC’s case against Zeek cannot withstand scrutiny under the “Howey Test” for what constitutes a security, that the SEC had a duty to catch Zeek much earlier — and, in any event and if all else fails, attorneys Bell sued last week and Bell himself are to blame for the unpleasantness.

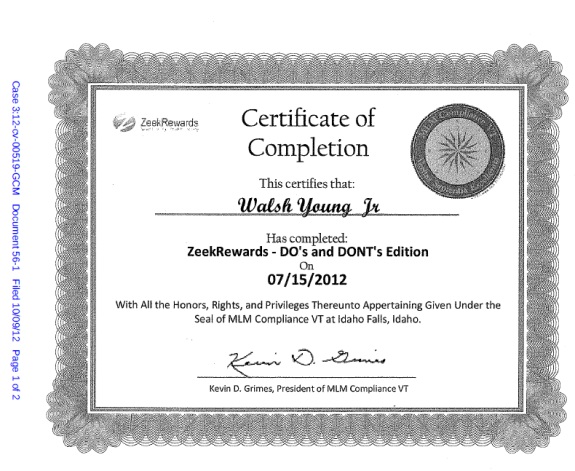

On June 25, Bell sued MLM attorney Kevin Grimes and tax attorney Howard N. Kaplan, alleging they helped Zeek thrive while helping Zeek gain unwarranted credibility by lending their professional reputations to a fraud scheme.

From Brockett’s June 30 “affirmative defenses” to the receiver’s clawback claims (italics added):

The Receiver has filed suit against two attorneys who provided legal advice to [Zeek operator Rex Venture Group] and Affiliates, including Brockett. Brockett relied on that advice in concluding that RVG was a legitimate business and in committing over $100,000 in his personal resources to grow his now defunct business. Because Brockett’s damages were caused in part by the conduct of the two lawyers, Brockett is entitled in equity at and at law to a credit for all money the Receiver recovers from the two attorneys as a result of his claims against them.

Also from Brockett’s “affirmative defenses” (italics added):

On information and belief, the SEC knew or should have known of the RVG Ponzi scheme, but delayed unreasonably in its prosecution of claims against RVG. Alternatively, the SEC knew for some time that RVG was operating as a Ponzi scheme but intentionally delayed disclosing that information to Affiliates and to the public. That unreasonable delay has prejudiced Brockett because he has paid taxes on the money he earned working on behalf of RVG, contributed a significant portion of his earnings to his retirement plan, and has incurred business expenses as a part of his work on behalf of RVG. The Receiver in this action stands in the SEC’s shoes and also delayed to Brockett’s detriment and now seeks return of all monies Brockett earned in connection with RVG, with no credit for the taxes or business expenses that Brockett legitimately paid, but that could have been avoided had the SEC or the Receiver timely advised Brockett of RVG’s true nature or acted in a more expeditious manner.

And from Brockett’s counterclaims against the receiver (italics added/editing for space performed):

On information and belief, RVG was not involved in the sale or marketing of any securities, so the SEC was without jurisdiction and the Court did not have subject matter jurisdiction over the SEC Action. Consequently, the appointment of the Receiver was void and of no effect, and all of the Receiver’s actions in his capacity as receiver for RVG have been unlawful and without justification . . .

RVG’s and the Receiver’s conduct described above and in the Complaint constitutes unfair methods of competition, unfair trade practices, and deceptive trade practices in violation of the North Carolina Unfair and Deceptive Trade Practices Act, N.C. GEN. STAT. § 75-1.1, et seq.

The conduct was illegal, offends public policy and is immoral, unethical, oppressive, unscrupulous, and deceptive.

Bell, the Zeek receiver, is a former federal prosecutor who once received a prestigious award from the U.S. Department of Justice for his work prosecuting a Hezbollah terrorist cell operating in North Carolina.

But some of the alleged Zeek winners now describe him with adjectives that could peel paint.

And as they do this, they seek to gut or circumvent the SEC’s authority to prosecute HYIP schemes while contending the agency fumbled the ball in investigating and prosecuting Zeek — that is, if anything was worth investigating and prosecuting at all.

It is a narrative apt to go over well in MLM HYIP Ponzi Land, the latest major expression of which is TelexFree, a rabbit hole case if ever there was one.

NOTE: Our thanks to the ASD Updates Blog.