URGENT >> BULLETIN >> MOVING: (13th Update 3:45 p.m. EDT U.S.A.) The FTC is going to federal court in the Central District of California, alleging that Herbalife engaged in “deceptive and unlawful acts and practices.”

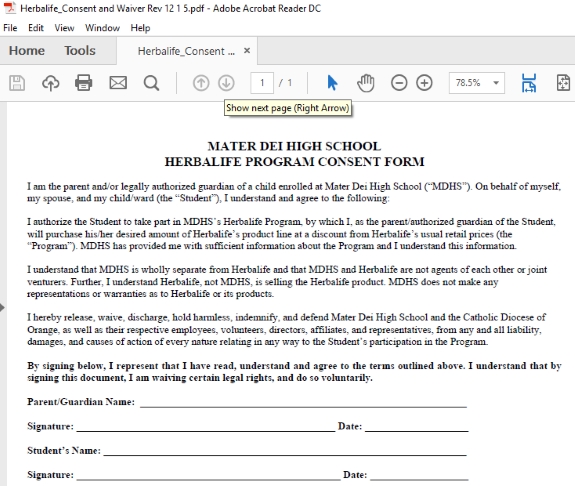

Separately, the agency announced a settlement with the company that will have Herbalife pay $200 million and change the way it does business. The company has not formally been accused of operating a pyramid scheme, although the agency directed harsh words at the MLM enterprise.

“This settlement will require Herbalife to fundamentally restructure its business so that participants are rewarded for what they sell, not how many people they recruit,” FTC Chairwoman Edith Ramirez said in a statement. “Herbalife is going to have to start operating legitimately, making only truthful claims about how much money its members are likely to make, and it will have to compensate consumers for the losses they have suffered as a result of what we charge are unfair and deceptive practices.”

Herbalife described the FTC settlement and a separate, $3 million settlement with the state of Illinois as wins.

“The settlements are an acknowledgment that our business model is sound and underscore our confidence in our ability to move forward successfully, otherwise we would not have agreed to the terms,” said Michael O. Johnson, chairman and CEO, in a statement.

Although Herbalife contended in a statement this morning that the “terms of the settlement do not change Herbalife’s business model as a direct selling company and set new standards for the industry,” the FTC’s complaint paints a picture of a company the institutionalized deception and pyramid behavior.

Herbalife currently “does not offer participants a viable retail-based business opportunity,” the FTC alleged.

And, it alleged, the firm’s “compensation program incentivizes not retail sales, but the recruiting of additional participants who will fuel the enterprise by making wholesale purchases of product . . . The retail sale of Herbalife product is not profitable or is so insufficiently profitable that any retail sales tend only to mitigate the costs to participate in the Herbalife business opportunity.”

Said Herbalife: “While the Company believes that many of the allegations made by the FTC are factually incorrect, the Company believes settlement is in its best interest because the financial cost and distraction of protracted litigation would have been significant, and after more than two years of cooperating with the FTC’s investigation, the Company simply wanted to move forward. Moreover, the Company’s management can now focus all of its energies on continuing to build the business and exploring strategic business opportunities.”

Herbalife’s stock soared when Wall Street opened this morning. At 9:36 a.m., it was up more than $10 — or more than 17 percent.

Guide for the Perplexed on $HLF: FTC slaps co.’s wrist really hard – but Ackman needed them to go after co. with an AR-15, and they didn’t.

— Michael Rapoport (@rapoportwsj) July 15, 2016

$HLF is interesting b/c the stock TODAY shows the bulls won (congrats!) but the FTC ruling shows just the opposite. Fascinating!

— Herb Greenberg (@herbgreenberg) July 15, 2016

The National Consumers League said it welcomed the settlement.

“The FTC’s action today addresses many of the concerns that NCL and other experts on pyramid schemes raised about Herbalife’s business practices. Specifically, consumers will benefit greatly from the settlement’s requirement that Herbalife base its compensation structure on verifiable retail sales to end-users of the product, not recruitment of new distributors. This is the core distinction, as enumerated by more than 30 years of case law, between a legal direct-selling company and a fraudulent pyramid scheme. The settlement’s requirement that at least 80 percent of product sales, companywide, must be made to end-users will further address concerns about a lack of retail sales to buyers outside the business opportunity. The FTC’s settlement will also address many of the blatantly unsubstantiated earning claims made by Herbalife’s distributors to entice new recruits to join the business opportunity and keep existing distributors paying to remain in the business opportunity. We look forward to the FTC’s forthcoming guidance to the direct selling industry as an opportunity to address the persistent lack of clarity that has characterized many industry practices.”

Despite Herbalife’s settlement with Illinois, the state still is soliciting complaints about the company.

“This scheme preyed on people looking to make a better life for themselves and their families,” said Illinois Attorney General Lisa Madigan. “Herbalife created an incentive structure that made it easy for people to invest, but impossible for most people to make any money.”

From Madigan’s office (italics added):

Madigan alleged that Herbalife’s current business model involved luring members with promises of lavish rewards for selling the company’s products, when in fact, the majority of incentives were given to people who recruited others to sell the company’s products. As a result, most people who joined Herbalife never made any money from the company but lost the costs of starting a business.

The FTC settlement requires Herbalife to change its business model to ensure all compensation is based on retail sales that are verified. It also prohibits Herbalife from making statements that indicate that participation in Herbalife is likely to result in a lavish lifestyle, such as you “can quit your job,” “be set for life,” “earn millions of dollars,” or “make more money than they ever have imagined or thought possible.” That also includes images of opulent mansions, private helicopters, private jets, yachts and exotic automobiles in their promotions.

Pershing Square Capital Management — the home of Herbalife short-seller Bill Ackman — suggested other regulators across the globe might follow the FTC’s lead in acting against Herbalife.

Ackman famously has called Herbalife a pyramid scheme.

“The FTC complaint and settlement provide a roadmap for regulators in 90 other countries around the world to enforce similar requirements,” Pershing Square said in a statement. “We intend to work with these regulators to ensure that no future victims are harmed whether in the U.S. or otherwise.”

Moreover, Pershing Square said the forced changes at Herbalife might cause core distributors to flee — something that could affect Herbalife’s bottom line.

“The [FTC] settlement also requires Herbalife to eliminate minimum purchase requirements and other inventory loading incentives,” Pershing Square said. “Furthermore, in order to maintain eligibility or advance in the plan, distributor requirements must be met through ‘Profitable Retail Sales’ or sales to ‘Preferred Customers,’ who are not buying product to participate in the business opportunity.

“We expect that once Herbalife’s business restructuring is fully implemented, these fundamental structural changes will cause the pyramid to collapse as top distributors and others take their downlines elsewhere or otherwise quit the business.”

Even though the FTC didn’t use the phrase “pyramid scheme” today in its actions against Herbalife, the agency’s “findings are clear,” Pershing Square contended.

It “appears that Herbalife negotiated away the words ‘pyramid scheme’ from the settlement agreement,” Pershing Square said.

Read the FTC complaint against Herbalife. Read the “STIPULATION TO ENTRY OF ORDER FOR PERMANENT INJUNCTION AND MONETARY JUDGMENT.”

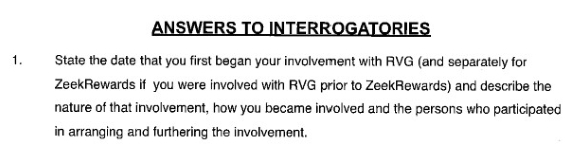

UPDATED 10 A.M. EDT JULY 5 U.S.A. The Ponzi-related criminal trial of Paul Burks of Zeek Rewards is scheduled to begin tomorrow (July 5) in federal court in Charlotte, N.C. Burks is 69. He is charged with wire fraud, mail fraud, conspiracy to commit both and tax-fraud conspiracy. Prosecutors say he fabricated numbers, sent bogus tax forms and duped Zeek members into believing he was at the helm of an enormously profitable enterprise.

UPDATED 10 A.M. EDT JULY 5 U.S.A. The Ponzi-related criminal trial of Paul Burks of Zeek Rewards is scheduled to begin tomorrow (July 5) in federal court in Charlotte, N.C. Burks is 69. He is charged with wire fraud, mail fraud, conspiracy to commit both and tax-fraud conspiracy. Prosecutors say he fabricated numbers, sent bogus tax forms and duped Zeek members into believing he was at the helm of an enormously profitable enterprise.

2ND UPDATE 2:25 P.M. EDT U.S.A. More horrible PR for the MLM trade: Banners Broker international pitchman and pyramid-scheme figure Kuldip Josun embezzled at least $3.6 million from affiliates, according to a receiver’s report.

2ND UPDATE 2:25 P.M. EDT U.S.A. More horrible PR for the MLM trade: Banners Broker international pitchman and pyramid-scheme figure Kuldip Josun embezzled at least $3.6 million from affiliates, according to a receiver’s report. UPDATED 3:59 P.M. EDT U.S.A. It surfaced on Twitter today in the

UPDATED 3:59 P.M. EDT U.S.A. It surfaced on Twitter today in the  Payza, an HYIP-friendly payment processor that recently bragged on Twitter about its attendance at an event for the teetering TrafficMonsoon scheme, has advised a federal judge that it is not responsible for millions of dollars that allegedly went missing in the Zeek Rewards’ scheme taken down by the SEC in 2012.

Payza, an HYIP-friendly payment processor that recently bragged on Twitter about its attendance at an event for the teetering TrafficMonsoon scheme, has advised a federal judge that it is not responsible for millions of dollars that allegedly went missing in the Zeek Rewards’ scheme taken down by the SEC in 2012.

UPDATED 3:11 P.M. EDT U.S.A. A report dated today at ShanghaiDaily.com says an individual “surnamed Xu” and associated with “World Capital Market Inc.” is “now in custody” after a police action against a “pyramid scheme” in China.

UPDATED 3:11 P.M. EDT U.S.A. A report dated today at ShanghaiDaily.com says an individual “surnamed Xu” and associated with “World Capital Market Inc.” is “now in custody” after a police action against a “pyramid scheme” in China. Roger Alberto Santamaria Del Cid, an apparent nominee director for offshore companies who is listed as a corporate “subscriber” for VX Gateway in Panamanian business records, is referenced at least three times in the “Panama Papers.”

Roger Alberto Santamaria Del Cid, an apparent nominee director for offshore companies who is listed as a corporate “subscriber” for VX Gateway in Panamanian business records, is referenced at least three times in the “Panama Papers.”