In this Nov. 13 post, the PP Blog published a list of red flags concerning online promos for Text Cash Network (TCN), purportedly an emerging business “opportunity” involving text advertising and cell phones. A promo for TCN appeared — and then vanished — from a website linked to huckster Phil Piccolo, known online as “the one-man Internet crime wave.” Piccolo has been associated with other schemes that involved cell phones, namely Data Network Affiliates (DNA).

This post raises another red flag — and once again, the issue is about Piccolo’s potential TCN involvement or the involvement of Piccolo associates. In the DNA scam, the purported firm used generic YouTube videos to drive traffic to its purported opportunity. In 2010, for example, DNA incongruously posted a YouTube video known as “JK Wedding Entrance Dance” to its website, using the video to promote DNA.

The “JK Wedding Entrance Dance” video — a You Tube smash — had absolutely nothing to to with DNA. The video was designed in part to create awareness about domestic violence and to publicize the Sheila Wellstone Institute.

Sheila Wellstone was a human-rights advocate. She and her husband, Sen. Paul Wellstone, D-Minn., were killed in a plane crash in 2002. Their daughter, Marcia, died in the same crash.

After conducting a “prelaunch” event with much fanfare on Nov. 11 — Veterans Day in the United States — TCN now has added a You Tube video to its website. An all-caps line of “OFFICIAL LAUNCH 12/12/2011” appears below the video, which plays in miniature on TCN’s site.

But the video also is playing in full size on YouTube’s site. Text on the YouTube site dubs it “THE OFFICAL TEXT CASH NETWORK (TCN) – RIGHT HERE – RIGHT NOW” site. The upload date of the video is listed as Nov. 15, 2011: yesterday.

The same video, however, appears elsewhere on YouTube — and its upload date is listed as Jan. 26, 2009, nearly three years ago. Despite the upload date, the video also is promoting TCN, whose website appears to have been registered just last month.

Both videos raise questions about whether YouTube is being gamed by TCN and affiliates. Meanwhile, the videos use the same soundtrack by Fat Boy Slim: “Right here, right now.”

Among other things, Piccolo is known to use all-caps presentations and to hype “prelaunches” and “launches” for weeks. He also is known to hype launches by publishing the names of top promoters — something TCN is doing — and to try to stay in the background of “opportunities,” as opposed to becoming the public face of them.

Joe Reid, a known Piccolo associate, has served as a conference-call host for TCN. Reid also hosted conference calls for DNA, which was linked to Piccolo last year and served up Theatre of the Absurd and a sea of incongruities.

DNA, for example, misspelled the name of its own CEO — and didn’t advise members that the CEO had left the company for nearly a week. The former CEO told the PP Blog last year that the firm was engaging in “bizarre” conduct and a campaign of “misinformation and lies.”

After the former CEO agreed to an interview with the PP Blog, a PR handler who described himself as a conflict-management strategist” sought to intervene. As the year proceeded, DNA appeared to have both entered and exited the cell-phone business in a matter of weeks — while planting the seed that it would pay enormous rates of return to customers who provided it money, even as it purportedly entered businesses such as mortgage writedowns and offshore “resorts” after apparently abandoning its purported core business of helping police recover kidnapped children.

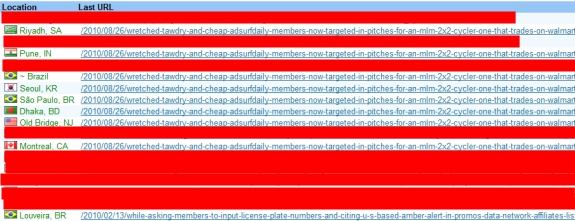

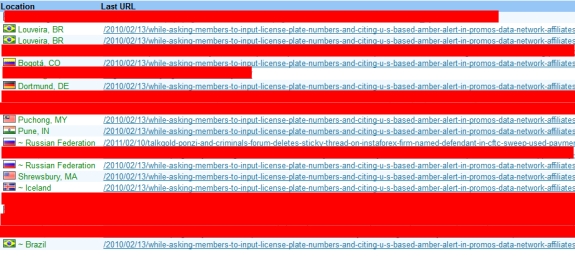

At one point, DNA was urging members to record the license-plate numbers of cars in a purported bid to assist the AMBER Alert program — while it was selling a purported “protective spray” that would make it impossible for cameras placed by police at intersections to snap usable photographs of the plates.

In 2009, another purported “advertising” opportunity known as Biz Ad Splash (BAS) used the same Fat Boy Slim soundtrack. Walter Clarence Busby Jr., the purported operator of BAS, is a figure in the alleged AdSurfDaily Ponzi scheme and is the former operator of Golden Panda Ad Builder. Golden Panda surrendered more than $14 million in the ASD Ponzi case, and the SEC said that Busby was involved in three prime-bank schemes in the 1990s.

The SEC has not responded to requests for comment on the emerging TCN “opportunity.”

As of now, it can be said that two “advertising” schemes — BAS and TCN — are using the same music in what appears to be largely generic promos for business “opportunities.”

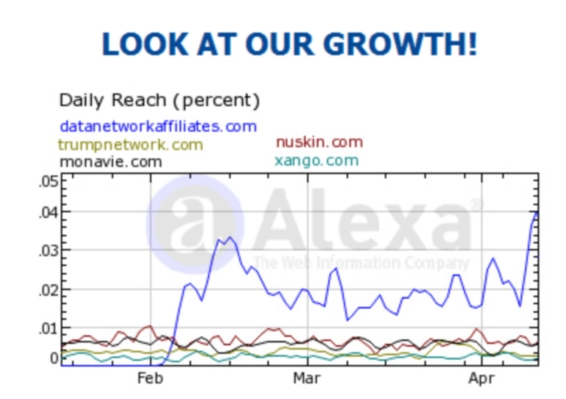

It also can be said that DNA, one of the “businesses” associated with Piccolo, also used generic videos and caused them to play in miniature on “prelaunch” and “launch” sites for “opportunities.”

It also seems possible — if not likely — that certain MLM promoters have found a way to edit YouTube sites to make the content appear “current” or to store generic videos and use them for multiple “opportunities.”

Questions

Why does one video for TCN show an upload date of January 2009 while the “official” site shows a video upload date of yesterday — when it is the same video and TCN purportedly is a “new” opportunity?

Did TCN exist in an earlier form as far back as 2009? If so, what happened back then — and why is it reemerging now?

Are certain MLMers simply using generic videos they uploaded earlier to YouTube — and then editing the YouTube sites when a new “opportunity” comes along, thus potentially maintaining a search-engine advantage no matter what “opportunity” comes along?

Why would a company that purports to be a market and technology leader use what appears to be a generic video as its “official” video?

Why did a promo for TCN that appeared on the website of OWOW — a site linked to Piccolo — suddenly go missing last week?

Why does TCN appear to be closely following “prelaunch” and “launch” strategies associated with purported Piccolo “opportunities?

Screen Shot 1

Screen Shot 2

Screen Shot 3