As the PP Blog reported more than six years ago, Pay It Forward (PIF) “programs” have a noxious history in HYIP and cash-gifting Scamland.

As the PP Blog reported more than six years ago, Pay It Forward (PIF) “programs” have a noxious history in HYIP and cash-gifting Scamland.

A new case in Michigan, however, may be off-the-charts in terms of noxiousness. That’s because investigators looking into a PIF scheme there found child pornography on the alleged PIF operator’s computer, the office of Michigan Attorney General Bill Schuette said in February.

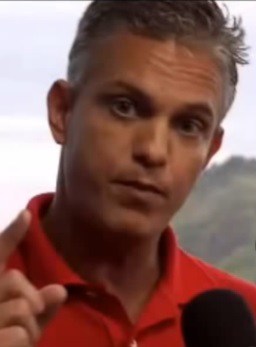

Michael Skupin, 54, of Oakland County, was charged with six counts of possession of child sexually abusive materials five counts of larceny by conversion,and one count of Racketeering- Conducting a Criminal Enterprise.

The PIF “program” was a Ponzi scheme that gobbled up $10,000 at a time from participants, Schuette’s office said.

Records show that it’s not unusual for Ponzi schemers in Michigan to be charged with racketeering, a 20-year felony.

“Victims allegedly made $10,000 cash investments in the [Skupin] scheme,” Schuette’s office said. “Their money would then cycle through a chart in which participants were eventually paid out of other new investors’ money. The scheme was discovered when eventually there were no new investors signing and most people in the scheme lost all of their money.”

The Oakland Press reported yesterday that Skupin was a former contestant on the “Survivor” television show.

And, the publication reported, Skupin was accused of violating his release conditions while waiting trial on the charges against him.

From the Oakland Press (italics added):

Following his arraignment, the former reality TV contestant posted bond and was under house arrest with conditions that barred him from using the Internet except for work.

But during a probable cause hearing Friday, April 8, in Clarkston’s 52-2 District Court, Judge Kelley Kostin ordered Skupin jailed because he violated the Internet bond conditions by posting on Facebook.

Skupin now has made bail for a second time.

PIF schemes have many price points — from low-dollar sums to high. In some PIF schemes, a recruiter may offer you the money to join a “program” — with the understanding you’ll do the same for your recruits. Some participants will purchase multiple “positions” for friends and family members, only to lose it all.

Other such schemes may encourage you to purchase second and subsequent “positions” if you get paid — in effect, paying it forward to yourself, so you can get paid again.

The money-cycling schemes ultimately collapse.

The docket of of New York’s Kings Supreme Court (Brooklyn) shows that Kenneth Goldstein has pleaded guilty to a charge of unlicensed practice of law and a charge of offering a false instrument for filing.

The docket of of New York’s Kings Supreme Court (Brooklyn) shows that Kenneth Goldstein has pleaded guilty to a charge of unlicensed practice of law and a charge of offering a false instrument for filing.

Big Four accounting firm Pricewaterhouse Coopers posted more than $115,000 in fees from the TelexFree Ponzi/pyramid scheme and will pay it all back under the terms of a stipulated settlement with TelexFree Trustee Stephen B. Darr, according to court filings.

Big Four accounting firm Pricewaterhouse Coopers posted more than $115,000 in fees from the TelexFree Ponzi/pyramid scheme and will pay it all back under the terms of a stipulated settlement with TelexFree Trustee Stephen B. Darr, according to court filings. With Herbalife under investigation by the Federal Trade Commission and

With Herbalife under investigation by the Federal Trade Commission and