UPDATED 7:58 P.M. EDT (U.S.A.) The mystery of precisely who would represent Zeek Rewards figure Robert Craddock in a bid to intervene in the Zeek Ponzi scheme case may be over.

UPDATED 7:58 P.M. EDT (U.S.A.) The mystery of precisely who would represent Zeek Rewards figure Robert Craddock in a bid to intervene in the Zeek Ponzi scheme case may be over.

Attorney Rodney E. Alexander of Charlotte has filed an appearance notice for Fun Club USA Inc., Craddock’s Florida business that raised funds for a court action challenging the Zeek case through ZTeamBiz.com.

Meanwhile, attorney Michael J. Quilling of Dallas has applied to the North Carolina federal court handing the Zeek Ponzi scheme case for permission to represent Fun Club.

Quilling’s application was sponsored by Alexander. Quilling is with Quilling, Selander, Lownds, Winslett & Moser, P.C.

In court filings today, Alexander said he “is appearing in this matter as local counsel for Fun Club USA, Inc and other entities whose assets were seized in connection with” the Zeek case.

Fun Club’s name does not appear as a defendant in the SEC’s civil case against Zeek, and it was not immediately clear whether a specific sum was seized from the company or whether Craddock and the unidentified “other entities” plan to argue that Zeek-related seizures in general by the government were unlawful.

The filing did not identify the other entities.

An email attributed to Craddock yesterday suggested that Senior U.S. District Judge Graham C. Mullen had permitted politics to enter the Zeek Ponzi fray. The email described the law firm of the court-appointed receiver in the Zeek case as “politically connected” and therefore potentially lacking “any incentive to protect anyone” and positioned to “run up a bill and submit invoices to the courts so they can pay themselves.”

Craddock did not explain why Mullen — a former Naval officer with 22 years on the bench — ever would play politics with Zeek. Zeek receiver Kenneth D. Bell, whom Craddock has painted as fee-hungry before Bell has submitted a single bill for the judge to review, is experienced as both a defense attorney and a prosecutor.

As a prosecutor, Bell was heralded by the U.S. Department of Justice for gaining convictions in a case against a Hezbollah terrorist cell operating in the United States. (See Bell in this YouTube video speaking about the cell.)

Craddock, though, appears to be dubious of Bell and his firm.

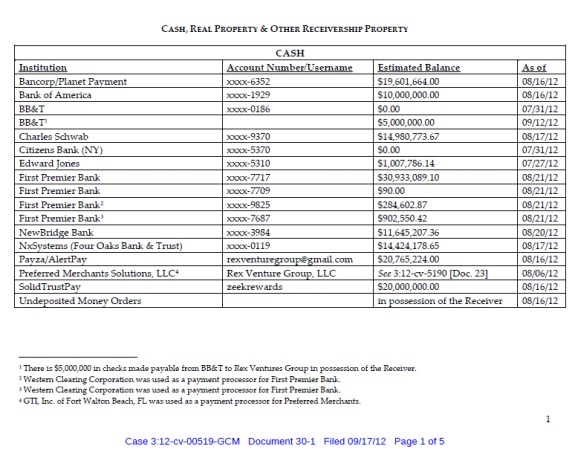

“So now we have an overzealous government agency, making unsubstantiated claims and convincing a judge to freeze the bank accounts and, dismantle the penny auction and for what, so the receiver can employ 100 people making in excess of 500 an hour for 210 weeks or 4.3 years and burn through the $500 million they have grabbed in 16 bank accounts,” the email attributed to Craddock read in part.

Scammers on well-known Ponzi-scheme forums such as MoneyMakerGroup also have planted seeds of doubt against the receiver. Zeek was promoted widely on forums listed in court filings as places from which Ponzi schemes are promoted.

Bell has said there potentially could be 2 million victims in the Zeek case. Yesterday alone attorneys for accused Zeek operator Paul R. Burks of Rex Venture Group filed thousands of Zeek-related records under seal. It is part of Bell’s job to examine those documents.

Craddock’s suggestion of political tomfoolery was curious, given that Craddock used the name of former Florida Attorney General Bill McCollum and the SNR Denton law firm in Craddock’s initial fundraising efforts to hire counsel. SNR Denton dropped out soon thereafter. McCollum is a partner at SNR Denton.

AdSurfDaily Ponzi scheme pitchman Todd Disner was present on a Craddock fundraising call last month. Among other things, Disner asserted in court filings earlier this year that ASD was not a Ponzi scheme even after ASD President Andy Bowdoin pleaded guilty to wire fraud and admitted ASD was a Ponzi scheme.

In a November 2011 lawsuit against the government for alleged misdeeds in the ASD Ponzi case, Disner also accused prosecutors of going shopping for a friendly judge when bringing the ASD Ponzi case in 2008. His claims were dismissed on Aug. 29, the same day Bowdoin was sentenced to 78 months in federal prison.

At an unclear point in time, Disner became a Zeek pitchman. Like ASD, Zeek featured a 1-percent-a-day (or more) payout plan on top of commissions for sales.

On Aug. 17, the SEC described Zeek as a Ponzi- and pyramid scheme that sold unregistered securities and raised $600 million.

Craddock has described himself as a consultant for Rex Venture Group LLC, Zeek’s parent company.