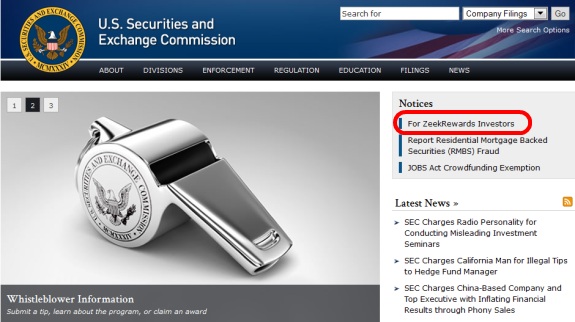

UPDATED 11:55 A.M. EDT (U.S.A.) On Aug. 17, the SEC accused the purported Zeek Rewards revenue-sharing program of being a $600 million Ponzi- and pyramid scheme that had affected more than 1 million people. Zeek was touted on the MoneyMakerGroup and TalkGold Ponzi forums.

UPDATED 11:55 A.M. EDT (U.S.A.) On Aug. 17, the SEC accused the purported Zeek Rewards revenue-sharing program of being a $600 million Ponzi- and pyramid scheme that had affected more than 1 million people. Zeek was touted on the MoneyMakerGroup and TalkGold Ponzi forums.

Now comes word that Zeek members are being pitched on a “program” known as “Wealth Creation Alliance” (WCA), which declares it is operated by an “Executive Dream Team,” makes strange use of capital letters in a sales promo, calls its pitchmen “prosperity advocates” and also has a presence on the Ponzi boards.

Like Zeek, WCA says members can send in sums of up to $10,000.

Zeek said participants were purchasing “bids”; WCA says its product is “ad units.”

The WCA “program” according to one promoter, touts a relationship with offshore payment processors and even Bank of America.

Bank of America also handled the banking for the 2008 AdSurfDaily Ponzi scheme, according to federal court files. A tie to the emerging WCA “program” could not immediately be confirmed.

Like ASD and Zeek, WCA has a purported “advertising” component and tiered commissions, according to one promo for the “opportunity” viewed by the PP Blog. Zeek-like language also is present in WCA. Both companies, for example, purport to operate (or have operated) a “profit pool.”

Some Ponzi-board apologists for Zeek have described it as a “freedom company.” WCA, meanwhile, says it “will apply the proven “Free Enterprise” formula” and emerge as a firm “Of the People, For the People and Built By the People.”

These email remarks (below/italics added) were received by at least one Zeek member and were attributed to Paul Skulitz, the purported owner of WCA. Many of the words on the left margin curiously begin with capital letters, which leads to questions about whether WCA and/or its pitchmen are communicating in code to certain prospects and are sympathetic to the so-called “sovereign citizens” movement.

Some “sovereign citizens” are preoccupied by the use of capital letters.

The capital letters in the first words in the first three lines of the email form the acronym “WCA,” for instance. Whether WCA has any “sovereign” ties is unknown.

Welcome to our rapidly growing family of prosperity advocates here at “Wealth

Creation”. It is our intention to develop a program that is innovative, profitable

And sustainable. Our priority is to build a successful ‘long term home’.

You and your families deserve dynamic success and we at WCA are committed

To providing you with the vehicle and tools to take control of your life and reach

Your greatest goals and dreams. Many of you want to become wealthy and free

And we intend to help you do just that! These goals will be met by putting in

Place a business model that is not simply exchanging money for money. The

WCA model will apply the proven “Free Enterprise” formula of providing

Much-needed product and service solutions to the global marketplace. We

Are building a sustainable business model with powerful products and services

That are in much demand.

To unleash the viral power of “Word of Mouth”, we are using a 15%, two level

Bonus plan along with a powerful global revenue pool that will be shared with

All active affiliates. This plan has produced some of the largest earnings in direct

Selling history.

An “Executive Dream Team” is guiding our business. These business professionals

Bring well over 120 years of high-level business experience to WCA. They have

Run companies and built marketing teams globally over the past 40 years and are

Committed to building a company that is, “Of the People, For the People and Built

By the People”.

Our core product/services are a virtual marketing and advertising tool and a global

Directory. These tools have been developed over the past decade by our CTO (Chief

Technology Officer) and are time tested and proven effective. Many of these product/

Services are available at no charge to our free affiliates. All of our advertising products

Can and are being used to promote not only WCA but also any other business or program.

There will be certain limitations. These products/services carry a huge profit margin,

Which fuel both our first (10%) level and second (5%) level commissions and our

Company wide profit pool.

Our business plan is dynamic and will require flexibility on your part as we roll out

Our different divisions, which will include, but not be limited to:

Our online banner and text ads, our marketing and communication tools

Our robust global directory where both affiliates and customers can advertise

Showcase their products/services and causes our upcoming online mall featuring

Products/services at a tremendous value

Our Life Literacy University, where individuals and families can tap into the wisdom

Of some of the world’s greatest mentors on topics as diverse as family finance, fitness/

Nutrition, self-esteem, generational wealth creation, goal settings & achievement, travel

& leisure, personal & spiritual development, language skills, public speaking and family

And friendship dynamic. As the community develops there will be online empowerment

Opportunities as well as regional gathering to learn your favorite topics.

As with any legitimate business, you will be able to buy these offerings at a discount

For personal use, make them available for resale on your website and generate profits

Or share the program with others and enjoy referrals bonuses on their purchases. What

Sets this apart form everything else is the company wide global profit pool. This is the

Best of it all… As our volume grows you will participate in the profit of the entire company

On a daily basis. WCA is truly committed to ‘ Sharing The Wealth ‘!’

We are committed to building people, who will develop culture, which will change this

World and make it a better place to raise our families. We are committed to a revolution

In the hearts and minds of each and every child of God who believe in their hearts, “There

has to be a better way!”

We are fully operational right now and in our company pre-launch, this simply means

that you are able to sign up for free and receive your business website and purchase

advertising units as well. You can also refer and sign others in as well. We are also

currently receiving payments and more importantly we are paying referral bonuses

and daily profit sharing. Our pre-launch will continue through October 2012. We

will hold our first major event the first weekend of November. (Details will be

forthcoming)

As we continue to upgrade our system to provide the very best opportunity for you,

please be patient as there will be moments of brief interruption of service while we

attend to necessary online functions. We just recently finished one fantastic

improvement to provide additional protection internally and the systems are

systematically coming back online. Our 65% auto re-purchase feature, our

100% default system and several other features are being put fully into operation.

All of these will have a wonderful affect on your profits and the company’s sustainability.

As we continue to improve daily and roll systems out for you, stay excited and

positive what the future holds in store for you.

Thank you for you time and your trust,

Best Wishes,

Paul Skulitz Admin

if you’ve questions

[Deleted by PP Blog]