Federal prosecutors went to court in the Southern District of Florida today, saying AdSurfDaily figures Todd Disner and Dwight Owen Schweitzer were confusing their November 2011 lawsuit against the government with two forfeiture actions filed in the District of Columbia by federal prosecutors and the U.S. Secret Service in the ASD Ponzi case.

Federal prosecutors went to court in the Southern District of Florida today, saying AdSurfDaily figures Todd Disner and Dwight Owen Schweitzer were confusing their November 2011 lawsuit against the government with two forfeiture actions filed in the District of Columbia by federal prosecutors and the U.S. Secret Service in the ASD Ponzi case.

An assistant U.S. Attorney serving under U.S. Attorney Wifredo A. Ferrer of the Southern District of Florida is serving as the attorney for the United States in the case because Disner and Schweitzer sued the government. Although the ASD Ponzi case was brought in the District of Columbia, Disner and Schweitzer sued the government in Florida. They later claimed that prosecutors had gone forum shopping in Washington to bring the Ponzi forfeiture case.

Among other things, Disner and Schweitzer claim that undercover agents who joined ASD had a duty to identify themselves to ASD management and that the ASD Ponzi case is a “house of cards” despite ASD President Andy Bowdoin’s guilty plea and public acknowledgment he presided over a Ponzi scheme.

In a puzzling motion stamped June 20 and entered on the docket of U.S. District Judge Cecilia M. Altonaga on June 21, Schweitzer and Disner claimed they had personally determined that a certificate of interested parties filed by the government in response to an order was “inadequate as a matter of law.”

Disner and Schweitzer, according to Disner and Schweitzer, had a right to know the identities of any ASD participant who filed a claim for remissions in the ASD Ponzi case, how much money they put into ASD and how much was returned to them by the government through the remission claims process.

Nonsense, the government said today.

“The plaintiffs misapprehend the purpose and spirit of the court’s order requiring a certificate of interested parties,” the government said in its response to the Disner/Schweitzer motion. “The instant case is not a forfeiture case as the two forfeiture cases involving AdSurfDaily have already been resolved in the District of Columbia.

“The certificate of interested parties is not some kind of alternative discovery vehicle collateral to the discovery provisions in the Federal Rules of Civil Procedure,” the government continued. “Rather, the certificate of interested parties in both the federal district and appellate courts is designed ‘to assist judges in making a determination of whether they have any interests in any of a party’s related corporate entities that would disqualify the judges from hearing the [appeal].’”

Moreover, the government argued, Disner and Schweitzer “did not confer with the defense” as required by the local rules in the Southern District of Florida prior to filing the motion.

As many as 11,000 parties filed remissions claims in the ASD case, according to federal court records.

Disner and Schweitzer apparently want to know who all of them are and to ascertain “the financial interest of each[,] including those individuals, separately identified, who applied for remission and, as to each, stating whether the request was approved, approved in part, or denied.”

The government, however, advised Altonaga that neither Disner nor Schweitzer have filed their own certificates of interested parties in the case.

Separately, Altonaga today granted the government’s June 4 motion by default to stay discovery in the case, explaining that Disner and Schweitzer have “not filed an opposing memorandum of law to the Motion, nor have they sought an extension of time to do so.”

Disner is a co-founder of the Quiznos sandwich franchise. Schweitzer is a former attorney now living in Miami whose license was suspended in Connecticut.

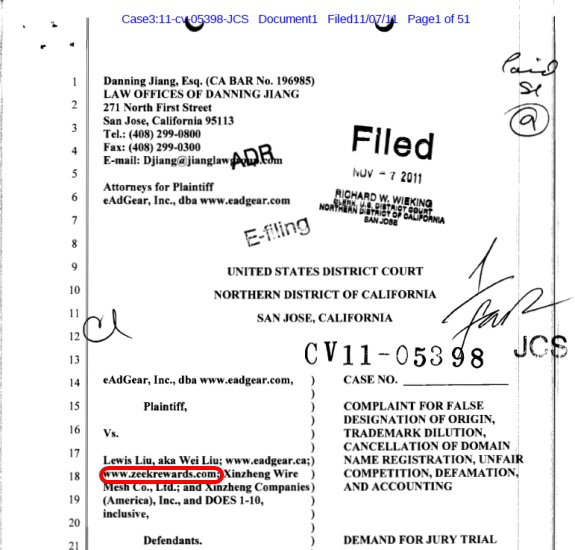

Both men later became pitchmen for Zeek Rewards, an MLM firm whose business model closely resembles the ASD business model that ASD’s Bowdoin admitted was a Ponzi scheme. Bowdoin is jailed in the District of Columbia. A federal judge revoked his bond June 12 after prosecutors proffered evidence that he continued to promote fraud schemes after the U.S. Secret Service seized tens of millions of dollars in the ASD Ponzi case and after Bowdoin was arrested on Ponzi-scheme charges in December 2010.

Bowdoin pleaded guilty in May to wire fraud in the ASD Ponzi case. His formal sentencing is set for August. He has been banned from multilevel marketing, Internet programs and mass marketing.

Other ASD-Related News From The OneX Fraud Wing

In other ASD-related news, a conference call cheerleading session for the purported “OneX” program was canceled tonight after a rah-rah session that had been scheduled for last Thursday also was canceled.

Tonight’s cheerleading session was to be sponsored by a downline with ASD ties and was contemplated to be one that would build on the purportedly exciting announcement OneX said would be made last week to identify its new payment processor, a source told the PP Blog.

But OneX apparently canceled the Thursday conference call and never identified a new payment processor, so there was nothing for the OneX downline with ASD ties to cheer about tonight.

“It is not possible to move forward without the processor being in place,” the ASD downline group said, according to the source.

But the group held out hope that OneX would announce its new payment processor tomorrow, according to the source.

In April, federal prosecutors said OneX was a “fraudulent scheme” and “pyramid” that was operating in ASD-like fashion.

BULLETIN: The SEC has gone to federal court in Atlanta, alleging that Aubrey Lee Price masterminded a $40 million investment fraud and that Price might have misappropriated millions of dollars from a “failing” bank in southern Georgia after a company he controlled bought a stake in the bank in 2010.

BULLETIN: The SEC has gone to federal court in Atlanta, alleging that Aubrey Lee Price masterminded a $40 million investment fraud and that Price might have misappropriated millions of dollars from a “failing” bank in southern Georgia after a company he controlled bought a stake in the bank in 2010.