URGENT >> BULLETIN >> MOVING: A U.S. citizen who told investors he was a “Christian” who shared their political philosophy of “limited government” ripped off hundreds of people in a $21 million Forex Ponzi scheme involving “fictitious trading,” used some of the cash to start an alternative newspaper, preyed on followers of U.S. Rep. Ron Paul and fled to Peru when his Panama-based scheme collapsed, U.S. officials said today.

URGENT >> BULLETIN >> MOVING: A U.S. citizen who told investors he was a “Christian” who shared their political philosophy of “limited government” ripped off hundreds of people in a $21 million Forex Ponzi scheme involving “fictitious trading,” used some of the cash to start an alternative newspaper, preyed on followers of U.S. Rep. Ron Paul and fled to Peru when his Panama-based scheme collapsed, U.S. officials said today.

Jeffery A. Lowrance, 50, was arrested in Lima earlier this year. He was extradited to the United States yesterday and arraigned today on criminal charges filed in the Northern District of Illinois, federal prosecutors said. Separately, the SEC charged Lowrance with fraud in a civil complaint, as did the CFTC.

The office of U.S. Attorney Patrick J. Fitzgerald of the Northern District of Illinois said this afternoon that Lowrance operated his Forex swindle from Panama, involving as many as 400 investors and causing losses of at least $5 million.

Fitzgerald is perhaps the most famous prosecutor in the United States, and has served during both Republican and Democratic administrations in Washington. Lowrance was jailed in the United States today after his arraignment in Chicago on charges of wire fraud and money laundering.

In bringing the case, government officials described Lowrance’s alleged crimes as a form of affinity fraud targeted at Christian voters with a keen interest in politics. Investigators have fretted that certain types of schemes have been designed deliberately to trade on sentiment against big government and that scammers have lined up to take advantage of the sentiment while leaving investors holding the bag.

Investors in 26 states, including California, Oregon, Illinois and Utah, were targeted in the scam, the SEC said.

Paul, R.-Texas, is an advocate for limited government and is a candidate in a crowded GOP field for next year’s Presidential nomination.

During the 2008 U.S. election cycle, Lowrance showed up at a Paul political rally in Minnesota, placing a copy of a newspaper Lowrance produced with investor funds he had “secretly” diverted “on every seat at the rally,” the SEC charged.

Even as he was touting his newspaper and his investment program at the Paul rally, the Ponzi scheme already was in a state of collapse, the SEC charged.

And, the SEC added, Lowrance’s purported investment firm — First Capital Savings & Loan Ltd. — actually was registered in New Zealand. Investors were instructed to send money to a “money converter” in Maryland, where it was whisked overseas to the Netherlands.

Ponzi payments were made from the Netherlands, the SEC alleged.

A Lowrance predecessor entity known as Mentor Investing Group had been ordered by the state of California in 2006 to “cease and refrain” from selling commodities and Forex contracts, according to records.

“[Lowrance] used a significant portion of the money he raised from investors to fund the creation of his alternative newspaper, USA Tomorrow, which claimed to promote ‘truth in journalism’ and contained articles and advertisements advocating a limited government ideology,” the SEC charged. “He then included in at least one edition of USA Tomorrow a flyer advertising the First Capital investment opportunity which he distributed at the September 2008 Ron Paul Rally for the Republic in Minneapolis, Minnesota. USA Tomorrow was placed on every seat at the rally,” the SEC charged.

Lowrance specifically targeted Christians and inexperienced investors in his sales pitches, the SEC charged.

Along the way to ruin, “Lowrance and First Capital knowingly and/or recklessly made the materially false claim that First Capital used investor money to trade foreign currency and in return, pay them a high, fixed, monthly rate of return,” the SEC charged.

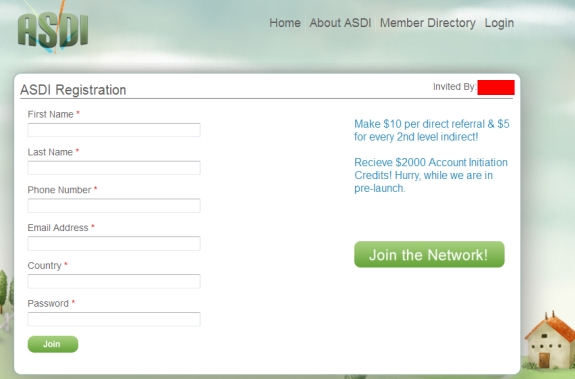

“Before February 2008, First Capital offered monthly rates of return ranging from 4% to 7.15% (resulting in annual rates of return up to 85.8%),” the SEC charged. “It also offered to pay referral fees for new investors ranging from 5% to 6% of the amount invested. As of July 2010, First Capital’s website offered monthly rates of return ranging from 1.104% to 1.558% (resulting in annual rates of up to 18.7%) and referral fees ranging from 1 % to 2%.”

Like other investment scams, the Lowrance Forex Ponzi used “a chart and spreadsheet purporting to show its multi-year history of profitable trades,” the SEC alleged.

But “First Capital never entered into the trades detailed on First Capital’s website,” the SEC charged. “Moreover, First Capital never was profitable.”

Even after the scheme collapsed, Lowrance continued to solicit funds, telling some investors in early 2009 that “the millions lost [did] not shake [him],” the SEC charged.

He urged investors that he had just acknowledged swindling to continue to have faith in him and said that he would trade foreign currency “to pay them back,” the SEC charged.

When some of his investors told others that Lowrance had swindled them, Lowrance sent “purported updates to other investors disparaging the character of those persons who circulated his earlier admissions and disparaging the character of anyone who questioned L[o]wrance’s integrity,” the SEC charged.

What he did not do was stop soliciting prospects for money and take his website offline. The site remained active until “at least” July 2010, despite the scheme’s 2008 collapse, the SEC charged.

On March 5, 2009, a month after Lowrance acknowledged that investors had lost their money, the Netherlands bank account contained $121, the SEC charged.

“In addition to failing to disclose First Capital’s true financial condition and operations to investors solicited between June 2008 and February 2009, Lowrance did not use any new investor money to trade foreign currency,” the SEC charged. “Rather, he used new investor money to pay himself, pay some 6 investors’ returns, and to pay for expenses associated with his start-up newspaper.”

Also involved in the probe are the FBI and the IRS. Elements of the investigation were assembled by member agencies of the interagency Financial Fraud Enforcement Task Force created by President Obama in 2009.

Jon Jason Greco, 40, of Minneapolis, has pleaded guilty to making a false and material statement in the Trevor Cook Ponzi scheme. He faces up to five years in federal prison. A sentencing date has not been scheduled.

Jon Jason Greco, 40, of Minneapolis, has pleaded guilty to making a false and material statement in the Trevor Cook Ponzi scheme. He faces up to five years in federal prison. A sentencing date has not been scheduled. Already a federal prisoner in a tax case, Mark D. Leitner has pleaded guilty in federal court in Florida to charges he filed bogus “maritime” liens for tens of billions of dollars against a former U.S. Attorney, “numerous” Assistant U.S. Attorneys, a former court clerk and a criminal investigator for the IRS.

Already a federal prisoner in a tax case, Mark D. Leitner has pleaded guilty in federal court in Florida to charges he filed bogus “maritime” liens for tens of billions of dollars against a former U.S. Attorney, “numerous” Assistant U.S. Attorneys, a former court clerk and a criminal investigator for the IRS. BULLETIN: Vincent McCrudden, who was arrested in January amid allegations he threatened to kill 47 regulators and government officials, has pleaded guilty to two counts of transmitting threats to kill.

BULLETIN: Vincent McCrudden, who was arrested in January amid allegations he threatened to kill 47 regulators and government officials, has pleaded guilty to two counts of transmitting threats to kill.

URGENT >> BULLETIN >> MOVING: A U.S. citizen who told investors he was a “Christian” who shared their political philosophy of “limited government” ripped off hundreds of people in a $21 million Forex Ponzi scheme involving “fictitious trading,” used some of the cash to start an alternative newspaper, preyed on followers of U.S. Rep. Ron Paul and fled to Peru when his Panama-based scheme collapsed, U.S. officials said today.

URGENT >> BULLETIN >> MOVING: A U.S. citizen who told investors he was a “Christian” who shared their political philosophy of “limited government” ripped off hundreds of people in a $21 million Forex Ponzi scheme involving “fictitious trading,” used some of the cash to start an alternative newspaper, preyed on followers of U.S. Rep. Ron Paul and fled to Peru when his Panama-based scheme collapsed, U.S. officials said today.

Even as bank failures and foreclosures were piling up in Georgia last year, a man associated with at least four failed autosurf companies was filing lawsuits against mortgage companies and 1,000 “Doe” defendants amid claims he did not know the “true names” of the “real lenders.”

Even as bank failures and foreclosures were piling up in Georgia last year, a man associated with at least four failed autosurf companies was filing lawsuits against mortgage companies and 1,000 “Doe” defendants amid claims he did not know the “true names” of the “real lenders.”

Joseph S. Forte, one of the earliest of the so-called mini-Madoffs, was sentenced in November 2009 to 15 years in federal prison — slightly more than a year in jail for each year his 13-year scheme operated. The SEC now says he had help from an accountant who looked the other way because Forte, a failed computer salesman, became a cash cow when he reimagined himself as an investment strategist in 1995.

Joseph S. Forte, one of the earliest of the so-called mini-Madoffs, was sentenced in November 2009 to 15 years in federal prison — slightly more than a year in jail for each year his 13-year scheme operated. The SEC now says he had help from an accountant who looked the other way because Forte, a failed computer salesman, became a cash cow when he reimagined himself as an investment strategist in 1995. A former San Francisco attorney who resigned from the bar a decade ago while under investigation for stealing $300,000 from his law firm now has been indicted on charges of running a five-year Ponzi scheme that gathered about $10 million.

A former San Francisco attorney who resigned from the bar a decade ago while under investigation for stealing $300,000 from his law firm now has been indicted on charges of running a five-year Ponzi scheme that gathered about $10 million.