BULLETIN: In 2009, federal prosecutors warned that pro se pleadings by members of Florida-based AdSurfDaily had the potential to slow efforts to provide restitution for victims of the ASD Ponzi scheme.

BULLETIN: In 2009, federal prosecutors warned that pro se pleadings by members of Florida-based AdSurfDaily had the potential to slow efforts to provide restitution for victims of the ASD Ponzi scheme.

Pro se filings by ASD President Andy Bowdoin and dozens of ASD members crowded the court docket for months and delayed the implementation of a remissions program for victims by at least a year, according to records.

All of the pro se pleadings misrepresented the history of the ASD case and the applicable law — and included claims that only can be described as bizarre. Although a federal judge issued rulings that denied standing to the filers, new pleadings from new nonparties making the same arguments streamed into the courthouse, forcing the judge to address them and issue more orders denying standing to the filers.

After months of such back-and-forth, each of the filers ultimately was ruled to have no standing, including Bowdoin, who at once was representing himself pro se and impermissibly representing his own corporation pro se.

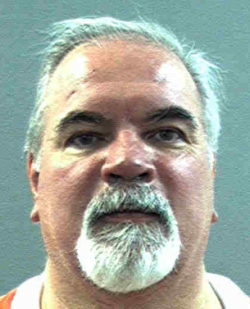

Now, R.J. Zayed, the court-appointed receiver in civil litigation related to the Trevor Cook Ponzi scheme in Minnesota, says pro se pleadings by accused scammer Jason Bo-Alan Beckman are slowing the receiver’s recovery efforts and wasting resources set aside for victims.

In March, the SEC charged Beckman with fraud, identifying him as a “leading” figure in a scheme pulled off by Cook and others. Beckman was accused of raising about $47.3 million of the $194 million gathered in the overall fraud — roughly 25 percent of the overall total.

Beckman has no standing to challenge the receiver’s authority to act in the interests of victims, Zayed argued. And, the receiver alleged, Beckman has filed pro se documents to delay the sale of properties he owns in Texas, actions that have forced Zayed to respond at the expense of victims of the scheme.

“The law does not permit individuals in Beckman’s position to challenge the Receiver’s actions precisely to prevent this type of costly motion practice,” Zayed argued, citing a provision of the receivership order that required Beckman to “cooperate with and assist the Receiver.”

Beckman was ordered that he “shall take no action . . . to hinder, obstruct, or otherwise interfere with the Receiver,” Zayed said.

“The funds available to the investors decrease every time the Receiver responds to an opposition raised by an entity that lacks standing,” Zayed argued. “Thus, the Receiver suggests that the Court consider prohibiting Mr. Beckman from filing additional documents challenging the Receivership’s disposition of assets.”

Zayed also claimed Beckman was making untrue and “bizarre” claims at odds with his own actions.

In February, prior to the formation of the receivership and the filing of a complaint against Beckman by the SEC, Zayed said, Beckman put one of the Texas properties on the market.

Although Beckman himself tried to sell the property only a few months ago, he is now asserting — despite having no standing to make the claim and the fact Zayed wants to sell the property before it becomes a cash-sucking white elephant on the receivership’s assets — that Zayed should not liquidate the property “during a recession or other time of economic difficulty,” Zayed said.

Beckman, Zayed said, researched the local market before listing the property in February. After his appointment as receiver in March, Zayed went to Texas to research the market himself.

“Tellingly, evidence that the Receiver recovered shows that Mr. Beckman sought to place the Paseo del Lago house on the market just weeks before the Court put the Receivership in place,” Zayed argued. “It is bizarre at best for Mr. Beckman to attack the Receiver for doing something he himself had sought to do several months earlier.”

Moreover, Zayed argued, holding onto the property adds costs.

“These costs — almost $10,000 in the first three months of operation, even excluding local counsel bills — are substantial, ongoing, and clearly outweigh any argument to wait years or even decades for the real estate market to recover,” Zayed said.

“It would significantly deplete the limited restitution funds if legal fees and other

expenses continue to accrue if the Receiver must continue to maintain and manage these properties,” Zayed said. “The Receivership is envisioned as a short-term entity, one that seeks to return value to the investors in the near future. As such, the Receivership does not have the luxury to play the market as Mr. Beckman suggests, even if the monthly maintenance expenses somehow disappeared.”