Sundays aren’t what they used to be.

Sundays aren’t what they used to be.

“Ken Russo” announced Sunday on the ASA Monitor Ponzi and criminals’ forum — a forum from which other promoters are targeting people of faith to join the MPB Today “grocery” program — that a member of his “team” is offering $50 “rebates” to entice prospects to sign up. (Read more about the “rebates” program below.)

On the same day, known in the Christian faith as the Lord’s Day, MPB Today members who apparently were wooed by the company and its affiliates’ sales pitches came to the PP Blog to describe MPB Today critics as “roaches,” “IDIOTS,” “clowns,” “terrible” people, “misleading” people, people who have led a “sheltered life,†people who have been “chained up in a basement,†people who have “chips” on their shoulders, spewers of “hot air,” “naysayers,” “complainers,” “trouble maker[s]” and “crybabies.”

And these remarks came from just three people in the MPB Today organization, which promoters say has 30,000 members. One of them denied on Sunday that MPB Today pays participants to recruit, something that MPB Today itself does not deny. MPB says commissions are “banked” until promoters sign up at least two other participants, and that no one cycles until a downline group becomes populated by seven members, only one of whom “cycles” and earns a matrix payout.

For good measure, the same affiliate claimed on Sunday that she is paid for “grocery” sales, but chose not to answer a question about how many people within her organization actually bought groceries by overpaying for them through MPB Today. At the same time, she claimed MPB Today is sustainable because “[inherently] there is hard data that a certain % of people just will not get 2 people and cycle.”

It was easy to read that as a Sunday concession that MPB Today relies on matrix “losers” to create matrix “winners.” In any event, it wasn’t much of an endorsement for the company, a company the member also described as a “blessing.” Blessings, like Sundays, aren’t what they used to be, it seems.

Another MPB Today member claimed on Sunday that there are “[rogues]” in the organization. He did not explain whether he was being paid from rogue money or money sent in by honest affiliates.

MPB Today members should be worried. A “rebate” program may signal that the MLM firm’s 2×2 matrix cycler is stalling and that the only effective way for average members to recruit two members who can recruit two other members in order to “earn” cycler commissions is to bribe them to join the program.

It also may signal that promoters are trying to plant the seed that it’s time for their downlines to start spreading the word that MPB Today’s shipping costs are such a deal-killer that the only effective way for members to recruit is to tell prospects they’ll help them defray the shipping charges in the unlikely event they’re actually keen on buying overpriced groceries from a company that offers no money-saving generic products, ships dry goods “ONLY” and may charge customers who just overpaid for name-brand groceries up to $300 for $200 worth of food.

“Ken Russo” said the “rebate” program was limited to four participants and that his “team” member would go $50 out-of-pocket for each of the four new recruits swayed by the offer. “Ken Russo” advertised that MPB Today’s shipping charges could be up to $50, a claim at odds with what MPB Today itself claims.

Indeed, MPB Today says shipping charges may amount to up to 50 percent of the cost of a grocery order and perhaps may be even higher. MPB Today supplies only an “average” and plants the seed that perhaps customers should choose “lighter” items, as opposed to “heavy” items that are more expensive to ship. It’s even unclear how MPB Today arrived at its published “average” of up to 50 percent, considering the company does not say how many of its purported 30,000 MLM customers actually get their groceries from the firm.

MPB Today is operated by Gary Calhoun. Calhoun once was the subject of a warning letter from the Food and Drug Administration for hawking a product that purported to treat Lou Gehrig’s disease and, for good measure, Herpes and Alzheimer’s.

“Ken Russo” doesn’t seem keen on telling prospects about Calhoun’s FDA experience. What he seems keen on, apparently, is talking about the “rebate” program started by someone on his “team” — and posting the news on the ASA Monitor Ponzi and criminals’ forum on a Sunday.

If other MPB Today affiliates borrow the idea announced on a Sunday and the “rebate” program takes off and expands, it means that MPB Today sponsors who offer the “rebates” are absorbing additional costs in an enterprise that already is impossible mathematically.

Any money MPB Today’s affiliates pay in the form of rebates inures to the benefit of the company — a company that already operates a matrix heavily weighted in its favor. Do you really want to go out-of-pocket even more for a 2×2 matrix cycler that uses a business model that came under fire by the U.S. Secret Service in the alleged Regenesis 2×2 Ponzi scheme last year?

The U.S. Department of Agriculture is investigating specific claims about the MPB Today program, which has been targeted at Food Stamp recipients. What’s next? Recruiting America’s poor by enticing them with rebates and asking them also to offer rebates?

Whether the “rebates” idea advanced from a Ponzi and criminals’ forum on a Sunday will go viral is unknown. Some affiliates easily could latch onto it, persuading themselves it’s better to ply prospects with rebates than take the chance MPB Today’s matrix will perform the magic itself. Our reading of the Sunday “rebates” idea is that it is an inducement to separate people from their money on all seven days of the week on the theory that it’s better to pay $50 on top of the $200 (plus website costs) you’ve already paid to plumb a commission.

If the MPB Today “grocery” program already is stalling, prospects may be few and far between if you’re aren’t willing to bribe them to overpay for groceries on the theory that doing it one time eliminates their grocery costs forever.

Here is another reason for MPB Today members to worry: Because the “rebate” program purportedly exists to defray the shipping costs MPB Today charges for the home delivery of groceries, it can be construed as an acknowledgment that MPB is not actually serious about selling groceries, that it is more interested in selling the “opportunity.”

If you’re an MPB Today member — and if you have not applied any sort of “reasonable person” standard to the program and instead have relied on hype from the company and your upline — you have made a mistake.

Any claim that a $200, “one-time” purchase of groceries from MPB Today can result in free groceries for life is absurd. Spin it as you will. Argue that it is theoretically possible. Argue that you’re already in “profit” and can vouch that the program “works.” Argue that members of your downline can make the same claim.

It is still absurd. No reasonable person would invest in such an argument and assign it any credibility at all. Jurors would laugh at such an argument. They shop at grocery stores. They know that a $200, one-time purchase and an accompanying claim that this relatively modest expense can result in free groceries for life is the precise sort of claim that exists only in the realm of the huckster.

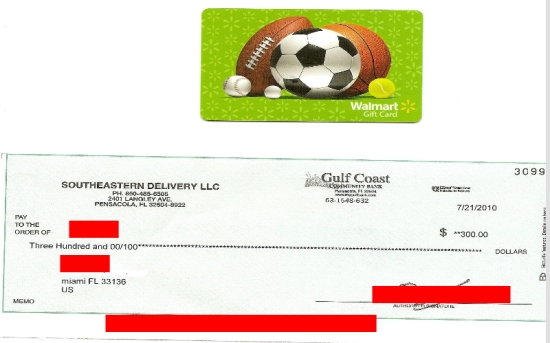

Wait until they’re told about the “catch” — i.e., that an MPB Today member must get two who can get two (or produce $1,200 in sales volume in some other combo) to set the stage for “free” groceries for life. And wait until they’re told that an MPB Today shopper perhaps has to pay up to $300 for $200 worth of groceries and that lots of the purported “grocery” money seems to have been converted to Walmart gift cards that can be used to buy big-screen TVs and laptop computers.

And wait until they’re told that the conditions above have to be repeated, well, repeatedly, in order for members to continue to get paid.

Speaking of Sundays: We noticed on Sunday that an MPB Today affiliate was promoting the opportunity through a .org domain. The promo shows a cart full of groceries and a bag of groceries of the sort not available through MPB Today, along with a bag of money.

The promo on the .org site positions MPB Today as a “Grocery Assistance” program.

“Our Grocery Assistance Program is helping thousands of families earn CASH and FREE groceries!” the page screams.

It is not unusual for MLM participants to register a .org domain in a bid to plant the seed that prospects will be aiding a charity by enrolling in a program and paying a sign-up fee. Members of Narc That Car and Data Network Affiliates, for instance, registered .org sites and sought to link the MLMs to the national AMBER Alert program administered by the U.S. Department of Justice.

The .org domain in the MPB Today program we noticed on Sunday — and please note that we have observed several other .org domains linked to MPB Today — hints that it is a government program by using the word “assistance” in its title.

On a closing note, the .org domain we noticed on a Sunday also was registered on a Sunday — Sunday Aug. 22, 2010, according to records.

So, no, Sundays aren’t what they used to be.

A website that promotes the MPB Today “grocery” program is targeted at Spanish-speaking prospects and uses Walmart’s name in its domain name.

A website that promotes the MPB Today “grocery” program is targeted at Spanish-speaking prospects and uses Walmart’s name in its domain name.