URGENT >> BULLETIN >> MOVING: (6th update 9:35 p.m. ET U.S.A.) Nicholas Smirnow, still listed by INTERPOL as a person wanted by the United States in the alleged Pathway To Prosperity (P2P) HYIP Ponzi scheme that affected people in 120 countries, has been arrested at Toronto’s Pearson International Airport, Canadian media outlets are reporting.

U.S. federal prosecutors charged Smirnow, believed now to be 56 or 57, in 2010. He has been listed by INTERPOL since that time.

CTV News, via the Canadian Press, is reporting that U.S. authorities are aware of the arrest. Smirnow also has been charged with crimes in Canada.

P2P was an instance of international mass-marketing fraud, U.S. authorities said in 2010. Though large for its time in the 2008 to 2010 time frame after allegedly gathering more than $70 million and affecting 40,000 investors, P2P since has been eclipsed in dollar volume and victims count by other mass-marketing fraud schemes such as Zeek Rewards and TelexFree.

Professor James E. Byrne, an HYIP expert consulted by the U.S. government in the P2P case, said in 2010 that “the investment scheme described in the materials that I have reviewed are not legitimate but resemble and are classic instances of so-called high yield frauds and fraudulent pyramid schemes. The proposed returns are excessive for even the most risky legitimate investments and are simply preposterous for investments whose principal is supposedly guaranteed.”

From Byrne’s P2P analyis (italics added):

The funds are turned over to the investment and “earn” returns that range from 1.5% daily for a 7 day plan Plus the return of the initial investment to 2.67% daily for a 60 day plan or 160.2% plus the return of the initial investment. The weekly returns on the 7 day investment would amount to approximately 540% per year without taking into account the principal and the 60 day plan would return approximately 950% annualized.

Like many HYIP schemes before and after, P2P had a presence on well-known Ponzi scheme forums such as TalkGold and MoneyMakerGroup. Both forums are referenced in P2P-related court filings. TalkGold got a mention last week in the Liberty Reserve money-laundering case.

Like current schemes with a Ponzi-board presence such as “Achieve Community,” the P2P tentacles spread far and wide and sucked in vulnerable people such as senior citizens. From a PP Blog story on May 31, 2010 (italics/bolding added):

The scheme was almost unimaginably widespread, the U.S. Postal Inspection Service said in an affidavit.

“Financial records of payment processors utilized by P-2-P to collect investment funds from investors show that approximately 40,000 investors in 120 countries established accounts with P-2-P,” a postal inspector said. “Despite the fact that the investment was supposedly ‘guaranteed, investors lost approximately $70 million as a result of [Smirnow’s] actions.”

The probe began when the U.S. government received a referral from the Illinois Securities Department “concerning an elderly Southern District of Illinois resident who had made a substantial investment in P-2-P,” the postal inspector said in the affidavit.

“In addition to P-2-P’s own website, I discovered that P-2-P’s investment scheme was marketed on other websites, including High Yield Investment Program forums, which I was able to access directly through the internet,” the inspector said.

Before long, the inspector determined that the scheme cost investors losses in 48 of the 50 U.S. states, and 18 of the 38 counties that comprise the Southern District of Illinois, prosecutors said.

Such penetration in Illinois may suggest Smirnow had a promotional arm in the state. The complaint spells out a case against conspirators “known and unknown,” and the complaint notes that family members told other family members about the scheme.

“When P-2-P’s funds were depleted and when investors did not receive a return of their funds as they had been promised, [Smirnow] caused a posting on P-2-P’s private forum warning investors not to complain to payment processors about P-2-P’s failure to return their money or they would find themselves ‘on the outside looking in,’” prosecutors charged.

The postal inspector has spoken to “hundreds of P-2-P investors” during the course of the investigation, according to court filings.

“Hundreds [of people] sent me copies of printouts they had made of P-2-P’s website, postings that had been made on the P-2-P’s members forum, and internet sites touting high yield investment programs which contained postings related to P-2-P,” the postal inspector said.

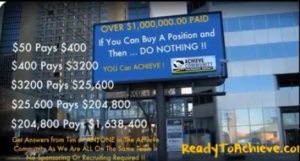

With “Achieve Community,” promoters claim that $50 turns into $400 in three months or less. Participants are encouraged to roll over profits.

Achieve Community promoters have published extrapolations that show “earnings” in the tens of thousands, hundreds of thousands and even the millions of dollars.