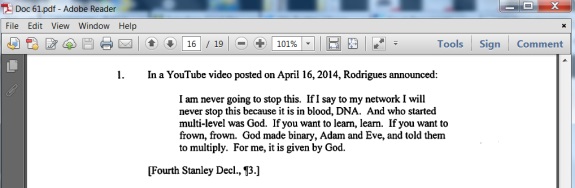

(UPDATED 8:21 P.M. EDT U.S.A.) The U.S. Securities and Exchange Commission says in new court filings that accused TelexFree promoter and securities fraudster Sann Rodrigues appeared in an April 16 YouTube video and asserted that “God” made MLM and “binary” and that Rodrigues claims he’s “never going to stop this.”

Rodrigues is now a two-time SEC defendant. He settled charges in 2007 that he was operating a pyramid scheme targeted at the Brazilian community through the purported sale of phone cards.

TelexFree is a combined Ponzi and pyramid scheme with a phone product that masked a massive, underlying fraud that gathered more than $1.2 billion, the Massachusetts Securities Division alleged on April 15. The SEC said the TelexFree scam mainly was targeted at Brazilian and Dominican immigrants.

Fellow TelexFree defendant Faith Sloan, meanwhile, appears to have removed certain videos but nevertheless has invoked “divine authority” elsewhere, according to SEC filings.

On March 15, the SEC alleged, Sloan claimed on her website that the TelexFree compensation plan was changing and was not in final form — “[b]ut is Getting BETTER as Jesus said.”

Sloan, a former promoter of the Profitable Sunrise and Zeek Rewards securities swindles, earlier claimed that the SEC was “picking on” her.

Separately, the agency alleged that TelexFree may be violating a temporary restraining order by putting its website back online.

“It appears that TelexFree and/or one or more of the individual defendants may be improperly using investor funds for that purpose,” the SEC alleged.

Moreover, the SEC said, none of the defendants has submitted the written accounting required under the order.

Sloan and Rodrigues are among four promoters charged by the SEC. TelexFree executives or co-owners James Merrill, Carlos Wanzeler, Joe Craft and Steve Labriola also were charged. The firm and related entities filed for bankruptcy protection in Nevada April 13.

Claims of divine authority or inspiration are not unusual in MLM HYIP frauds. In the 2008 AdSurfDaily case, for instance, accused operator Andy Bowdoin claimed God was on his side and compared the U.S. Secret Service to “Satan” and the 9/11 terrorists.

Bowdoin, who also fraudulently traded on the name of then-President George W. Bush to sanitize the ASD scam, had experience as a securities swindler prior to ASD, according to court records. He is now serving a 78-month term in federal prison for his role in the $119 million ASD swindle. One of his business partners, according to federal records, was implicated by the SEC in the 1990s in three prime-bank swindles, including one that touted a return of 10,000 percent.

Brazil-based TelexFree figure Carlos Costa also routinely invokes God over TelexFree-related issues.

On Dec. 19, 2013, the PP Blog reported that TelexFree puff pieces were appearing in a publication that featured a columnist who asserted Jesus Christ was the person who inspired modern network marketers through his recruitment of 12 disciples.

Ads for an apparent cash-gifting scheme appeared in the same publication.

Images of Jesus Christ also were used in the alleged Profitable Sunrise and WCM777 HYIP swindles.

NOTE: Thanks to the ASD Updates Blog.