UPDATED 5:41 P.M. EDT (U.S.A.) A spammer hit a Profitable Sunrise Facebook site yesterday with five drive-by offers for “AdHitProfits.” All five of the machine-gunned theft bids claimed the same thing: “make money every half an hour…100% commission let your money grow for you at high speed.”

UPDATED 5:41 P.M. EDT (U.S.A.) A spammer hit a Profitable Sunrise Facebook site yesterday with five drive-by offers for “AdHitProfits.” All five of the machine-gunned theft bids claimed the same thing: “make money every half an hour…100% commission let your money grow for you at high speed.”

The AHP “program” also is being pitched on the Ponzi boards, with the thread-starter at MoneyMakerGroup bragging that “Payza, []STP & Liberty Reserve Accepted !!”

LibertyReserve was described last week by federal prosecutors in New York as a criminal enterprise that had laundered more than $6 billion for Ponzi schemers, credit-card fraudsters, identity thieves, investment fraudsters, computer hackers, child pornographers and narcotics traffickers.

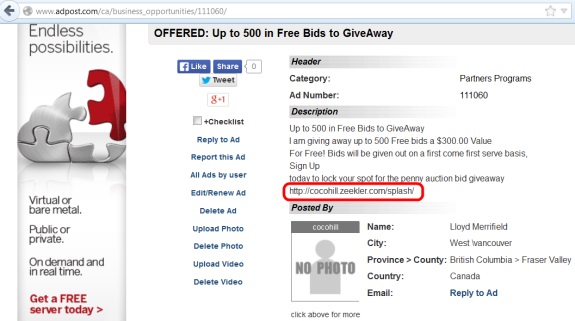

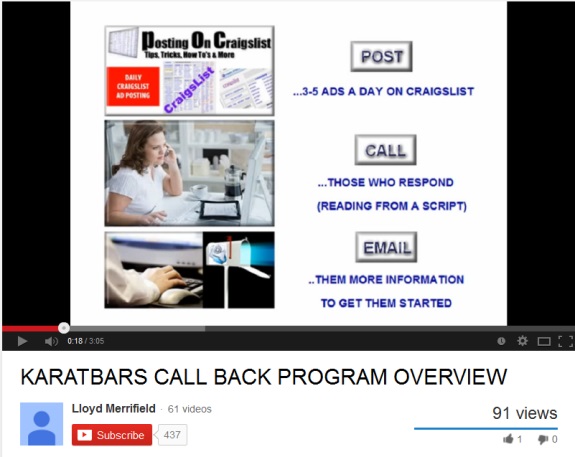

The names of Payza predecessor AlertPay and SolidTrustPay, meanwhile, appear in U.S. court files as payment processors for Ponzi schemes. In August 2012, the SEC accused Ponzi-board “program” Zeek Rewards of orchestrating a $600 million Ponzi- and pyramid fraud. Earier in 2012, Zeek Rewards was auctioning sums of U.S. cash and telling successful bidders they could receive their winnings through AlertPay and SolidTrustPay.

Forums such as MoneyMakerGroup and TalkGold are referenced in U.S. court filings as places from which HYIP frauds/Ponzi schemes are promoted. AHP also has a presence on both forums. It also has a presence on DreamTeamMoney, yet another Ponzi forum.

Like other recent Ponzi-board “programs,” AHP is triggering a security warning from McAfee Site Advisor. The warning declares the AHP site a “Dangerous Site.”

“Whoa!” the warning begins. “Are you sure you want to go there?”

In March, the SEC described Profitable Sunrise as a murky pyramid scheme that may have gathered tens of millions of dollars through offshore bank accounts. Court filings show that money tied to Profitable Sunrise and Liberty Reserve ended up in offshore bank accounts. Whether Profitable Sunrise had a Liberty Reserve account is unclear.

Although HYIP schemes always are dangerous, they may be particularly dangerous now as operators scramble for new, Ponzi-sustaining cash after a series of seizures related to the Liberty Reserve investigation. The amount of HYIP-related cash seized in the Liberty Reserve probe is unknown. A well-known scam that has operated under at least three names — JSS Tripler, JustBeenPaid and ProfitClicking — claimed it accepted Liberty Reserve and now appears to have wiped out investors’ purported holdings and perhaps zeroed out the purported earnings of many of them.

In an April 6 thread-starting post for AHP at MoneyMakerGroup, the claim is made that “You Purchase 1 Or More Revenue Share Ad Spot(s) For $45 !!” and that “You Earn $56.25.” The pitch also claims that a return of 125 percent is “More Stable For Long Term !!”

Separately, the thread-starter’s forum signature tries to lure visitors to a “program” known as “AddWallet,” with a claim that it is “Better Than Zeek (( A Complete Passive Income With Best Advertising Revenue Income Ever )).”

AHP shills have paraded to TalkGold to make “I Got Paid” posts for the purported “opportunity.” Shills did the same thing for Zeek and the other “programs.”

An emerging Ponzi-forum darling like Zeek and Profitable Sunrise before it, AHP appears to have debuted in April, just weeks after the website of Profitable Sunrise went missing.

A series of reload scams are been targeted at Profitable Sunrise victims via a Facebook site. Many of the “programs” claimed to accept LibertyReserve, PerfectMoney, Payza or SolidTrustPay.

PerfectMoney, which purportedly operates from Panama, now claims it is banning new registrations from U.S. prospects.

UPDATED 11:51 A.M. EDT U.S.A. Zeek Rewards’ receiver Kenneth D. Bell had no comment this morning on reports that some Zeek clawback defendants also were participants in Traffic Monsoon,

UPDATED 11:51 A.M. EDT U.S.A. Zeek Rewards’ receiver Kenneth D. Bell had no comment this morning on reports that some Zeek clawback defendants also were participants in Traffic Monsoon,  News came

News came