UPDATED 3:44 P.M. EDT (U.S.A.) Facing felony charges of wire fraud, securities fraud and selling unregistered securities and the potential of 125 years in prison, accused Ponzi schemer Andy Bowdoin has responded by accusing federal prosecutors in the District of Columbia of forcing members to lie to qualify for compensation from a victims’ fund in the AdSurfDaily case, according to an email ASD members have received.

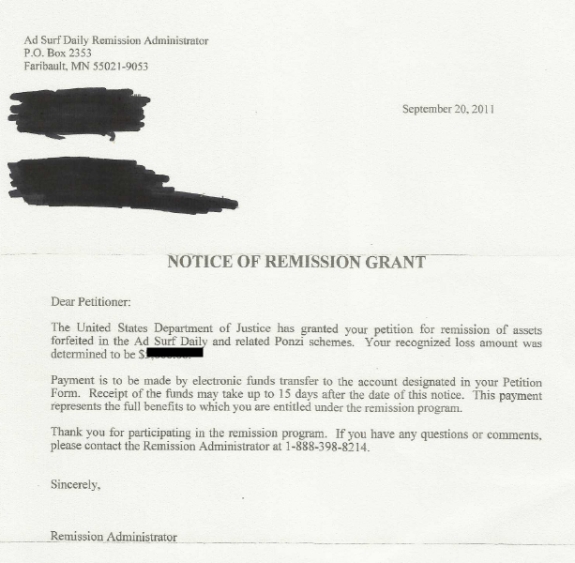

Last week, the government released $55 million seized in the ASD case and began to distribute it through Rust Consulting Inc., the remissions claims administrator approved by the U.S. Department of Justice and the U.S. Secret Service. Members began to receive payments Friday. About 8,400 ASD members filed approved claims, according to the government.

In an email to ASD members yesterday in which Bowdoin continued his efforts to solicit $500,000 to pay for his criminal defense, the ASD patriarch suggested prosecutors had set up the remissions program to dupe them into identifying themselves as crime victims. (Emphasis added.)

“We need the legal defense funds now more than ever to combat this great injustice where the government forced members to sign the untrue statement to get a refund of their monies,” Bowdoin claimed in the email.

The remissions money was not the proceeds of a Ponzi scheme, Bowdoin claimed. Rather, the money members received constituted a return of their “advertising expenses.”

Bowdoin did not explain in the email what he intended to do if the government produced evidence that people were advertising nonexistent businesses on ASD’s closed network. Nor did he explain what he would do if the government produced evidence that the sums sent to ASD for individual advertising purchases bore no connection to the real world: a sole proprietor of an MLM sideline business hawking fruit juice who historically posted $5,000 in gross revenue suddenly spending three times that amount to advertise on ASD, for example.

Bowdoin himself was accused in 2008 of advertising a failed, dissolved business in his own advertising “rotator” to generate purported “rebates.” In making the assertion, the government effectively was claiming that even a nonexistent business — or perhaps even a blank page or a page that promoted a personal Facebook site — could generate a return on investment if inserted in ASD’s rotator.

“To secure some of ASD’s rebates himself, Bowdoin promoted a bogus website through ASD,” prosecutors claimed on Aug. 25, 2008. “Bowdoin explained to the Secret Service that he used the ‘advertising’ he secured from ASD to promote GPS Tech, an unsuccessful business endeavor that had already been dissolved.”

In a footnote within the three-year-old filing, prosecutors claimed “Bowdoin also acknowledged that he modeled ASD after12dailypro, that ASD had no significant income (except maybe a couple thousand dollars) other than what its members paid in (and expected back as rebates). Bowdoin said he was not sure how ASD differed from 12dailypro except, he said, ASD did not guarantee a particular percentage, and its payments were only based on its sales. Bowdoin acknowledged that representations that he had met with the Securities and Exchange Commission (SEC) in Washington, DC, and representations that a team of SEC attorneys that he hired had approved of his operation were made up, as was ASD’s representation that Bowdoin had been awarded a Medal of Distinction by President Bush for business acumen.”

12DailyPro was an autosurf successfully sued by the SEC in 2006 amid allegations it was operating a massive online Ponzi scheme. Prosecutors said later that Bowdoin had a “silent partner” in ASD — and that the silent partner had been Bowdoin’s 12DailyPro sponsor. The government has said all along that ASD falsely traded on Bush’s name to sanitize a fraud that gathered tens of millions of dollars.

The U.S. Secret Service and prosecutors said in August 2008 that Bowdoin had disguised his securities venture as an advertising company that paid “rebates” of 125 percent. They later said that ASD’s internal computer systems described payouts to members as “ROI” — for “return on investment.”

Bowdoin, though, claimed yesterday that ASD, “by definition,” was not a Ponzi scheme. He did not addresses the government’s contention about the “ROI” reference, instead insisting that ASD offered “no guarantees” that members would receive payouts. In August 2008, the government claimed that ASD’s Terms of Service included these words:

“Advertisers will be paid rebates until they receive 125% of their ad purchases.”

An expert witness hired by ASD acknowledged in 2008 under cross-examination that the words had appeared in ASD’s TOS. Despite the fact that the TOS document has been a matter of public record for more than three years, some ASD members claimed that the government has produced no evidence and that ASD members who agreed that they are victims of a massive financial crime will be “torn apart” on the witness stand by ASD’s lawyers.

The “torn apart” claim was made on Jan. 17, 2011, two days before the deadline for ASD members to file a remissions claim with Rust in the case. The claim followed previous claims that a “group” of ASD members might sue persons who identified themselves as victims.

Bowdoin, 76, further claimed in yesterday’s email that, at his upcoming trial, the government will use claims forms signed by members to prove “they were ‘investors’ and therefore victims” of a Ponzi scheme.

On Jan. 23, 2009 — just 10 days after Bowdoin withdrew his claims to the seized money “with prejudice” and just one day after a federal judge memorialized Bowdoin’s withdrawal and consent to forfeit the seized money — federal prosecutors explained the law to ASD victims and said the compensation program would be governed by these federal regulations. (Emphasis added in next paragraph.)

“Under Section 9.8(a)(1) and (2) of Title 28 of the Code of Federal Regulations, in a petition for remission or mitigation of forfeiture a non-owner victim must demonstrate that it suffered a pecuniary loss of a specific amount directly caused by the criminal offense(s) underlying the forfeiture, or a related offense, and that the loss is the direct result of the criminal acts,” the government said in explaining remissions regulations.

A month later — in February 2009 — Bowdoin reentered the case as a pro se litigant and sought to rescind his decision to submit to the forfeiture. That effort failed after months of legal wrangling, and U.S. District Judge Rosemary Collyer issued a final order of forfeiture for the lion’s share of the seized funds in January 2010.

Bowdoin appealed that order and a separate forfeiture order issued by Collyer, but lost both cases in the U.S. Court of Appeals.

In April 2009, in response to Bowdoin’s pro se pleadings, prosecutors revealed that Bowdoin had signed a proffer letter in the case and acknowledged that the government’s material allegations were all true. Bowdoin later revealed in his own court filings that he had met with prosecutors over a period of at least for days in late 2008 and early 2009 and had given information against his interests.

In yesterday’s email, Bowdoin did not address the proffer issue and his own acknowledgment that he’d provided information against his interest in the hopes of receiving a sentencing reduction. Instead, he asserted that he had “very strong feelings about what the govt. is really doing.

“[B]ut due to my court case and upcoming trial, I can only pass on a statement made by one of the attorneys on my Legal Defense Team, in response to the govt. media press release issued on Monday, Sept. 26th, with the headline – “$55 MILLION BEING RETURNED TO VICTIMS OF INTERNET FRAUD – Victims Receive Forfeited Ponzi Scheme Proceeds,” Bowdoin continued.

“I am in full agreement with what my attorney had to say about this govt. press release, which is in ‘quotation marks’ as follows:

‘The release is a gross distortion of the facts. There are no ‘victims.’ Not a single person lost a dime until the government shut down the business. These customers bought advertising on the net. They were not investors.’”

Bowdoin did not say whether the email he sent to members yesterday in which he claimed the government “forced” members “to sign the untrue statement” to qualify for remissions was approved by his attorney.

Bowdoin fired his original attorneys in 2009, after he had submitted to the forfeiture and agreed to cooperate in the investigation. He later hired replacement attorneys.

Prior to Bowdoin’s email, an ASD members who identified herself as “Sara” claimed in an email that some ASD members had received amounts like “$50,000 and $60,000” back through the remissions program.

The email attributed to “Sara” painted a picture of a government conspiracy.

One apparent ASD member posting on Bowdoin’s Facebook fundraising site claimed last week that he received back $27,690 through the remissions program. The person did not say whether the business he had advertised on ASD had posted revenue that would justify such an advertising purchase, and the government had no comment on the Facebook assertion.

UPDATED 4:32 P.M. EDT (U.S.A.) It’s only getting stranger . . .

UPDATED 4:32 P.M. EDT (U.S.A.) It’s only getting stranger . . .