UPDATED 9:36 P.M. EDT (U.S.A.) The American Red Cross is a national treasure whose powerful and noble name never should be diluted or trifled with. But it is now apparent that various Club Asteria-related entities have done exactly that by not revealing certain critical information to the Red Cross while at once shamelessly seeking to build the Asteria brand across multiple platforms by tying it to the Red Cross — beginning in the spring during a period in which the agency was responding to a crisis in Japan.

UPDATED 9:36 P.M. EDT (U.S.A.) The American Red Cross is a national treasure whose powerful and noble name never should be diluted or trifled with. But it is now apparent that various Club Asteria-related entities have done exactly that by not revealing certain critical information to the Red Cross while at once shamelessly seeking to build the Asteria brand across multiple platforms by tying it to the Red Cross — beginning in the spring during a period in which the agency was responding to a crisis in Japan.

To describe what the Asteria entities have done as spectacularly parasitic with equally disgusting measures of greed and ham-handedness thrown in would be a gross understatement. In any event, the Asteria entities have created a deplorable situation that sparked the Red Cross to issue a statement today. (You’ll see the full statement beginning four paragraphs below.) The statement was issued this afternoon from Washington, D.C., and emailed by the Red Cross to the PP Blog. The statement concerns the purported Asteria Philanthropic Foundation, which is linked to the purported Club Asteria business “opportunity” and other Asteria-themed enterprises. The Asteria enterprises are using the Red Cross name and logo in promos across multiple websites — while calling the Red Cross a partner. No partnership exists, the Red Cross made clear today.

Members of Club Asteria — participants in any of the Asteria-themed enterprises — need to know that at least one of Club Asteria’s purported owners, Hank Needham, has been linked to promotions for online Ponzi schemes and pyramid schemes. (You’ll see a cash-gifting video starring Needham below.) The stench lives on three years after the taping, and it cannot be dissipated by leeching off the name of the Red Cross.

This is a story that only is getting uglier. Ten days ago — after becoming concerned that its name and logo were being misused — the Red Cross sent the purported Asteria Foundation a cease-and-desist letter. It later developed that Needham had appeared in a May 2008 video that advertised a cash-gifting scheme. Needham, whose face also appeared in a 2008 promo for the alleged $110 million AdSurfDaily Ponzi scheme, is seen in the video opening an envelope from a courier service. A smaller envelope was packaged in the courier envelope — and five $100 bills spilled out of the smaller envelope. Needham fanned them for the camera. Cash-gifting schemes are prosecutable under pyramid-scheme statutes, despite what prospects are led to believe. U.S. Sen. Richard Blumenthal, D-Conn., called cash-gifters “parasites” when he was attorney general of Connecticut.

The PP Blog has added the italics to today’s statement by the Red Cross:

The Asteria Foundation contacted the American Red Cross in April and said it wanted to make a donation to aid relief efforts in Japan after the earthquake and tsunami. At the time, the organization requested information on how the donation might be put to use and we directed their representative to published information on Red Cross recovery efforts. The organization also requested the ability to mention its donation to us in its own press materials, which we felt was appropriate.

However, we have no record of receiving a donation from this organization and have not partnered with them on that or any other projects. We have requested that the organization remove our logo and other materials from its web site, and they have agreed to do so.

In September, Club Asteria removed an image and purported “interview” with famed actor Will Smith from its recruitment emagazine amid questions about whether the purported “opportunity” was trying to plant the seed that Smith had endorsed the company.

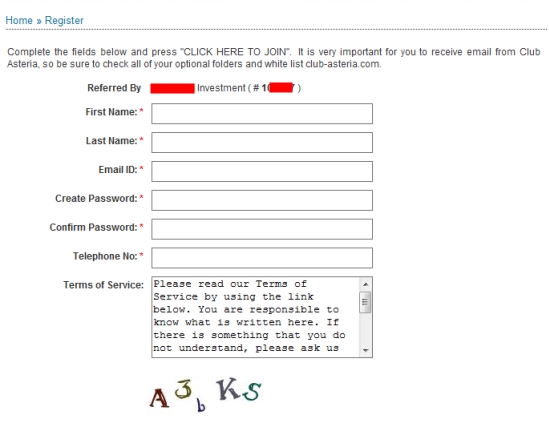

Scores of promos for Club Asteria, which trades on the name of the World Bank, have appeared online this year. The promos described Club Asteria as a “passive” investment opportunity that generated a weekly return of up to 10 percent. Club Asteria suspended member cashouts in June, after acknowledging its PayPal account had been suspended — and after claims about Club Asteria came under investigation in Italy.

Club Asteria was widely promoted on Ponzi scheme forums such as TalkGold and MoneyMakerGroup. Members said payouts were routed through a Hong Kong entity known as Asteria Holdings Limited. When things turned sour at Club Asteria, the Ponzi-forum promoters turned their attentions to other HYIP “programs” that offered absurd returns that translated into purported yearly gains in the hundreds of percent.

The Asteria Foundation also has used a Hong Kong address — tying it to a fax number in Virginia. Asteria Corp., Club Asteria’s apparent parent company and also the apparent driving force behind the purported Asteria Foundation, is based in Virginia.

State authorities said last month that neither Club Asteria nor Asteria Corp. was registered to sell securities. Club Asteria has blamed its members for promotional blunders and for PayPal’s decision to suspend its account. That explanation, however, strains credulity — given Needham’s history of pushing multiple fraud schemes. It is inconceivable that Club Asteria did not know that its growth was being fueled by serial hucksters on Ponzi forums and by thousands of promos on the independent websites of Club Asteria affiliates, many of whom preemptively denied Club Asteria was conducting a Ponzi scheme. They could not possibly know whether Club Asteria was on the up-and-up without seeing the books and records from banks and as many as four separate payment processors.

How much money Club Asteria gained as a result of promos that positioned the company as a cash cow is unclear. Scores of members claimed that paying Club Asteria $19.95 a month would produce a yearly income of more than $20,000. Club Asteria is believed to have gained considerable traction in the Third World. Club Asteria pitchman “Ken Russo,” who also is known as “DRdave” and is believed to operate from the United States, claimed on Ponzi boards to have received thousands of dollars in recruitment commissions via wire from Hong Kong.

Club Asteria, which has described itself as a revenue-sharing program, does not publish verifiable financial information. The firm now appears to be branching out into social networking, positioning itself as an education leader and “cause” marketing company.

Ponzi forum promoters, whom some critics describe derisively as “pimps” and “referral whores,” shilled for Club Asteria for months before the company suspended cashouts.

2008 Hank Needham Video On Cash-Gifting

Please note that the URL advertised in the Dailymotion video below — ptigift.com — no longer resolves to a server.

A Virginia-based company that trades on the name of the World Bank and claims to help lift some of the poorest people on earth out of poverty by involving them in an income and MLM-like recruitment scheme has suspended member cashouts, according to posts on Ponzi scheme and criminals’ forums.

A Virginia-based company that trades on the name of the World Bank and claims to help lift some of the poorest people on earth out of poverty by involving them in an income and MLM-like recruitment scheme has suspended member cashouts, according to posts on Ponzi scheme and criminals’ forums.