“Well we have been dealt a setback today…the judge here agreed with the government to transfer us to the District Court in Washington DC… The same judge who railroaded Andy. I will make a motion for her to recuse herself and if she will not (and she will not) I will take an appeal.” — Remark attributed to Dwight Owen Schweitzer that is contained within email by former AdSurfDaily spokeswoman Sara Mattoon that discusses plan to “flood” a federal judge with letters of support for jailed ASD Ponzi schemer Andy Bowdoin, Aug. 13, 2012

Former AdSurfDaily member Dwight Owen Schweitzer — later to join former ASD colleague Todd Disner as a pitchman for the Zeek Rewards 1-percent-a-day-plus MLM scheme — is quoted in an email circulating among ASD members that ASD President Andy Bowdoin was “railroaded” by a federal judge.

The quotation attributed to Schweitzer was contained within an Aug. 13 email forwarded by Disner after being assembled by former ASD spokeswoman Sara Mattoon. Mattoon has a history of packaging communications friendly to ASD, adding her purported insights to the communications and emailing them to members. The Aug. 13 email calls for ASD members to “flood” a federal judge with letters of support for Bowdoin. The ASD patriarch and veteran securities swindler is scheduled to be sentenced Aug. 29 in the District of Columbia by U.S. District Judge Rosemary Collyer.

Previous Mattoon emails have quoted Kenneth Wayne Leaming, a purported “sovereign citizen” now jailed near Seattle after a 2011 investigation by an FBI Terrorism Task Force. Leaming was accused of filing false liens against at least five public officials involved in the ASD Ponzi case, harboring two fugitives wanted in a separate home-business scheme, being a felon in possession of firearms and uttering a bogus “Bonded Promissory Note” for $1 million.

Leaming, who is not an attorney, was said to be performing legal work on behalf of some ASD members.

In May 2012, Bowdoin pleaded guilty to wire fraud in the ASD Ponzi case and acknowledged that ASD was a Ponzi scheme and that his company never operated lawfully from the inception of its 1-percent-a-day (or more) “program” in 2006. Bowdoin, 77, originally remained free on bond after his guilty plea, pending formal sentencing.

But Bowdoin was jailed in June 2012, after prosecutors presented evidence that Bowdoin continued to promote scams after the U.S. Secret Service seized more than $80 million in ASD-related proceeds in 2008 and after Bowdoin was arrested on ASD-related Ponzi charges in 2010. Prosecutors identified those scams as “OneX,” and AdViewGlobal (AVG).

Like ASD, AVG was a 1-percent-a-day “program.” AVG, which launched in February 2009 after the seizure of ASD-related bank accounts in 2008, vanished mysteriously in the summer of 2009 after issuing threats to members and journalists. AVG was referenced in a lawsuit filed by ASD members who accused Bowdoin of racketeering.

Contained within the forwarded email dated Aug. 13 are at least two ads for the Zeek Rewards’ MLM which, like ASD, plants the seed that a return that corresponds to an annualized return in the hundreds of percent is possible. Precisely why the Zeek ads appeared in the email is unclear. They are attributed to a Zeek affiliate known as “Compassion Ministries” and display Zeek videos produced by USHBB Inc., a company that once produced ads for the Narc That Car pyramid scheme that collapsed in 2010 after the Better Business Bureau raised concerns about Narc and investigative reporters began to write about Narc and produce television reports about the “program.”

Even as the Mattoon email solicited support for Bowdoin as his Aug. 29 sentencing date approaches, it cautions ASD members to “be careful” if they write to Bowdoin in jail because “they read his mail.”

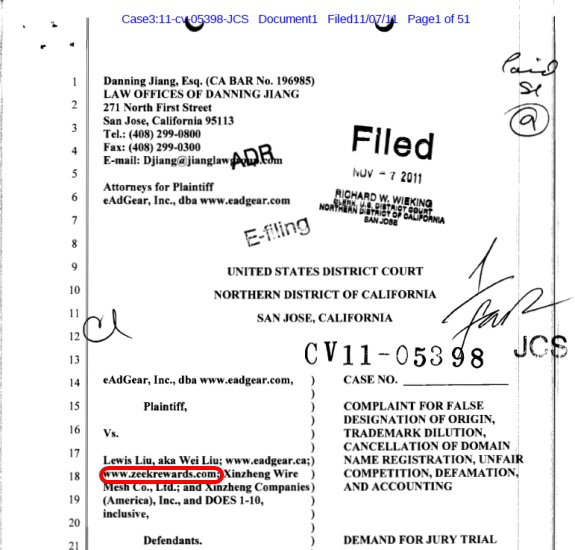

Disner and Schweitzer sued the U.S. government in November 2011, claiming the seizure of ASD’s database was unconstitutional. The lawsuit originally was filed in the Southern District of Florida, but a judge there granted a request by the government to transfer the case to the District of Columbia. The case now appears on the docket in U.S. District Court for the District of Columbia and has been assigned to Collyer.

The Aug. 13 email from Mattoon quotes Schweitzer as saying, “Well we have been dealt a setback today…the judge here agreed with the government to transfer us to the District Court in Washington DC… The same judge who railroaded Andy. I will make a motion for her to recuse herself and if she will not (and she will not) I will take an appeal.”

When suing the United States in November 2011, Disner and Schweitzer relied in part on a purported expert opinion from Keith Laggos that ASD was not a Ponzi scheme. Like Disner and Schweitzer, Laggos also has been linked to the Zeek Rewards’ scheme.

Laggos reportedly was fired as a Zeek “consultant” last month. Details surrounding the reported firing remain unclear.

Zeek is now the subject of an “examination” by North Carolina Attorney General Roy Cooper.

Zeek’s news Blog published this baffling message yesterday (italics added):

Hello Fine People:

The team wanted to let you know there won’t be any training, recruitment or leadership calls for the next few days while planning is going on. Standby for some important announcements. Thank you for your patience!