EDITOR’S NOTE: See related story from earlier today that outlines where about $2.133 million of the $5 million cited in the story below is being held for safe-keeping. The whereabouts of the balance is creating a mystery, according to court files.

U.S. District Judge Christina A. Snyder has scheduled a hearing April 24 in Los Angeles to address a court-appointed receiver’s claim that a $5 million transfer by accused WCM777 Ponzi scheme operator Phil Ming Xu to a lawyer a month before an asset freeze was a “sham” designed to stash cash.

The lawyer, Vincent Messina, now has retained a lawyer and is refusing to return most of the cash and explain what happened to more than $2.66 million that hasn’t been accounted for, insisting that the transaction was a “loan” for investment purposes and that he also was helping Xu set up a “political action committee,” according to receiver Krista L. Freitag.

Messina has retained Maranda Fritz, an attorney in New York, according to court filings.

Freitag, who wants the money returned and an accounting of how it was used, has asked Snyder to freeze Messina’s bank accounts.

“There is not only a strong likelihood that monies transferred to Mr. Messina will be dissipated, but evidence they already have been,” Freitag argued.

And, she continued, “[t]his poses a serious risk of irreparable injury to the receivership estate and investors. Once monies are disbursed by Mr. Messina, it will be difficult, if not impossible, to recover them for the benefit of investors.”

The SEC has described WCM777 as a $65 million Ponzi- and pyramid scheme. Freitag says her early analysis suggests that WCM777 may have more than 479,000 “member accounts.”

Moreover, Freitag argued, Messina refused to return the money even when asked by Xu in a March 20 letter.

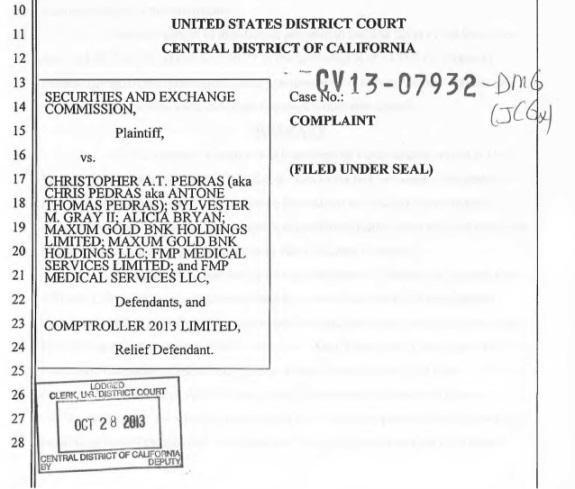

Xu, according to the letter, described Messina as his attorney, not as a business partner, and wrote he wanted the $5 million returned so he could use it “to settle any outstanding SEC issues that I may have.” (See screen shot above.)

Other records show that the SEC had been investigating Xu since October 2013. Snyder granted an asset freeze on March 27, after the SEC appeared in federal court and alleged that WCM777 and related entities were conducting an ongoing fraud.

Xu allegedly transferred the $5 million to Messina a month prior to the March 27 freeze.

From the receiver’s motion to freeze Messina’s bank accounts (italics/carriage returns added):

Considering the large sum of money at issue, the compelling evidence of fraud and that Defendant Xu uses nominees to hold the proceeds of fraud, as well as the proximity of the transfer to the filing of the case, and the fact that Mr. Messina refuses to provide any information about the whereabouts of the remaining $2.668 million, it is critical that Mr. Messina’s bank accounts be immediately frozen to protect the Receivership Entities’ investors from further dissipation of the funds.

The temporary freeze should remain in place pending further investigation and a determination by the Court of the true nature of the $5 million transfer. To aid in this investigation and determination, Mr. Messina should be directed to provide an accounting of the funds, a relatively simple task considering he received them only about 40 days ago.

The accounting will also assist in determining the appropriate scope of the freeze, which should cover accounts containing funds received from Mr. Xu or the Receivership Entities.

Thanks to the ASD Updates Blog. View WCM777 case docs 29 through 29-2 here.