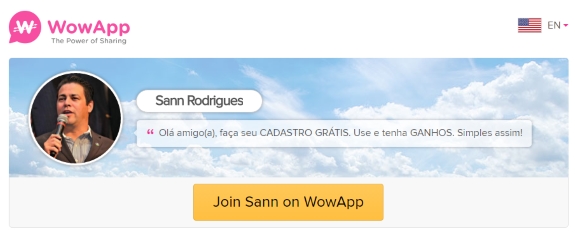

2ND UPDATE 2:22 P.M. EDT U.S.A. “WowApp,” which has a Facebook page that thanks the “deaf community” for joining, now is being pushed by TelexFree figure and alleged immigration fraudster Sann Rodrigues, according to a web promo.

WowApp says it is a communications platform. It further says it is based in Hong Kong and urges members to “Use your WowCoins to contribute to a cause of your choice or cash them out.”

WowCoins purportedly have a value of 1 U.S. cent.

A post pitching WowApp on the MoneyMakerGroup Ponzi forum claims “You Can Cashout To Paypal,BankWire Or CC / Donate To 2000 Charities In 110 Countries!”

“CEO Thomas C. Knobel Founder Nobel (company) Released WOWAPP!” the Oct. 30, 2015, MoneyMakerGroup post says.

WowApp is part of YouWowMe Limited of Hong Kong, according to its website.

From the WowApp Terms and Conditions (italics added):

In an effort to earn your loyalty and repeat business, YouWowMe offers you a 10% reward back (“Self-Earnings”) on all of your paid calls using the Service. Immediately following completion of each paid call, the Self-Earnings are credited to your WowApp Account as “WowCoins”, our own special currency. Starting from 100 Wow’s (or its equivalent $1.00), you may use Self-Earnings which are credited to your YouWowMe Account to place additional paid calls. Because you have this option of using your “WowCoins” to make future paid calls using WowApp, for which you will receive an additional 10% reward, our maximum reward for these call offering is 11.11% (“max self-earnings”).

Translated by Google Translate from Portuguese to English, The WowApp promo credited to Rodrigues reads, “It’s free. It is simple and gives every day gains! This application works better than whatapp and the coolest is that it generates every day gains. I believe this is the future. Free things that generate in earnings. USE EVERY DAY!”

Rodrigues has a history of hitching his wagon to “programs” that pitch communications devices.

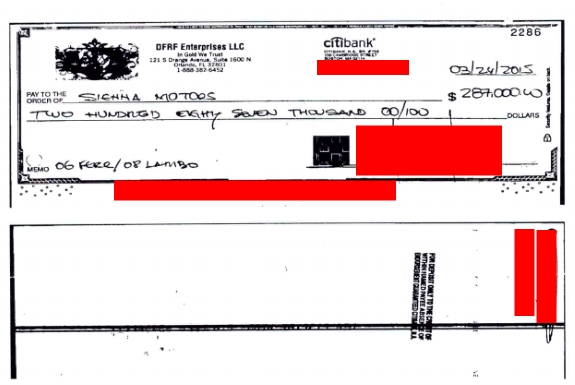

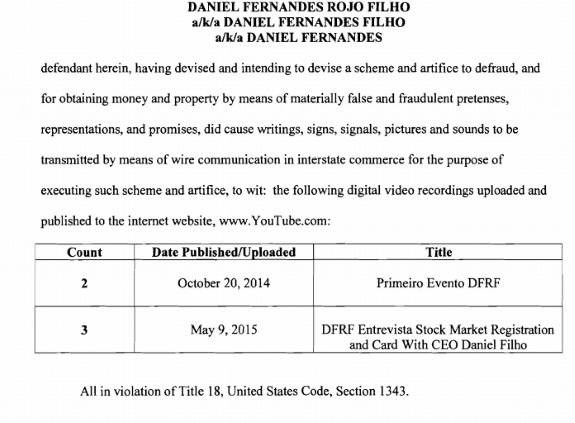

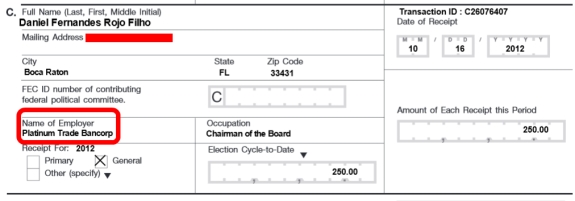

The SEC, which charged Rodrigues with securities fraud in the TelexFree Ponzi- and pyramid case in 2014 and later linked him to alleged DFRF Enterprises Ponzi-schemer Daniel Fernandes Rojo Filho, did not respond immediately to a request for comment. (Update 2:04 p.m. The SEC declined to comment.)

Rodrigues also is charged criminally in a separate case that alleges he engaged in visa fraud to enter the United States from his native Brazil.

NOTE: Our thanks to a reader.