A recidivist securities felon tied to at least 24 bank accounts had an airline ticket for Bermuda last week but was arrested in Florida before he could get offshore after scamming investors in a long-running fraud scheme that had gathered $20 million, according to law-enforcement officials.

A recidivist securities felon tied to at least 24 bank accounts had an airline ticket for Bermuda last week but was arrested in Florida before he could get offshore after scamming investors in a long-running fraud scheme that had gathered $20 million, according to law-enforcement officials.

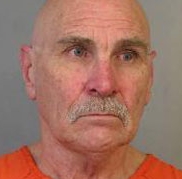

Charged in a criminal complaint by the U.S. Postal Inspection Service was James D. Risher, who is associated with firms identified as Jade Asset Group LLC, Managed Capital LLC and Safe Harbor Investments. Risher is accused of mail fraud, wire fraud, money-laundering and conspiracy.

Risher, 61, of Sanibel, Fla., was released from federal prison on Aug. 14. 2004, according to records. His imprisonment stemmed from 1997 convictions for mail fraud, securities fraud and money-laundering for which he was sentenced to 92 months, with three years’ supervised probation after his release.

He also has state-level convictions in Georgia from a securities swindle in the early 1990s, according to records.

The new charges against Risher suggest he embarked on a new swindle in early 2007, perhaps while still on probation for the swindle that led to his 1997 convictions. The FBI, the IRS, the Florida Department of Law Enforcement and the Florida Office of Financial Regulation are assisting postal inspectors in the new probe, which is ongoing.

One of the keys to Risher’s arrest was a notification that law enforcement received from U.S. Immigration and Customs Enforcement (ICE) that Risher had a plane ticket to fly from North Carolina to Bermuda last week, according to court documents.

Risher, according to the investigating postal inspector, had been placed on an ICE watch list during the probe and was being monitored for “scheduled travel outside of the country.”

The investigating postal inspector advised a federal magistrate judge that Risher was a flight risk and may have a bank account in Bermuda, which is located in the Atlantic Ocean about 640 miles from North Carolina. ICE is part of the U.S. Department of Homeland Security.

Risher had reason to believe investigators were closing in, according to the postal inspector’s affidavit.

Fleeced investors were demanding their money, according to the affidavit. Meanwhile, at least two Florida law firms were investigating claims against Risher on behalf of about 150 investors, according to other records.