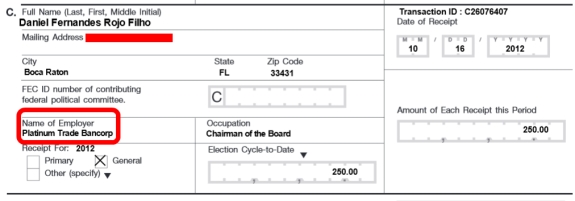

In 2012, Daniel Fernandes Rojo Filho, purportedly an employee of an entity known as Platinum Trade Bancorp and using the address of a mansion in Boca Raton, Fla., made a $250 campaign contribution to Obama for America, according to Federal Election Commission records.

The PP Blog is declining to publish the address of the 6,742-square-foot (est.) waterfront property, which appears not to have been owned by Filho. Records suggest the six-bedroom home has at least 6,200 square feet with air-conditioning and a separate quarters for domestic staff.

It sold for $2.025 million in August 2013, but Filho was listed neither as buyer nor seller. If he ever lived in the mansion, it appears he was a tenant, not an owner.

The donation to President Obama’s reelection campaign in Filho’s name (and listing the address of the Boca Raton mansion) was recorded on Oct. 16, 2012, just three weeks before the Nov. 6 general election that returned Obama to the White House for four more years. Obama is a Democrat.

Filho, now implicated criminally and civilly by the FBI and the SEC in the alleged DFRF Enterprises Ponzi- and pyramid scheme that traded on an international gold-mining theme, is not a U.S. citizen, according to court filings. Rather, he is a citizen of Brazil.

Campaign donations by “foreign nationals” are illegal under U.S. law. There is an exception for U.S. residents who have a green card “indicating his or her lawful admittance for permanent residence in the United States,” according to the FEC.

It is unclear whether Filho has a green card and is in the country lawfully. Federal prosecutors in Massachusetts described him July 22 as an Orlando resident and fugitive arrested the day before “coming out of a restaurant in Boca Raton.”

Sann Rodrigues, a defendant in the epic TelexFree Ponzi- and pyramid case and an alleged Filho business associate, was arrested in May 2015 on a charge of immigration fraud. Like Filho, Rodrigues is a citizen of Brazil. Prosecutors said Rodrigues lied to get a green card.

Both men have listed addresses in Florida and Massachusetts and have been implicated in alleged frauds targeted at people who speak Portuguese or Spanish.

FEC records show that the donation in Filho’s name lists him as “Chairman of the Board” of Platinum Trade Bancorp. Where the purported business was based is unclear. No such company appears to exist in Florida.

The name of the purported firm, however, is similar to the name of Platinum Swiss Trust, a company the SEC said played a role in the DFRF fraud.

Platinum Swiss Trust, the SEC alleged, is a “purported Swiss private bank that is not actually authorized to conduct banking activities in Switzerland.” It purportedly is associated with Heriberto C. Perez Valdes, 46, of Miami. Valdes is a DFRF codefendant in the SEC’s civil case.

DFRF, the agency said, advanced a story that it has a $3.1 billion line of credit with Platinum Swiss Trust and used investors money to “leverage the credit line and generate a total return of 600%.”

Darren Covar, a Florida immigration attorney who appeared with Filho and others in a DFRF promo, is listed in FEC records as a contributor to Democratic causes. He has not been accused of wrongdoing.

FEC records lists Covar as having made $2,800 in 2012 contributions, though none to Obama. These contributions consisted of $300 to the Democratic Executive Committee of Florida, and $2,500 to the Kristen Jacobs for Congress campaign. Jacobs, a Democrat running for seat in the U.S. House, lost the race to Democrat Lois Frankel, the former mayor of West Palm Beach and the former minority leader of Florida’s state house.

Whether bail has been set for Filho is unclear. The U.S. Attorney’s office in Massachusetts did not return an inquiry on the matter.

Filho made an appearance in federal court in the Southern District of Florida yesterday. Miami defense attorney David A. Howard made a “temporary” appearance for him, according to the docket of the case.

Howard did not immediately return an inquiry for comment on Filho’s bail status.

Court records suggest he is in the custody of the U.S. Marshals Service and will be returned from Florida to face the DFRF-related criminal charge of wire fraud in federal court in Massachusetts.

NOTE: Our thanks to the ASD Updates Blog.