“Many investors gave cash to the company and to their leaders (or upline sponsors) who then deposited the cash along with other investor funds.” — Krista L. Freitag, court-appointed receiver in the WCM777 pyramid- and Ponzi case, Feb. 27, 2015

EDITOR’S NOTE: Tens of millions of dollars allegedly flowed through WCM777 and related entities. At the bottom of this column, you’re going to read that an apparent apologist for accused Ponzi schemer Ming Xu is claiming the U.S. Securities and Exchange Commission is violating his human rights. Fair warning: You might want to have your vomit bucket at the ready . . .

EDITOR’S NOTE: Tens of millions of dollars allegedly flowed through WCM777 and related entities. At the bottom of this column, you’re going to read that an apparent apologist for accused Ponzi schemer Ming Xu is claiming the U.S. Securities and Exchange Commission is violating his human rights. Fair warning: You might want to have your vomit bucket at the ready . . .

UPDATED 10:31 A.M. ET U.S.A. Here’s how you rob the Christians in an offering fraud that involves the sale of tens of millions of dollars in unregistered securities across state and national borders: You start an MLM “program,” get it in the churches and on YouTube, permit “leaders” to gather money from their enraptured audiences and put out the word that $1,999 returns $3,200 in 100 days.

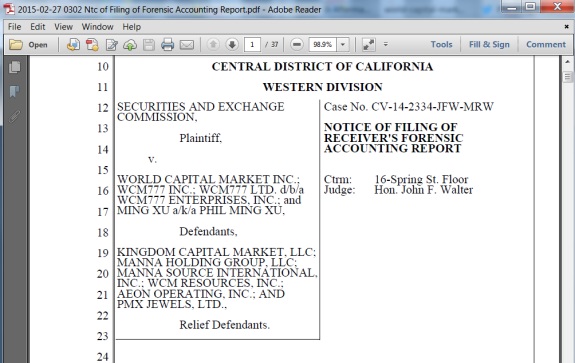

It might help if you have a storefront in, say, Peru. It also might help if you have, say, promoters willing to tout the “program” in webinars and from a “function room in a hotel in Massachusetts.” At the same time, it might help if you have promoters willing to steal the intellectual property of the “Rocky” movie franchise to drive dollars into any of the “77 domestic and 23 foreign bank accounts” you’re using. (The bank-account information is sourced from a forensic accounting by Krista L. Freitag, the court-appointed receiver in the WCM777 case. It was filed Feb. 27 in U.S. District Court for the Central District of California and is the basis for part of this PP Blog column. Links to exhibits are provided near the bottom of the column.)

Along the way, it might help if you follow the standard blueprint from one MLM scam after another that calls for you to disarm skeptics by dropping the names of plenty of famous businesses, perhaps with the aim of hoping your “leaders” will follow your lead and do the same thing. Damn! Wouldn’t you know it! They did exactly that! (See link in first paragraph of this story.)

Might you follow the blueprint of earlier scams such as Zeek Rewards that calls for you to get some of the money you’re gathering offshore, perhaps to Hong Kong? You betcha!

It might be particularly helpful if you make a calculation that a bank such as HSBC in Hong Kong might frown upon a subpoena issued in the United States and clam up when it comes to assisting the receiver appointed to your case after the SEC moves in.

“To date, HSBC-Hong Kong has not responded to the Receiver’s requests/subpoena,” Freitag advised U.S. District Judge John F. Walter in her forensic accounting.

Why would HSBC shun the receiver? Well, perhaps it had something to do with this July 2012 hearing by the U.S. Senate Permanent Subcommittee on Investigations that examined “U.S. Vulnerabilities to Money Laundering, Drugs, and Terrorist Financing: HSBC Case History.”

Or maybe HSBC doesn’t want to open a new can of worms after it settled with the Justice Department in December 2012 by forfeiting $1.256 billion and entering into a deferred-prosecution agreement after it was accused of “willfully failing to maintain an effective anti-money laundering (AML) program, willfully failing to conduct due diligence on its foreign correspondent affiliates, violating [the International Emergency Economic Powers Act] and violating [the Trading with the Enemy Act].”

In May 2014, the SEC said it had an email from accused WCM777 Ponzi schemer Ming Xu to Vincent Messina, the asserted “general counsel” to a Xu business entity known as “World Capital Market.”

“Vincent,” the alleged Ming Xu email to Messina began. “We have lots of members for our social capital company, WCM777 in Brazil. They paid us in Brazil. How to move the money legally from Brazil to USA or Hong Kong?”

Whether Messina provided guidance on how to get money out of Brazil and move it to the United States and Hong Kong is unclear. Ming Xu’s email, however, suggests that WCM affiliates in Brazil, like their U.S. counterparts, also were collecting money directly from MLM recruits and that Ming Xu needed to find a way to get the cash under his control.

This situation is eerily reminiscent of how the massive TelexFree scheme conducted business and almost certainly explains why the U.S. Department of Homeland Security got involved in the 2013/2014 TelexFree probe alongside the FBI and the SEC.

It’s also highly reminiscent of a scam known as Imperia Invest IBC that stole millions of dollars from people with hearing impairments in 2010.

Freitag says she has traced $5 million in Ming Xu proceeds to Messina, and Walter ordered Messina to return it. Only $2.133 million has been returned, Freitag says.

Messina wasn’t just a lawyer; he was a WCM777 “insider,” the receiver alleges.

Because Freitag has access to certain WCM777 banking records, she has been able to determine that “$29,404,996” went to HSBC in Hong Kong “for 7 Receivership Entities and 1 individual.”

Ming Xu used numerous companies as part of his overall money-moving scheme, the receiver contends.

Here’s how she describes one transaction that occurred after WCM777 got in trouble with the Massachusetts Securities Division in late 2013 and agreed to return money to the fleeced investors in that state (italics added):

“ . . . rescission payments were made to WCM777 investors in accordance with the Consent Order issued by the Massachusetts Securities Division. Bank records show that funds from ToPacific bank accounts were used to make payments to the Massachusetts WCM777 investors.”

“ToPacific” was a company in the WCM777 fold.

How circuitous were things within WCM777 (italics added):

“the payment methods with which investors payments were made varied from third-party electronic disbursement (primarily Global Payout) to physical checks written directly on Receivership Entity bank accounts. There does not appear to be any consistency in the bank accounts from which investor checks were written. Rather, bank records indicate payments were made to investors from whichever accounts happen[ed] to have funds available at the time the payments were made.”

The FBI has been warning about shell companies involved in crime and how banks and payment processors can get caught up in it since at least 2010. Even so, the WCM777 entities somehow managed to open at least 100 bank accounts while also gaining access to bank wires and at least one payment processor.

Here’s how Freitag describes the overall scheme (italics added/light editing performed):

“The Receivership Entities’ primary source of income was investor deposits, which was also the primary source of virtually all funds distributed to the investors; [t]he vast majority of the Receivership Entities’ business activities revolved around raising and distributing investor funds; [i]nvestor funds were so materially commingled between and among the Receivership Entities that the entities operated as a unitary enterprise, rather than as separate entities.”

And while WCM777 recruits thought they were joining an MLM “program,” their money financed the purchases of two golf courses in California, several pieces of real estate, including one with live koi, and a series of purported investments elsewhere. These allegedly included jewelry or gold, oil and gas — and even piles of “jeans, shorts, pants and leggings” stored by Ming Xu’s sister.

Ming Xu’s Mom allegedly got a new house, but not until after the cash to purchase the home had passed through bank accounts linked to Ming Xu and his sister.

Earlier, Ming Xu used Twitter to send a declaration of love to the Peruvian people — on the letterhead of a company suspended in California.

The Ming Xu Twitter account, which once claimed all would become known when “blood moons” appeared in the sky and published a picture of Apple co-founder Steve Wozniak, whom Ming Xu had corralled at a networking event in California, now includes a link to a website that claims (italics added):

U.S. Securities and Exchange Commission was wrong to close down the company and confiscate about $43M cash asset and oil reserve asset of $50M. It has violated the company’s legal interests and human rights of Ming Xu.

Read the exhibits from Freitag’s forensic accounting. (Here’s one; here’s the other.)

As noted above, you might want to have a vomit bucket handy if you’re contemplating how certain MLM “programs” are operating these days in the era of epic white-collar fraud and while terrorism, beheadings and attacks on police are occurring.