BULLETIN: (7th Update 8:51 p.m. ET U.S.A.) Entities known as Fleet Mutual Wealth Limited, MWF Financial Limited and Mutual Wealth are frauds that filed invalid forms with the SEC to dupe the masses, the SEC said.

An associated web domain styled MutualWealth.com also is a fraud, the SEC said in a statement and emergency court filing that alleges a pyramid scheme in which promoters become referral agents or purported “accredited advisors” to earn recruitment commissions.

“Mutual Wealth used Facebook and Twitter as well as a team of recruiters to spread a steady stream of lies that tricked investors out of their money,” said Gerald W. Hodgkins, an associate director in the SEC’s Division of Enforcement.

Some recent scams have purported to operate out of Hong Kong, something that appears also to be the case with Mutual Wealth.

“[A]lmost nothing that Mutual Wealth represents to investors is true,” the SEC said. “The company does not purchase or sell securities on behalf of investors, and instead merely diverts investor money to offshore bank accounts held by shell companies. Mutual Wealth’s purported headquarters in Hong Kong does not exist, nor does its purported ‘data-centre’ in New York. Mutual Wealth also lists make-believe ‘executives’ on its website, and falsely claims in e-mails to investors that it is ‘registered’ or ‘duly registered’ with the SEC.

And, the SEC said, Mutual Wealth may operate through entities in Panama and the United Kingdom “and through Russian or Belarussian nationals.”

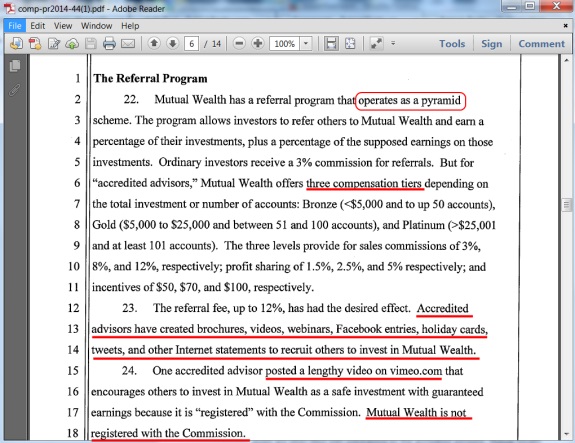

From the SEC complaint (italics added):

Investors who complete an account application are instructed to transfer money to Mutual Wealth either by wire transfer to banks located in Latvia and Cyprus or through third-party payment processors such as SolidTrust Pay, EgoPay, or Perfect Money.

Like other fraud schemes, Mutual Wealth has a presence on the MoneyMakerGroup and TalkGold Ponzi forums.

U.S. District Judge Dolly M. Gee of the Central District of California has ordered an asset freeze on all accounts “at any bank, financial institution, brokerage firm, or third-payment payment processor (including those commercially known as SolidTrust Pay, EgoPay, and Perfect Money) maintained for the benefit of Mutual Wealth,” the SEC said.

Assisting in the probe are the FBI, the Financial and Capital Market Commission of Latvia, the Ontario Securities Commission and the Cyprus Securities and Exchange Commission, the SEC said.

From the SEC’s statement (italics added):

According to the SEC’s complaint, Mutual Wealth operates through entities in Panama and the United Kingdom and uses offshore bank accounts in Cyprus and Latvia and offshore “payment processors” to divert money from investors. Mutual Wealth’s sole director and shareholder presented forged and stolen passports and a bogus address to foreign government authorities and payment processors.

As in previous scams, the Mutual Wealth fraud spread on social media, the SEC said.

“Mutual Wealth maintains Facebook and Twitter accounts that link to its website and serve as platforms through which it lures new investors,” the SEC said. “Some of Mutual Wealth’s ‘accredited advisors’ then use social media channels ranging from Facebook and Twitter to YouTube and Skype to recruit additional investors and earn referral fees and commissions.

“Mutual Wealth’s Facebook page spreads such misrepresentations as ‘HFT portfolios with ROI of up to 250% per annum. Income yield up to 8% per week,’” the SEC said. “A Facebook post on Aug. 12, 2013, boasted ‘$1000 investment into the Growth and Income Portfolio made on April 8th, 2013 is now worth $2,112.77.’ Mutual Wealth regularly posts status updates for investors on its Facebook page, and the comment sections beneath the posts are often filled with solicitations by the accredited advisors. Mutual Wealth also tweets announcements posted on its Facebook page.”

Regulators have been warning for years about scams spreading on social media.

Scammers recently have been purporting they are conducting IPOs or pre-IPOs or are registered with the SEC.

“Mutual Wealth has filed three Securities Act Forms D with the Commission,” the SEC said. “Each Form D purports to give notice of offerings of securities that are exempt from registration with the Commission under Regulation D of the Securities Act.

“But Mutual Wealth’s offers and sales of securities do not qualify for the exemptions cited in the Forms D or any exemption under from registration under Regulation D of the Securities Act. Consequently, the Forms D are invalid and of no legal effect,” the SEC said.

About 150 U.S. investors opened Mutual Wealth accounts, plowing “at least” $300,000 into the scheme, the SEC said.

Note: Thanks to Jordan Maglich at PonziTracker.com.