UPDATED 10:44 A.M. EDT U.S.A. In an amended complaint filed in August 2014, Zeek Rewards’ receiver Kenneth D. Bell sued MLM attorney Kevin Grimes, the Grimes & Reese law firm and a Grimes-related entity known as MLM Compliance VT LLC.

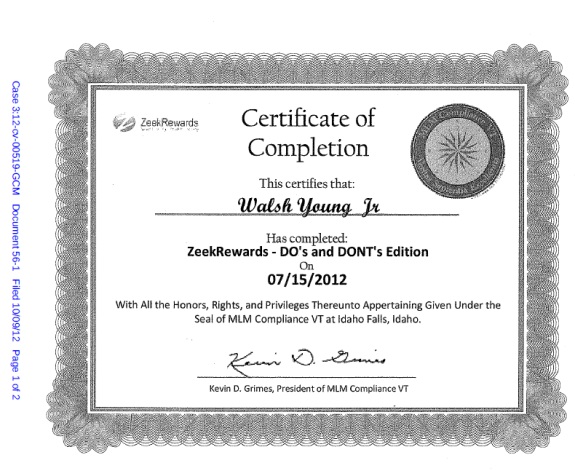

Among other things, Bell alleged that Grimes and MLM Compliance received $843,000 from the Zeek pyramid- and Ponzi scheme through the sale of a “bogus compliance course.”

Bell further alleged that “[t]he final payment from [Zeek operator Rex Venture Group] to Grimes and MLM Compliance was, upon information and belief, a check rushed to and [e]ndorsed by Kevin D. Grimes for $342,510, which posted on August 13, 2012, less than a week prior to ZeekRewards’ shutdown.”

The course, Bell alleged, served as “window dressing” for the Zeek fraud.

By April 2015, Bell and the defendants had entered settlement talks through mediation, according to court filings. In late May, there was news of a definitive settlement agreement. The sum was not immediately known.

On June 2, the sum became known: $1.175 million. How the figure was arrived at was not immediately clear. The number, however, appears to absorb the entire $843,000 Grimes and MLM Compliance allegedly received through sales of the compliance course alleged to be bogus. It also appears to erase virtually all of the $342,510 Grimes and MLM Compliance allegedly received via a “rushed” check in Zeek’s closing days and hours.

As part of the settlement agreement docketed June 3, Grimes and the other defendants “do not admit to any wrongdoing or liability to the Receiver and the Receiver does not admit that the Defendants should be exonerated from liability for the wrongdoing alleged by the Receiver in the Grimes lawsuit.”

Senior U.S. District Judge Graham C. Mullen of the Western District of North Carolina has approved the settlement.

The parties specified in the settlement that they wished to enter the agreement “for the purposes of resolving these disputed matters and to avoid the cost and expense of litigation.” All parties will bear their own attorneys’ fees and costs.

Mullen ruled that the settlement was “in the best interest of the Zeek victims.”

NOTE: Our thanks to the ASD Updates Blog.