URGENT >> BULLETIN >> MOVING: (3RD UPDATE 8:44 P.M. EDT U.S.A.) Senior U.S. District Judge Graham C. Mullen has denied a motion by alleged winners in Zeek Rewards to intervene in the SEC’s Ponzi-scheme case and to dissolve the receivership.

URGENT >> BULLETIN >> MOVING: (3RD UPDATE 8:44 P.M. EDT U.S.A.) Senior U.S. District Judge Graham C. Mullen has denied a motion by alleged winners in Zeek Rewards to intervene in the SEC’s Ponzi-scheme case and to dissolve the receivership.

In December 2012, alleged Zeek “winners” Trudy Gilmond and Kellie King asked Mullen for permission to intervene in the case and to end the court-appointed receivership, arguing that Zeek did not sell securities as defined under federal law.

Mullen today denied the motion on both fronts.

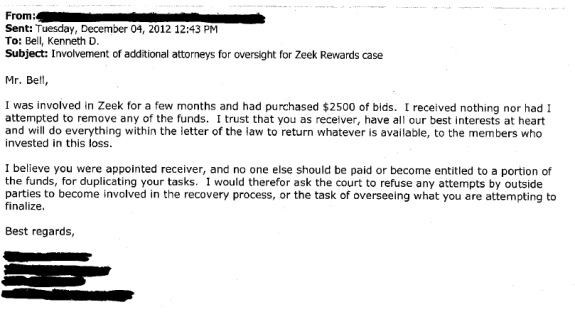

Kenneth D. Bell is the receiver. He opposed the Gilmond/King motion. So did the SEC, which described Zeek in August 2012 as a $600 million Ponzi- and pyramid fraud selling unregistered securities through Rex Venture Group LLC in North Carolina.

Gilmond may have more than $1.364 million at risk in a clawback lawsuit. King potentially faces a claim from Bell for more than $205,180, according to court filings.

“Gilmond and King seek to improperly interfere with a settled SEC enforcement action against defendants Rex Venture Group and Paul Burks to deny the Receiver the ability, as directed by the Court, to marshal the estate’s assets for the benefit of all aggrieved ZeekRewards investors,” the SEC argued in January. “The Motion to Intervene is a transparent attempt to obtain prospective relief in an improper forum with respect to clawback litigation the Receiver has yet to initiate.”

For his part, Bell said Gilmond and King were engaging in “delaying tactics.”

Gilmond and King are represented by Ira Lee Sorkin, Bernard Madoff’s defense attorney.

“The issue Gilmond and King seek to litigate — whether the ZeekRewards program was an ‘investment contract’ or ‘security’ — has been resolved for the purposes of this settled SEC enforcement action,” the SEC argued in January. “As a result, Proposed Intervenors assert no ‘claim or defense that shares with the main action a common question of law or fact.’ Thus, there is no basis for intervention.

“Finally,” the SEC continued, “Proposed Intervenors provide no factual or legal support for their request to dissolve the receivership in this matter. Therefore, the Motion to Intervene should be denied in its entirety.”

Mullen did just that today.

Zeek operator Paul R. Burks consented to a judgment in the SEC case in August 2012.

NOTE: Thanks to the ASDUpdates Blog.