We will still be able to create membership accounts, but you will not be able to buy, sell, or trade Utokens until February 8, 2015.”

“Many investors gave cash to the company and to their leaders (or upline sponsors) who then deposited the cash along with other investor funds.” (Click here to read “WCM777: More Theft And Money Laundering MLM-Style.”)

Back in 2010, something similar happened in the deeply disturbing Imperia Invest IBC scam that appears to have operated offshore and definitely targeted people with hearing impairments. The SEC first charged Imperia and, in 2011, charged alleged pitchman Jody Dunn. Millions of dollars went missing.

Dunn may not have learned his lesson. His name later appeared as an alleged “winner” in Zeek Rewards, yet another cross-border MLM/network-marketing debacle. Zeek, operating from the United States, allegedly plucked $897 million. Some of the money allegedly ended up in places such as Moldova, the Cook Islands and the Turks and Caicos.

Moving forward to the 2014 TelexFree scheme taken down by the SEC and the U.S. Department of Homeland Security, what do we see? Well, allegations that TelexFree, too, had created conditions under which promoters were collecting money for the scheme and effectively becoming money mules.

TelexFree may have gathered $1.8 BILLION — yes, billion with a “b.”

Welcome to the black markets of MLM/network marketing. The schemes may feature in-house transfer vessels in which participants can transfer money or cash-earning investment points to other members in underground fashion. Promoters also can do back-alley deals with recruits, opening up second and subsequent black-market tiers.

BehindMLM.com reported yesterday that INTERPOL was about to become involved in the cross-border investigation into UFunClub/UToken that originated in Thailand. If it happens, it’s an encouraging sign.

UFunClub/UToken may have plucked more than $1.17 BILLION.

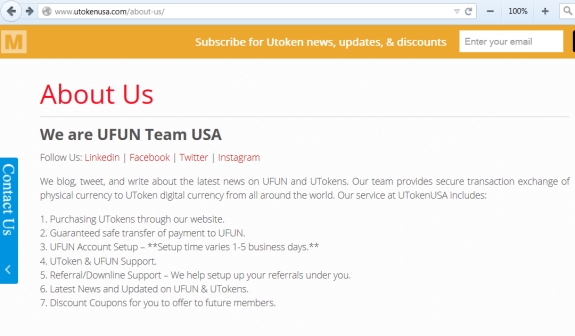

Separately, the PP Blog learned yesterday that a UFunClub/UToken promoters’ group known as UFUN Team USA had published a promo that claimed this (italics/bolding added):

We blog, tweet, and write about the latest news on UFUN and UTokens. Our team provides secure transaction exchange of physical currency to UToken digital currency from all around the world. Our service at UTokenUSA includes:

1. Purchasing UTokens through our website.

2. Guaranteed safe transfer of payment to UFUN.

3. UFUN Account Setup – **Setup time varies 1-5 business days.**

4. UToken & UFUN Support.

5. Referral/Downline Support – We help setup up your referrals under you.

6. Latest News and Updated on UFUN & UTokens.

7. Discount Coupons for you to offer to future members.

This leads to questions about whether an unlicensed Money Services Business was gathering funds for another unlicensed Money Services Business. UToken promoters claim the value of the purported digital currency only can rise and never can fall.

The UFUN Team USA site published a phone number with the 323 Area Code in Greater Los Angeles. That’s the same area from which WCM777 was operating.

Like any number of schemes, UFunClub/UToken has been positioned as a “passive” investment opportunity that already has created anywhere from 200 “millionaires” to 5,000, depending on the source of the claims.

This brings questions about an offering fraud and the sale of unregistered securities into play. The same sorts of questions existed with WCM777, Imperia, Zeek and TelexFree.

As the screen shot below taken from a YouTube promo shows, UFunClub/UToken did an in-house announcement about the “THE CONVERSION OF TRADABLE UTOKEN TO INVESTMENT POINTS” — apparently on Jan. 31.

Some American MLMers/network marketers have claimed they traveled from the United States to Thailand to vet UFunClub/UToken and found the “program” to be legitimate.

The Thai police say the “program” is an international fraud scheme.