Because we’re writing about the uber-bizarre HYIP wing of MLM/direct sales, we’ll emphasize at the beginning of this story that the WCM777’s receiver’s recommendation to a federal judge to disallow nearly 85 percent of filed claims DOES NOT MEAN she gets to pocket the money from the disallowed claims.

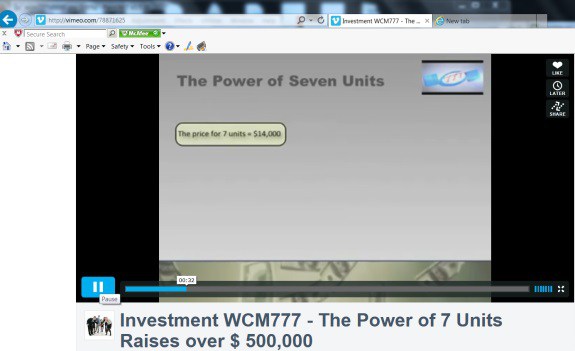

HYIP hucksters are infamous for recklessly accusing receivers of misdeeds and even felonies, never mind that the “program” in receivership was a train-wreck-waiting-to-happen because the advertised payouts were preposterously large or unusually consistent (or both) to such an extent that even Bernard Madoff would laugh out loud. (See graphic below of an ad for WCM777.)

Sometimes the accusations are preemptive, with ad hominem attacks thrown in for good measure. That’s what’s going on now on the sidelines of the Traffic Monsoon scheme. The receiver there is being called “Piggy” and “b***h” and “Lying cow.” (We’re noting this near the top in part because both receivers happen to be women and because both hired Epiq, a global provider of integrated technology and services for the legal profession, to assist with receivership chores. Conspiracy theories almost certainly will follow.)

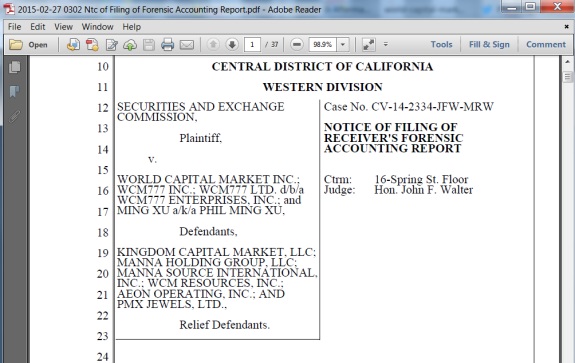

But back to the main point of this column: Krista L. Freitag, the WCM777 receiver, recommended that U.S. District Judge John F. Walter of the Central District of California disallow a whopping 84.6 percent of the claims. This was not done out of meanness — in fact, it was done to preserve funds for people whose claims could be legitimized. Court submissions by Freitag show that she tested claims in multiple ways to provide a real-world means by which fleeced investors in this fantastic scheme targeted at Christians would have the best chance to file an approved claim.

Just how fantastic was WCM777? As chronicled by the PP Blog prior to the SEC’s 2014 action, one affiliate’s ad claimed $14,000 sent to the scheme would fetch back $500,000, 35 times-plus the initial outlay. In HYIP Ponzi Land, this memorably was called “The Power of Seven Units.”)

Here is some of the WCM777 claims math, as presented by Freitag to Walter:

- Total number of claimed investments: 72,753.

- Claims that should be allowed: 4,018 (5.6 percent of the total claimed investments).

- Claims that should be partially allowed: 7,159 (9.8 percent of total claimed investments).

- Claims that should be disallowed (includes Disallowed portion of Partially Allowed): 61,576 (84.6 percent of total claimed investments).

It’s easy enough here to suggest that one remedy disallowed claimants who are legitimate victims should consider is suing their sponsor, sometimes known as the upline. Freitag doesn’t specifically mention this, but she informed Walter that a “very large amount of investors” paid their “leaders” or others, instead of paying WCM777 directly.

Some of those “leaders” and others “perpetrated their own side scheme,” Freitag informed the judge.

This skulduggery happens in scheme after scheme. Regardless, some investors may be reluctant to identify their “leaders” or others because it very well could be a spouse, family member or friend. Beyond that, many of the transactions involve cash. Freitag points out that many individuals who filed claims “did not/could not provide bank record documentation to support their claim.”

Thousands of WCM777 claimants also may have tried to game the system. Freitag told Walter that a “high number of suspicious claims” were received. “Notably” among them were “approximately 27,000 claims” submitted “immediately before” the Dec. 24, 2015 claims deadline.

Schemes such as WCM777 also create the MLM equivalent of money mules — people who accidentally or purposely end up gathering money for a scam. Freitag told Walter that “[t]his scheme involved countless ways in which investors purportedly transferred funds, much of which went to leaders or other individuals and may or may not have ever reached the Receivership Entities.”

All in all, Freitag informed Walter, claims seeking more than $412 million were filed, and yet “the net loss transacted at the defendant entity level was $80.8 million.” This again shows how hard it may be for people who pay their upline to gain even a partial recovery from a scam. At the same time, it may suggest that any number of participants tried to claim losses beyond their initial outlays, perhaps attempting to recover lost profits or even fictitious ones.

Schemes such as WCM777 are always rancid and always include elements of magical thinking.

The receivership estate is in possession of about $27 million. Freitag is proposing distributing about $21 million to approved claimants in an initial disbursement, with the balance of the allowed claims paid in a second or subsequent distribution in the future. Some holdback is required because more work needs to be done, according to the motion.

From the receiver (italics added):

Although it is possible that claims of some investors who gave cash to another investor and therefore are unable to substantiate their claims will be disallowed, there is no reliable and consistent way to differentiate such investors from people who transferred funds to a leader operating a side scheme or people asserting bogus or duplicative claims. The huge volume of cash transactions, including those amongst individuals, and the lack of investor bank record support means the claims review and analysis cannot be perfect. The scheme itself was wildly disorganized, with numerous individuals paying cash to other (and oftentimes unknown) individuals . . . and leaders propagating their own scheme of sorts (selling points for their own profit such that “investors” paid money to individuals who never forwarded said funds to the defendant entities), making the claims review process extremely challenging. That said substantial effort has been made to make the system as fair and inclusive as possible. The Receiver has not only attempted to match each sufficiently supported claim to a deposit, but has also conducted supplemental testing to try and match unclaimed deposits to unsupported and unidentified claims. This was successful in many instances and reduced the number of real investors whose claims may be disallowed.

Read the receiver’s motion, which includes information on the supplemental testing in the interest of fairness to all investors.