HYIP or autosurf Ponzi promoter? Player? Forum “expert?” Moderator? Cheerleader?

Get ready for a surprise: Your downline perhaps already has identified you as a pimp or even one of the masterminds.

If your plan is to continue to promote the programs on the Ponzi forums and though emails, you should know that things could be occurring behind the scenes that could put you four-square at the center of investigations. Not all HYIP and autosurf players are crooked. Not all of them understand the wink-nod nature of the HYIP and autosurf trades. In other words, they aren’t a crook or pimp like you and can’t be relied upon not to implicate you. They aren’t playing your game.

You, on the other hand, are a veteran pusher of Ponzi poison and perhaps a tax schemer who recommended yet another pig and painted it yet again with lipstick. Your victims very well may come to see themselves as your marks, as their knowledge of this shadowy and insidious business grows. Some of them will talk. Some of them have talked.

It’s now clear from court filings that some of them even are making handwritten notes and/or printing out emails and forum conversations — even if the forums purportedly are “private.”

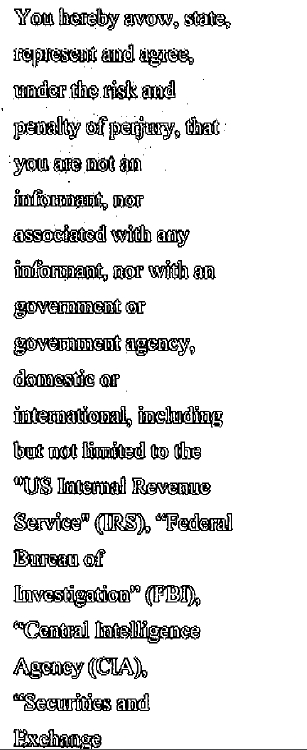

And, speaking of “private,” how crazy are you going to look — and how vulnerable to prosecution are you going to be — if you happen to be pitching a purported “offshore” program that requires a loyalty oath and forces members to swear they aren’t government informants or agents?

Just agreeing to such bizarre terms potentially makes you a co-conspirator.

Here’s how silly you could end up looking later as you try to impress forum mates today with your “insider” knowledge and claims of due diligence. The reality you cannot deny is that an undercover investigation already could be under way into the program you’re pushing.

While you’re singing the praises of a company and talking about its purported expert management, you could be revealing yourself as just another willfully blind pimp while demonstrating your actual lack of knowledge about the programs you’re pushing.

Have you connected the dots yet? If not, here they are — in a nutshell: Your lack of knowledge can be construed as evidence of your guilt. You’re pushing programs you know virtually nothing about except what you’ve been told by people who rely on you to be the human equivalent of a trained seal who performs for a treat. You are not registered to sell securities, and you very likely are implicating yourself in a criminal wire-fraud, money-laundering and tax-evasion scheme.

There you are, pitching a program, professing your knowledge while perhaps even dissing the doubters, and you don’t even know the program you’re cheering already is the subject of an undercover investigation.

There’s a good chance the boss knows, though. He perhaps is in a secret panic. If word of the depths of the investigation leaks or the names of the agencies leak, well, the money stops streaming in. Maybe he didn’t tell you because he was too busy trying to figure out how to make it all go away when money was being seized in other investigations — and those seizures were leading to the choking of cash conduits for the programs you are pushing while purporting to be an expert.

Paperwork later could reveal you weren’t an insider at all (or at least not enough of one actually to have the ear of the boss), that you were just another commission-grubbing or “earnings”-hungry liar in a sea of commission-grubbing and earnings-hungry liars. You’d say anything for a commission, which is why you’re now the potential target of a criminal prosecution and an accompanying lawsuit filed by victims. You have criminal and civil exposure. At the very least, you could become an unindicted co-conspirator, which means the government holds the hammer and sees you as a potentially useful witness.

You never imagined yourself singing for your supper, of course. You were too busy picking the pockets of friends, neighbors and people you didn’t even know. If you get a break and become an unindicted co-conspirator, here’s what the jury will think as you’re singing for your supper: trained seal. Performed on cue for the schemers. Now batting the government’s ball to stay out of prison.

Jurors contemplating how you got yourself in this box actually will be willing to give an actual trained seal more credit. Seals perform for treats because they don’t know any better; you performed for money and did know better — and you likely knew the money was stolen to begin with.

Indeed, the marks who relied on your misrepresentations and claims of “due diligence” and other purported research could be maintaining a substantial paper trail. After all, it’s their money, and they want to make sure it’s safe. They’ve relied on your assertions. They’ll hold your feet to the fire when things start to go south, they’ll hold you to your claims and perhaps share your name, forum username and phone number with law enforcement.

What Willfully Blind Promoters Can Learn From The Legisi Case

Did you know that the U.S. Secret Service and the Michigan Office of Financial and Insurance Regulation (OFIR) sent undercover agents to interview Gregory McKnight, operator of the alleged Legisi Ponzi scheme, in May 2007, a full year before knowledge about the depths of an SEC investigation became public? Some Legisi members later learned the SEC was asking questions, but the inquiry was dismissed as routine. The SEC says Legisi continued to collect money up to November 2007, months after McKnight got the surprise of his life when he realized that two men with whom he had conversed actually were undercover agents.

It is likely that very few Legisi members knew that the Secret Service and OFIR had infiltrated Legisi in May 2007. Undercover agents walked right through the front door, according to court filings.

And did you know that the undercover agents were backed up by a Michigan state trooper who was only a short distance away — outside in the parking lot?

How silly do you think your forum posts, your cheerleading look now? You were championing a program that already was under investigation by at least three agencies that were in the process of sharing information and assembling a time-consuming case that crossed international borders. The public filings were 12 months away.

These are among many details about the probe, the paperwork for which originally was filed under seal by the SEC in May 2008. The Secret Service and OFIR agents posed as investors who wanted information on the Legisi program, which the SEC said was a massive Ponzi scheme. They recorded their discussion with McKnight, which took place in Legisi’s office in Flint, Mich. The Secret Service prepared a transcript of the conversation, which the SEC presented to a federal judge as part of 267 pages of exhibits used to gain an asset freeze.

After the undercover agents met with McKnight, they left the building and met with the trooper in the parking lot. A short time later, the agents — this time accompanied by the trooper — went back inside and presented their identification to McKnight, according to court documents.

Here’s what happened next, according to the SEC:

“Within hours of the interview, an announcement appeared on the Legisi website stating that the Legisi program was closed to new investors, effective immediately, and representing that Legisi had to close that afternoon because of a ‘massive influx’ of new investors.

“McKnight also cut off access to the Legisi website by the public by requiring a login and password to enter the site,” the SEC said.

After McKnight found out he had been talking to undercover agents, he told them that Legisi did not accept checks for the program. Even as the interview was taking place, an unnamed individual approached the office with a check made out to Legisi Marketing Inc., according to court filings.

It has become clear that law enforcement is using multiple tools, including undercover operatives, infiltrations, Internet archives and notes kept by victims, to investigate and then prosecute HYIPs and autosurfs. Records viewed by the PP Blog show that the law-enforcement community is making one tie after another between and among various illegal investment businesses and their participants.

The common signatures of the promoters of these illegal enterprises are greed and wanton lawlessness — all so the scammers can enjoy the proceeds of theft. This work has not generated headlines; it mostly has gone about quietly, but there simply no longer is any doubt that multiple state and federal agencies have pooled resources and talents to destroy these insidious enterprises and a day of reckoning is at hand for the purveyors.

As the screen shot on the left shows, Legisi participants even were asked to certify that they weren’t “informants” or representatives of agencies such as the SEC, FBI, and IRS.

Last week the PP Blog wrote about the fraud case filed by the SEC against Mazu.com operator Matt Gagnon, Gagnon was accused of helping Legisi pull off a $72 million Ponzi scheme affecting more than 3,000 investors by using Mazu to shill for Legisi while not disclosing that “he was to receive 50% of Legisi’s purported ‘profits’ under his agreement” with McKnight.

Gagnon allegedly netted about $3.8 million in the scheme.

The filing of the complaint against Gagnon prompted the Blog to perform some more research into Legisi. Among the documents we obtained was the 267-page exhibit of evidence originally filed under seal by the SEC in the case against Legisi on May 5, 2008.

Prior to reading the document, we had wondered just how effective companies that purported to offer “private” HYIP and autosurf programs could be. For example, could these so-called “private” programs keep out what some investors describe as the prying eyes of government and the tax man?

If such purportedly programs offered a “private,” members’-only forum, could those forums have any expectation that the prying eyes of government and the tax man could be kept out?

“Private” is one of the big selling points of some HYIPs and autosurfs. We’ve always viewed the claims as dubious. After all, the schemes operate on the Internet. They involve people. People talk. It’s one thing to say you offer a “private” forum; it’s quite another to contain discussion to a single forum, perhaps especially when participants begin to smell a rat.

We learned this in a big way when we were covering events surrounding the collapse of the AdViewGlobal (AVG) autosurf last year. When some members finally removed their blinders, AVG had no way to contain discussion to its purportedly “private” forum — not that it should have had any expectation that it could contain discussion even if things were going swimmingly.

When AVG started to tank, some of its members couldn’t wait to share details about events that occurred in the “private” forum. Threats against them for purported copyright violations and to ban IPs and kick members out of the program for sharing information outside “association” walls did not work. In fact, they became the signatures of a scam in progress and the relentless efforts to hide it.

But getting back to Legisi and the issue of whether a “private” forum provided any protection for members and any insulation from the prosecution of Legisi . . .

It turns out that the government did not even have to “break in” to Legisi’s “private” forum, so to speak, to gain information on the program. Legisi members concerned about losing their money were keeping notes, including handwritten notes, and printing out page after page of posts from the “private” forum and Legisi’s own website.

Legisi members bothered by the company’s explanations and efforts to maintain secrecy when dealing with investors’ money turned over the information to the SEC.

Yep. Avatars, pictures, user names, real names and all.

Prior to filing its case against Legisi, the SEC also had other hard-copy printouts from members, including emails and information from Legisi members’ back offices. At least one of the exhibits included the handwritten notes of a Legisi member.

The words “Money Maker Group.com” are spelled out in longhand on one of the exhibits, as are telephone numbers of individuals associated with the program. One of the numbers has the name “Matt Gagnon” spelled out in longhand above it.

Still promoting HYIPs and autosurfs? Still shilling in forums public and “private?”

Your day of reckoning could be drawing near.