Back in April, federal prosecutors described the purported OneX “program” as a “fraudulent scheme” and “pyramid” pushed by former AdSurfDaily President Andy Bowdoin, the author of the $110 million ASD Ponzi scheme.

Bowdoin, 77, now is jailed in the District of Columbia — in part because of his OneX pitches. He’d initially been free of bond while awaiting his criminal trial in September 2012 on charges of wire fraud, securities fraud and selling unregistered securities in the ASD Ponzi case. Bowdoin was arrested by the U.S. Secret Service in December 2010.

The ASD patriarch pleaded guilty in May to wire fraud in the ASD Ponzi case, acknowledging that ASD was a Ponzi scheme and never operated lawfully from its 2006 inception. Bowdoin remained free after his guilty plea. But a federal judge ordered him jailed in June — pending an August 2012 sentencing date — after prosecutors linked Bowdoin both to OneX and a scam known as AdViewGlobal.

Bowdoin, according to prosecutors, chose to continue to commit crimes — even after the August 2008 seizure by the U.S. Secret Service of $65.8 million in his 10 personal bank accounts at Bank of America and even after he was arrested on Ponzi charges. In October 2011, Bowdoin told OneX conference-call listeners that they could make $99,000 very quickly and that he intended to use his profits from OneX to pay for his criminal defense in his ASD-related Ponzi scheme trial.

College students were excellent prospects for OneX, Bowdoin ventured.

Much remains murky about OneX, including the identity of its purported operator and precisely where the company operates from. A male referred to as “J.C.” presides over OneX conference calls, which occasionally continue to be held despite prosecutors’ assertions against the firm in April. “J.C.” has described himself as a “consultant,” even though he apparently is empowered to make financial decisions for the murky enterprise.

OneX has announced it no longer is using SolidTustPay, the Canadian payment processor linked to one HYIP fraud scheme after another.

But “J.C.” announced during a OneX conference call this week that the “program” was switching to I-Payout, according to a source.

“J.C.” made the I-Payout announcement on July 17, the same day the U.S. Senate Permanent Subcommittee on Investigations was grilling HSBC executives, including one who announced his resignation in front of the panel.

Part of the presentation by “J.C.” in the conference call included the presentation of a screen shot that showed I-Payout’s name in the back offices of OneX members who’d been wondering if and when the company would find a substitute for SolidTrustPay, according to a source.

It is unclear if OneX has an actual account at I-Payout. What is clear is that it is encouraging members to register for I-Payout accounts, only three months after prosecutors described OneX as a scam that was recycling money to members in ASD-like fashion.

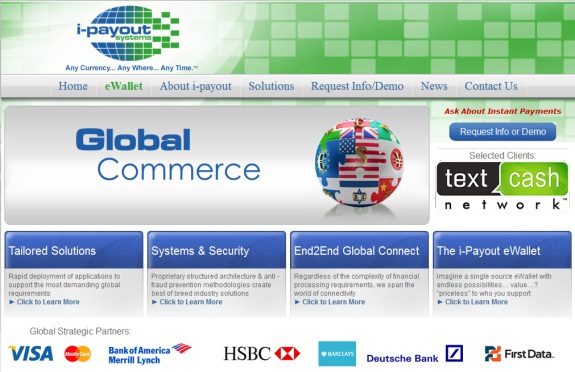

Among the clients I-Payout touts on its website is TextCashNetwork. (See Feb. 14, 2012, PP Blog story on TextCashNetwork.)

I-Payout’s website publishes the logos of HSBC, Deutsche Bank, Bank of America, Barclays and other “Global Strategic Partners.”

Bloomberg/Businessweek is reporting this morning that HSBC and Deutsche Bank employees are under investigation for alleged manipulation of the LIBOR interest rate in a growing scandal that also involves Barclays and other major financial institutions.