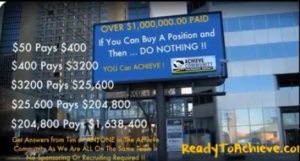

UPDATED 11:39 A.M. ET DEC. 12 U.S.A. In its latest effort to expand its reality-distortion field, “The Achieve Community” money-cycling “program” that tells prospects a $50 “position” increases by a factor of eight and turns into $400 in a few months (or even in as few as 55 days) has compared itself to The Walt Disney Co.

Achieve represents both a “micro” and a “macro” scheme. Although participants can buy a single “position” for $50, they also can buy multiple “positions” for hundreds or even thousands of dollars, according to promos. At least one promo contends that 200 “positions” can be purchased 100 at a time in two separate transactions of $5,000 each. If this proves to be the case either in the past or in the future, the crime of structuring transactions to evade bank-reporting requirements could be on the table.

Structuring is an element in the prosecution of figures associated with the eAdGear network-marketing “program” shut down by the SEC in September. Allegations of structuring also appear in civil filings by the Massachusetts Securities Division against TelexFree network-marketing figures in April. TelexFree now is in bankruptcy court, with prosecutors calling it a massive Ponzi- and pyramid scheme.

The specific Achieve Community analogy noted in the headline and lede above is to Walt Disney World Resort in Lake Buena Vista, Fla. Even more specifically, it is to the rides at Disney World and the purported “hours” it takes to board one of them.

From a Dec. 8 “Monday Night Update” post on the Achieve Community Blog credited to co-founder Kristi Johnson (italics added):

I want to explain a bit more about how we work for the benefit of those new members . . . and thanks goes to Sheila once again for this wonderful analogy.

Think of Achieve as a ride at Disney World. You get in line for the ride and it can takes [sic] hours! But it’s always moving, just like our matrix. And finally you get to the ride (the matrix) and it’s over in a few minutes! It may take a few months to hit our matrix, and once you get there you’ll be paid within days on all three levels. Then you can take the ride again!

Here’s our initial take on the claims:

-

From a YouTube promo for Achieve Community. If you submit to this bollocks and think of Achieve as a ride at Disney World, you’re as out of touch as the Achieve organizers and some of their professional hucksters want you to be. Wake. Up. Now.

- If you choose to remain in a network-marketing-induced Stepfordian trance, expect that a sudden desire to embrace every conspiracy theory under the sun will come next. If that happens, you’d better hope the BBC’s “Sunday Politics” program hosted by Andrew Neil never gives you the Alex Jones treatment.

- You also might starting hearing, “Kenneth, what is the frequency?”

- Lines indeed can be long at Disney World. (But there’s a free app for that.)

- Disney doesn’t sell $50 cycler tickets and tell parents and starry-eyed kids that those tickets pay not only for the ride, but also will convert to $400 cash before fall takes over from summer. And Disney also doesn’t encourage parents and kids waiting in lines to plunk down another $50 (or more) as a means of fetching another $400 (or more) before winter takes over from fall. Moreover, unlike Achieve, Disney does not operate a cycler. The New York Stock Exchange would go apoplectic if Disney or its fans took to the web to claim purchases and repurchases of “positions” set the stage for $50 to morph into more than $1.6 million.

- If Disney did what Achieve is doing, its operating revenue of nearly $49 billion in 2014 would translate into a liability of nearly $392 billion, creeping up on a hole of almost half-a-trillion dollars.

- As a great American company, Disney wouldn’t dare do what Achieve Community is doing — for the same reasons Google wouldn’t do what the AdSurfDaily “advertising” scam was doing in 2008 and eBay wouldn’t do what the Zeek Rewards “auction” scam was doing in 2012.

Cyclers such as the one operated by Achieve Community are among the Internet’s oldest forms of the Ponzi scheme. Because the fraud is so old — and because cycler carcasses litter cyberspace — cyclers have sought new and better ways to dupe the public. Internal mechanics and entry points may vary from $10 to hundreds of dollars. Recruiting may or may not be required, and there may be talk of “algorithms” or “secret algorithms.” Achieve purportedly has a proprietary “triple algorithm.”

Ever hear of the Regenesis 2×2 matrix-cycler scam in 2009? The U.S. Secret Service did — and kept a Dumpster under surveillance to gather evidence. Material seized in the case, according to court records, included envelopes containing credit cards, debit cards and financial statements; 13 Priority Mail envelopes and 10 First Class Mail envelopes; and various computers, computer equipment and business records.

Federal agents investigating now-shuttered Regenesis said they found the personal financial records of customers in the Dumpster, plus complaint faxes sent by customers and a letter from a law firm complaining about false, misleading and deceptive advertising.

As is the case now with Achieve Community, Regenesis promoters took to the web with reports of getting paid. Getting paid, however, is not proof that no scam exists. In 2010, promoters of the MPB Today cycler scam took to the web with “payment proofs” that were even crisper than the Regenesis “proofs.”

MPB Today operator Gary Calhoun later was sentenced to a term in a Florida state prison.

In HYIP Cycler Land, the much ballyhooed matrices move only when new money flows to a scheme, assuming the matrices even exist and further assuming an early entrant (or even a later one) doesn’t try to blackmail an operator by mixing a threat to go to the police with a demand for hush money or a selective payout.

Is it any wonder that Vimeo has banned “videos pertaining to multi-level marketing (MLM), affiliate programs, get-rich-quick schemes, cash gifting, work-from-home gigs, or similar ventures?” Also not permitted on Vimeo are “rips of movies, music, television, or any other third party copyrighted material.”

Members of WCM777, a network-marketing “program” taken down by the SEC earlier this year after money was channeled to all kinds of secret businesses, found ways to work images of Sylvester Stallone and the music and imagery of the “Rocky” franchise into their scam. In 2010, promoters of the MPB Today “program” wrapped the music of Heart into their sales appeals. “Guaranteed No Scam,” one promo read in part.

This could in part explain why Vimeo appears to return no search results for “The Achieve Community.” It’s heartening, but the great MLM/network-marketing ripoffs on YouTube continue — from pitches for obvious scams to piracy of music and video content. At least one promo for Achieve Community appropriates virtually the entire soundtrack of a recording of “You Raise Me Up” by Celtic Woman.

And, hell, why not make a commercial for Achieve Community at an ATM provided by an FDIC-insured bank to sanitize your scam?

In 2011, a now-missing cycler known as AutoXTen came out of the gate with a message of “Turn $10 into $199,240.” The purported opportunity was appropriate for “churches,” according to a sales pitch. AutoXTen debuted even as the state of Oregon was investigating a cycler and ordering sanctions totaling $345,000 against a pitchman. That “program” was known as “InC,” for “I need cash.”

Is Traditional MLM Fighting Back?

Though he doesn’t reference Achieve Community in a video posted Nov. 29 on YouTube, network-marketing veteran Eric Worre of NetworkMarketingPro.com laments all the “lazy . . . MLM online idiots in the marketplace.”

“There’s too many, and it’s causing too much damage,” Worre says, noting the MLM ban at Vimeo and “boorish stuff” from MLMers “on any of the [social media] platforms.”

“It’s out of control. It doesn’t work, and it’s causing tremendous damage,” Worre says.

Nine days later came the preposterous Achieve Community analogy to Disney — this after Achieve reportedly had lost its original payment processor but went scouting for new ones, plus an offshore company to process credit cards. Purchasing and repurchasing of “positions” reportedly opened back up last week with a new card processor at the helm, but payouts to participants reportedly have not resumed.

Not to worry, Achieve Community says.

“When our Payout Processor is added next week,” the enterprise said Dec. 5 in a Blog post titled Friday Update, “we will be paying members who joined September 12th and will start paying out nearly $500,000.00 to our members.”

If those payouts materialize, they will come after a payout halt of more than a month and after Achieve Community apparently found an offshore company to provide a merchant account that permitted it to take credit cards for the acquisition of matrix “positions.” In other words, Achieve started collecting “new” money and now publicly announces a plan to pay “old” members who were due to be paid in early November for “positions” taken out on Sept. 12.

That, friends, is what Ponzi schemes do. More than that, it’s an indicator that Achieve was racking up a liability of $400 for every $50 it took in and was at least technically insolvent when Payoneer — its previous payment processor — reportedly pulled out weeks ago. Solving an insolvency condition by lining up new vendors to rekindle cashflow is one of the oldest tricks in the HYIP Ponzi books.

The Achieve Community Disney analogy makes no sense at all — except perhaps in that uber-bizarre, network-marketing way.

That the Disney comparison came on a Monday night is particularly rich. That’s because ESPN, part of the Disney Media Group, was getting ready to televise Monday Night Football. Even as ESPN was doing that, other Disney brands such as ABC (and ABC News) were broadcasting to the world. At the same time, the Walt Disney Studios was engaged in movie production, and Disney Consumer Products and Disney Interactive were doing what they do.

With Achieve, it’s only the upstart cycler and the hidden matrix positioned to be miraculous. What a racket!

Disney stock closed yesterday at $93.80, up a humble 4 cents. The iconic brand is a Dow and S&P 500 component, but it’s easy enough to imagine the Achievers saying, “Four cents! Only 4 cents! Better join Achieve!”

Did we mention the app for those Disney World lines?