EDITOR’S NOTE: For background, see Feb. 17 PP Blog story: RECEIVER: Payza And Payment World ‘Facilitated’ Zeek Ponzi Scheme; Whereabouts Of $13.1 Million An ‘Open Question’

(Updated 11:14 a.m. ET U.S.A.) Money due victims of Zeek Rewards from transactions involving Payza and Payment World may have been transferred from VictoriaBank in Moldova to JSC TusarBank in Russia in violation of an asset freeze imposed in 2012 by a U.S. court, according to court filings by Zeek receiver Kenneth D. Bell.

Meanwhile, OboPay’s name now has surfaced in filings by Bell. This is in the form of an October 2012 email from a Payment World official to a Payza official questioning Payza’s relationship with OboPay. The U.S. Justice Department last year announced a criminal investigation involving Payza and OboPay. The specific reason behind the probe and the targets are unknown.

TusarBank collapsed in September 2015 and has been recommended for criminal investigation, according to the press office of Russia’s central bank. The bank’s website is beaming a “not available now” message.

Senior U.S. District Judge Graham C. Mullen of the Western District of North Carolina last week lifted the seal on Bell’s 258-page filing in which Bell alleged Payza, Payment World and VictoriaBank enabled Zeek’s Ponzi scheme shut down by the SEC in 2012. The filing consisted of a 26-page motion and 232 pages of exhibits, including emails between Payza and Payment World. As noted above, one of the exhibits raises the name of OboPay.

Mullen imposed the asset freeze in August 2012.

Whether the possible transfer of Zeek-related funds from Moldova to Russia is part of the Russian probe is unclear.

Adding to the international intrigue is that a second Russian bank that somehow might have been involved in the Payment World-related money flow reportedly collapsed in 2013. This institution is known as Master Bank and is described in Bell’s exhibits as a “sponsoring bank” of a Payment World entity in Hong Kong.

A sponsoring bank provides processors access to Visa or MasterCard networks

On Sept. 13, 2015, just prior to the collapse of TusarBank, the Moscow Times listed Master Bank as one of “Russia’s Biggest Banking Crashes of the Last 2 Years.” This crash occurred in 2013 and was notable for something beyond the 31.3-billion-ruble bailout.

As the Moscow Times reported (italics added):

Even having Igor Putin, a cousin of President Vladimir Putin, on the board of directors could not save Master Bank. The lender’s license was revoked in November 2013 with the Central Bank alleging the bank had violated money laundering legislation and processed large suspicious transactions.

In 2012, just prior to the collapse of Zeek, Zeek figure Keith Laggos claimed he had helped Zeek move payment operations offshore, including to Hong Kong. Specific details of that asserted move are unknown. Zeek had about 15 financial vendors, according to court filings.

Payza, under the leadership of Firoz Patel, has claimed it conducted due diligence on Zeek, according to Bell’s filings. Even if true, it somehow appears to have missed that Zeek was offering an outrageous and unusually consistent return averaging about 1.5 percent a day and also claimed “compounding” was possible.

The SEC has described Zeek as a cross-border Ponzi scheme that gathered nearly $900 million while operating from North Carolina.

From Bell’s filing (italics added):

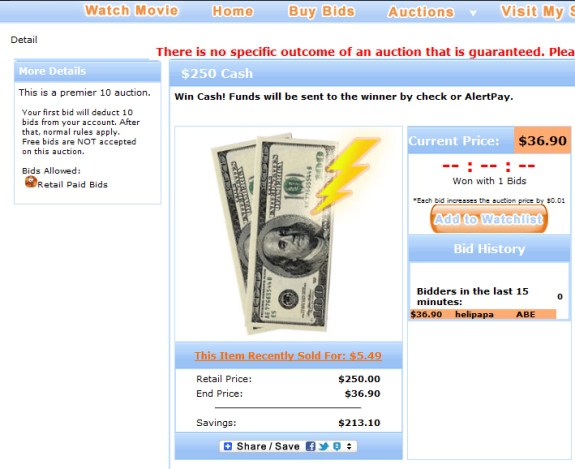

On August 29, 2010, Paul Burks [of Zeek] onboarded an account with Payza (then, known as AlertPay) in the name of Rex Venture Group LLC that was associated with two websites: www.zeekrewards.com and www.zeekler.com. Prior to the boarding of the account, Payza purportedly conducted due diligence, collecting and reviewing information about Paul Burks and the business. According to Payza, during the course of the relationship, it monitored and mitigated risk. Despite these procedures, Payza did not identify or address the red flags indicating that ZeekRewards was a Ponzi scheme and, instead, together with PaymentWorld and VictoriaBank [of Moldova], facilitated access and payment to and from ZeekRewards by numerous affiliates worldwide.

Bell’s 258-page filing is available on the landing page of the receivership website. It is styled, “Memorandum in Support of the Receiver’s Motion for an Order Directing Payza, Payment World, and VictoriaBank to Turn Over Receivership Assets and/or Find Them in Contempt of the Court’s Order Freezing and Preserving Receivership Assets.”

NOTE: Our thanks to the ASD Updates Blog.