URGENT >> BULLETIN >> MOVING: (16th update 5:42 p.m. EDT U.S.A.) The SEC has gone to federal court in Los Angeles, alleging that the WCM777 “program” is a “worldwide” pyramid scheme, a Ponzi scheme and an offering fraud that targeted Asian and Latino communities and gathered more than $65 million.

URGENT >> BULLETIN >> MOVING: (16th update 5:42 p.m. EDT U.S.A.) The SEC has gone to federal court in Los Angeles, alleging that the WCM777 “program” is a “worldwide” pyramid scheme, a Ponzi scheme and an offering fraud that targeted Asian and Latino communities and gathered more than $65 million.

A federal judge has granted an asset freeze, the SEC said. The agency brought the case in an emergency complaint.

“[Phil Ming] Xu and his entities claimed they were using investor funds to build a strong cloud services company that would then ignite other high-tech companies and ultimately make their investors very wealthy,” said Michele Wein Layne, director of the SEC’s Los Angeles Regional Office. “In reality, they were operating a pyramid scheme that preyed on investors in particular ethnic communities, leaving them with nothing left to show for their investment.”

Some MLM promoters have pitched WCM777 alongside the TelexFree “program.” TelexFree is not referenced in the SEC complaint. But the complaint does reference a Massachusetts probe into WCM777 last fall. TelexFree has been under investigation by the Massachusetts Securities Division since at least February 2014.

Charged in the SEC’s WCM777 case are WCM777 Inc. of Nevada, World Capital Market Inc. of Delaware, WCM777 Ltd.( dba as WCM777 Enterprises Inc.) of Hong Kong and Ming Xu, also known as Phil Ming Xu, of Temple City, Calif.

Several firms are listed as relief defendants, amid allegations they received ill-gotten gains. These include Kingdom Capital Market LLC of Delaware, Manna Holding Group LLC of California, Manna Source International Inc. of California, WCM Resources Inc. of Texas, Aeon Operating Inc. of Texas and PMX Jewels Ltd. of Hong Kong.

Even as WCM777 was under investigation by state regulators in the United States, the SEC said, the “program” raised “more than $37 million from investors which has been deposited into [the defendants’] Hong Kong bank account.”

During the state-level probes in Massachusetts and elsewhere, “Defendants stopped depositing investor funds into their United States bank accounts, although the WCM777 offering continued,” the SEC alleged.

Xu, the SEC charged, is “involved in all aspects of the fraud.”

From the SEC complaint (italics/bolding/carriage returns added):

The bulk of the investor funds have been used to pay cash for real property purchased in the United States, purchased in many cases with funds transferred through Defendant World Capital Market Inc. (“WCM”), and held in the names of Relief Defendants Manna Holding Group LLC and Kingdom Capital Market LLC, which are affiliated with Defendant Xu.

The properties include two golf courses, a warehouse, vacant land, and several single family homes. Defendants have also used investor funds to play the stock market and to make investments, through intermediary companies, in an oil and gas offering of Relief Defendant Aeon Operating, Inc.

Defendants have also sent investor funds to Relief Defendant PMX Jewels, Limited, which is a rough diamond jewel merchant in Hong Kong, and to Relief Defendant Manna Source International, Inc., which is affiliated with Defendant Xu.

The golf courses were identified as Glen Ivy Golf Club in Corona, Calif., and the Links at Summerly in Lake Elsinore, Calif. To acquire Glen Ivy, WCM777 plunked down $6.5 million in cash, with the money coming from “WCM777 accounts that held investor proceeds,” the SEC charged.

Meanwhile, the Links at Summerly was acquired for $1.65 million in cash. Again, the SEC charged, the money to acquire the course “originated from WCM777 accounts that held investor proceeds.”

Along the pyramid and Ponzi path, the SEC charged, WCM777 bought a single-family home in Walnut, Calif., for “$2.4 million in cash,” a single-family home in Monrovia, Calif. for “$980,000 in cash,” a single-family home in Lake Elsinore, Calif., for “$500,000 in cash,” vacant land in New Cuyama, Calif., for “$700,000 in cash,” a warehouse in El Monte, Calif, for “$1,051,750 in cash” and used “$1,456,041.56” to close on the purchase of a single-family home in Monrovia, Calif.

This Monrovia sale never closed, the SEC said.

And “Ming Xu opened an account at a major brokerage firm in June 2013 in the name of WCM,” the SEC charged. “Between June 2013 and January 2014, Defendants deposited a total of $2.155 million into this brokerage account. The cash originated from WCM777 accounts that held investor proceeds.”

Moreover, the SEC charged, WCM777 disbursed $200,000 in investors proceeds to ToPacific Inc., $210,000 to Agape Technology and $230,000 to Media for Christ.

All of these entities, the SEC charged, were “associated or otherwise affiliated” with Xu.

Media for Christ — apparently before Xu’s alleged involvement — found itself at the center of an international firestorm in 2012 over a film production known as “Innocence of Muslims.” (See PP Blog report dated Nov. 21, 2013.)

Among the alarming allegations is that WCM777 falsely planted the seed that it had partnerships “with more than 700 major companies such as Siemens, Denny’s, and Goldman Sachs,” the SEC said.

WCM777 also asserted a false association with Stouffer Hotels and Resorts, a company that “has not been in business since 1996 when it sold its real estate portfolio to another company, and that was then purchased by Marriott in 1997,” the SEC said. “Marriott does not have any relationship with Defendants.”

As the PP Blog reported in October 2013, affiliates of WCM777 helped spread the claims about ties with famous businesses across the web.

Commingling

The WCM777 enterprises “opened and used numerous accounts located at three different banks in the United States, to move and commingle most of the investor proceeds before they were disbursed to third parties,” the SEC said.

It is common for HYIP scams to use banks and payment processors to warehouse proceeds from fraud schemes, a practice that brings national-security concerns into play.

HYIP schemes often also purport to offer interest-earning “packages” while using a “points” system and touting future public offerings, things allegedly in play at WCM777.

From the SEC complaint (italics added):

Through publicly available websites and promotional materials, Defendants offer packages or membership units in “WCM777.” Defendants portray WCM777 as a profitable multi-level marketing venture that sells packages of “cloud media” or cloud services. In the WCM777 offering, Defendants promise investors that they will earn 100% or more returns in 100 days. Defendants represent that the “points” investors receive for their investments will be convertible into equity in initial public offerings (“IPOs”) of “high tech” companies Defendants are purportedly incubating. Defendants have facilitated a “secondary market” in the points they award to investors, and Defendants estimate that $890 million of the points have traded on this market.

But in reality, the SEC said, the WCM777 enterprises “do not realize any appreciable revenue other than from the sale of ‘packages’ of cloud services to investors. WCM777 is not profitable, and is a pyramid scheme. Defendants use some of the investor funds to make Ponzi payments of returns to investors.”

The SEC, which says WCM777 was selling unregistered securities as investment contracts, is seeking the appointment of a receiver, a request the judge has approved.

Like other HYIP schemes, WCM777 preemptively denied it was a “Ponzi scheme.”

“Is WCM777 a Ponzi Game?” WCM777 wrote on its website, before answering its own question, the SEC said. “In summary, we are not a Ponzi game company. We are creating a new business model.”

In reality, the SEC said, “The cash paid to investors were Ponzi payments made with funds received from other investors, and were not paid from net income or profits of the WCM777 enterprise.”

At a 2013 business event in California, Xu was photographed alongside luminaries such as former U.S. Vice President Al Gore and Apple co-founder Steve Wozniak. It is somewhat common for Ponzi schemers to trade on the names and reputations of prominent individuals.

Zhi Liu, another WCM777 executive identified in state-level filings, is not directly referenced in the SEC complaint. There may be an oblique reference, however.

“On January 27, 2014, WCM777 Ltd. filed a lawsuit against a former employee in the Superior Court for the State of California, County of Los Angeles,” the SEC said.

Liu is known as “Tiger.”

A Twitter site under the name of “Dr. Phil Ming Xu” has a March 14 entry that claims, “Tiger created the system and took $30M worth of unauthorized ecash from WCM777. WCM777 sued him.”

As noted above, however, the SEC has alleged that Xu was involved in all aspects of the fraud. And also as noted above, the SEC further alleged that “more than $37 million from investors” had been deposited in a Hong Kong bank account.

Whether Liu had a role in the Hong Kong deposits is unclear. Also unclear is whether Liu remains in the United States or has relocated elsewhere.

In its emergency filing, the SEC said the WCM777 enterprise constituted an “ongoing” fraud.

Read the SEC’s statement and complaint.

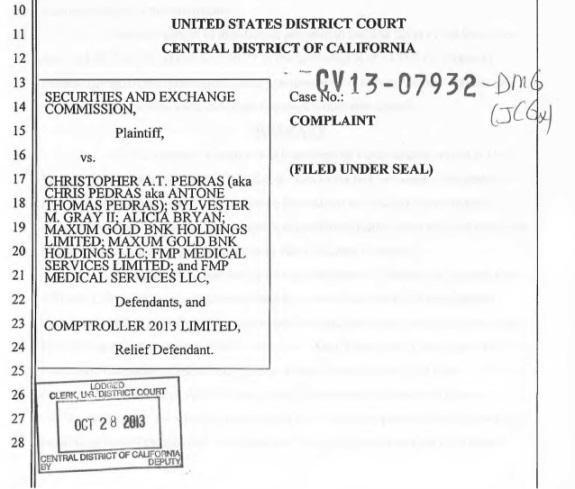

BULLETIN: (7th update 3:26 p.m. EDT U.S.A.) An SEC complaint against USFIA Inc. first reported on Tuesday by the Sierra Madre Tattler and BehindMLM.com now has become public, with the SEC calling the venture a “worldwide pyramid scheme” that gathered on the order of $32 million while claiming it was backed by amber mines and duping MLM participants into believing they’d score big through a purported cryptocurrency known as Gemcoins.

BULLETIN: (7th update 3:26 p.m. EDT U.S.A.) An SEC complaint against USFIA Inc. first reported on Tuesday by the Sierra Madre Tattler and BehindMLM.com now has become public, with the SEC calling the venture a “worldwide pyramid scheme” that gathered on the order of $32 million while claiming it was backed by amber mines and duping MLM participants into believing they’d score big through a purported cryptocurrency known as Gemcoins.