“Foreclosure-rescue scams prey on distressed homeowners’ desire to save their homes and to find any means to help fix their dire financial situations. As is the case with most loan-modification and foreclosure-rescue operations, consumers who dealt with Bella Homes lost not only the thousands of dollars they paid for ‘help,’ but also their homes.” — John Suthers, Attorney General of Colorado, Feb. 23, 2012

BULLETIN: Colorado’s U.S. Attorney and the state’s Attorney General have gone to federal court in Denver to halt what they described as a foreclosure-rescue scam operated through an entity known as Bella Homes LLC.

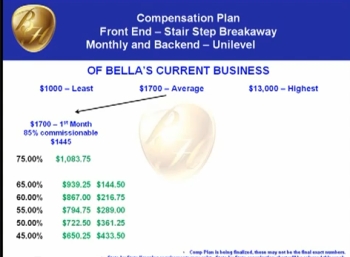

Bella, which operated as an MLM and allegedly recruited more than 200 salespeople who paid the firm a combined total of more than $138,000 to pitch the “opportunity” and earn a shot at commissions from desperate homeowners, has been sued.

Also named defendants were Mark Stephen Diamond, Michael Terrell, David Delpiano and Daniel David Delpiano.

In court filings in the civil case, Daniel Delpiano was described by state and federal prosecutors as the Georgia-based “mastermind” of the Bella Homes fraud, which allegedly gathered more than $3 million.

Daniel Delpiano is a convicted felon currently on supervised federal probation, prosecutors said. Terrell is a Georgia attorney, and Diamond is an Arizona businessman, according to the complaint.

In February 2005, Daniel Delpiano was convicted of conspiracy to commit wire fraud in the District of Massachusetts. After that — in November 2006 — he was convicted of conspiracy to commit mail fraud, wire fraud and money laundering in the Middle District of Florida, prosecutors said.

And in May 2007, prosecutors noted, he was convicted of mortgage fraud and racketeering in Georgia Superior Court. Daniel Delpiano is the father of David Delpiano, who also resides in Georgia, prosecutors said.

RealScam.com, a forum that concerns itself with mass-marketing fraud, was among the first outlets today to report the news of the Colorado lawsuit. RealScam has been tracking Bella Homes’ developments at least since Nov. 27, 2011.

“To become a representative, the representative must pay Bella Homes an initial enrollment fee of $99.00 and a $195.00 fee to complete mandatory online training,” prosecutors said. “Each representative also has an option to pay a $49.00 monthly fee to create his own replicate of the Bella Homes website in order to recruit homeowners for the program.”

But the program, which has ceased to operate in the wake of the state and federal action, was a scam, prosecutors said.

“Bella Homes gave false hope to desperate homeowners, taking advantage of their desire to do anything to save their homes,” said U.S. Attorney John Walsh. “Bella Homes’s actions not only hurt those vulnerable homeowners, but the housing market generally. The company will now face the consequences of its misconduct.”

At least 450 people sent Bella money to save their homes, but no evidence has surfaced that Bella saved any homes, prosecutors said.

The 52-page complaint includes a number of examples in which financially strapped homeowners allegedly paid Bella thousands of dollars in illegal, upfront fees.

“The homeowner is fraudulently induced to pay ‘rent’ to Bella Homes in lieu of making the mortgage payments,” prosecutors charged. “Some of the mortgage lenders and mortgage servicers detrimentally affected by Bella Homes’ fraudulent scheme are federally insured financial institutions.”

Most of the money paid by victims “has been diverted to the individual Defendants for their own personal use,” prosecutors said.

Diamond, for instance, allegedly received “at least” $321,000 in fraud proceeds, “including more than $277,000 for his American Express bills,” prosecutors said.

Meanwhile, Daniel Delpiano received “at least” $184,000 in fraud proceeds that were applied to personal expenses. Of that sum, as much as $86,180 appears to have come in the form of ATM cash withdrawals, prosecutors said.

“The ATM cash withdrawals were frequently in the amount of $700,” prosecutors said.

Although YouTube videos touting the Bella Homes’ MLM compensation scheme continue to appear, the company’s website is offline and a federal judge has issued orders to preserve assets.

Here is a snippet from the complaint. (Italics added):

Rather than helping homeowners remain in their homes long term, as promised, Bella Homes preys upon distressed homeowners, duping them into paying thousands of dollars based on false promises and false representations, yet provides no meaningful assistance to prevent foreclosure or to allow homeowners to remain in their home for the time period promised by Bella Homes.

Bella Homes has fraudulently obtained approximately $3,000,000 from over 450 homeowners across the nation, and is rapidly expanding its fraudulent operations. In the last two months of 2011 alone, it has fraudulently obtained approximately $1,000,000 from homeowners.

As part of the scheme, Defendants solicit distressed homeowners to convey title to their home to Bella Homes for no consideration and to enter into purported three-, five-, or seven-year lease agreements under which the homeowner pays Bella Homes monthly “rent.” Bella Homes also collects an advance fee from the homeowner of three-months? “rent” upon transferring title and signing the lease. Despite Bella Homes taking title to and collecting “rent” for the property, it does not pay the homeowner for the property and it does not pay off or assume the existing mortgage. Nor does Bella Homes make any of the mortgage payments or pay any of the taxes or insurance for the property.

Read the complaint.

Here is a snippet from the preliminary injunction. (Italics added):

Except as noted below, Defendants and those involved in active concert with them who are served with a copy of this Order are ENJOINED from:

1. Conducting or continuing to conduct business activities by or on behalf of Bella

Homes, LLC, including but not limited to: (a) engaging in any action affecting real title to any property; (b) entering into any agreements relating to real property; (c) collecting, negotiating, or depositing any rental payments made by purported lessees of Bella Homes, LLC; (d) distributing or receiving disbursement of any funds from Bella Homes, LLC; and (e) advertising, promoting, or soliciting customers on behalf of Bella Homes, LLC.

2. Transferring, withdrawing, pledging, dissipating, or otherwise using or concealing

funds of Bella Homes, LLC or funds received by any Defendant from Bella Homes, LLC in any accounts with any financial institution . . .

Read the preliminary injunction:

The defendants have agreed to the preliminary injunction, which calls for “ceasing further operations and transferring approximately $500,000 to the government for homeowner restitution, pending final resolution of the case,” prosecutors said.

Is your purported debt coach or foreclosure-relief expert a “sovereign citizen” with an avowed contempt for the U.S. government and banking in general? Is he (or she) actually trying to recruit you into a criminal scheme that only will add to your stress? Is your last disposable dollar going into the pockets of a domestic extremist posing as a patriotic problem-solver and putting you in the position of having to explain incomprehensible legal filings to a judge?

Is your purported debt coach or foreclosure-relief expert a “sovereign citizen” with an avowed contempt for the U.S. government and banking in general? Is he (or she) actually trying to recruit you into a criminal scheme that only will add to your stress? Is your last disposable dollar going into the pockets of a domestic extremist posing as a patriotic problem-solver and putting you in the position of having to explain incomprehensible legal filings to a judge?